Table of Contents

Requote Definition

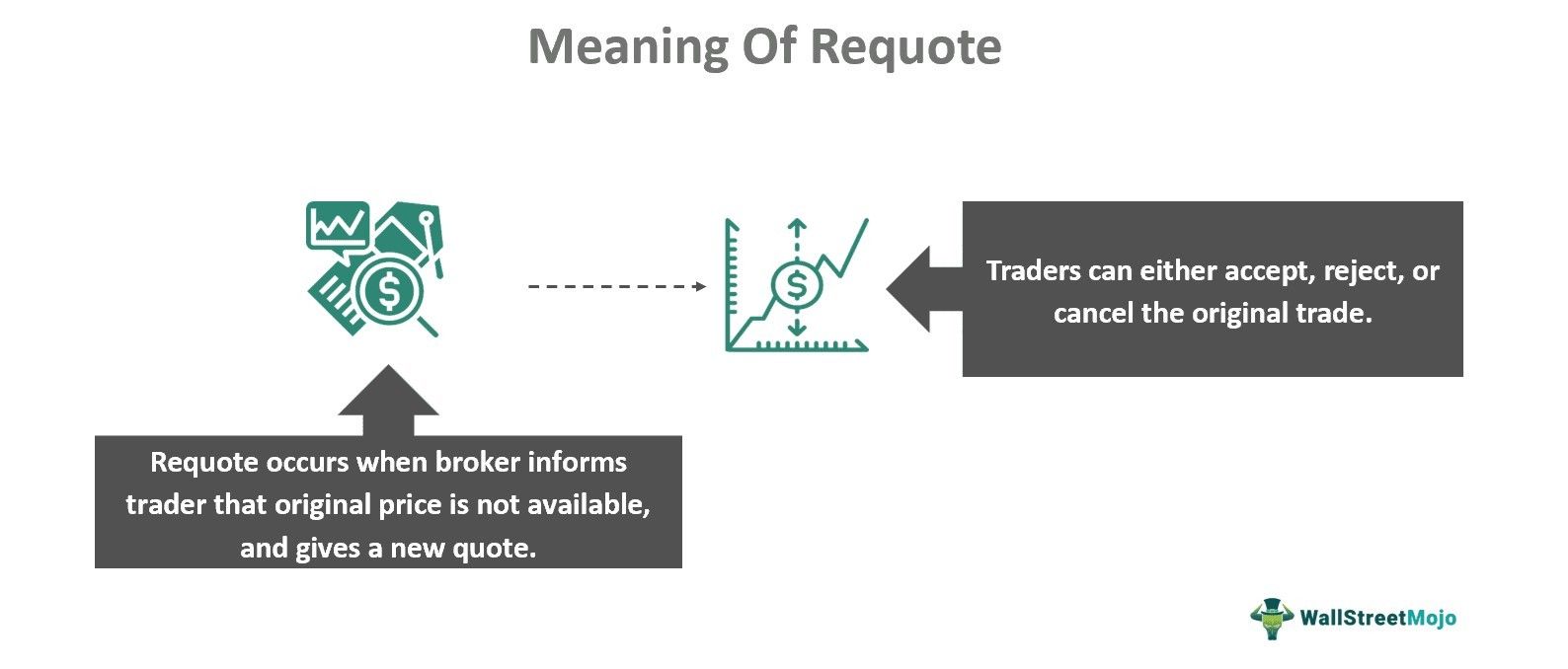

Requote is a notification enabled by brokers to traders informing about the change in the execution price and issuance of a new price. It is commonly used in equity markets where traders can either accept this new price or cancel the executed trade.

This feature is available in almost all markets sensitive to price fluctuations like forex requotes. They occur in fast-moving or liquidity-based markets. However, it can be frustrating for traders in intraday sessions. They might face losses or miss out on a profitable opportunity due to these requests.

Key Takeaways

- Requotes are popular in forex and equity trading, where traders receive a new price quote against the original one. They can either accept or reject the proposal; otherwise, cancel the trade.

- There are different causes for this trade, including volatility, liquidity problems, slippage, and technical glitches.

- It is an attempt to inform traders about the current market price and further confirmation. This quoting is always a treat for the broking platforms.

- Likewise, traders can use various methods to avoid this situation by reconsidering their broker or trading platform, monitoring market volatility, and using limit order and stop loss.

Requote In Trading Definition

Requote is a financial term used to express a situation where the broker issues a new price quote against the previous one. Brokers put a proposal quoting a new price, where traders can either accept or reject it. Alternatively, they can wholly cancel the entire transaction and place a new trade. They do this to inform the traders about the price changes due to market sentiments. So, if a trader places a trade at $200 and receives a requote at a higher price, they can decide based on their trading position. However, these are more visible among high-volume traders.

The mechanism of forex requotes starts with the trade placed. When a person (trader) places a trade on the broking platform, they can set a particular price and confirm it. Now, if the price reaches that quote, the trade gets executed. Likewise, for market price, the ongoing price is immediately considered. However, this process consumes time until it reaches the broker.

In other words, when the quoted price reaches the broker, the market might move in any direction. As a result, there is a visible gap between the quoted and order price. Thus, the broker may now re-confirm with the trader on the price quoted. The former may send a notification request informing on the current trend the stock or currency is following and decide on whether to accept the current price or requote the price again. However, in most cases, they are worse or, in other words, attracts losses for traders.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Causes

There can be various factors causing forex requote to occur in the forex markets. However, the major ones include market volatility, liquidity issues, technical glitches, and slippage. So, let us understand them in detail:

#1 - Volatility

The foremost cause for such quotes is market volatility that causes sudden fluctuations in the stocks. It causes an uneven change in the stock or currency price that is apart from the quoted price. So, when volatility occurs, the chances of the broker trying to requote the price are higher.

#2 - Liquidity problems

Even liquidity issues contribute to the possibilities of such quotes. It usually occurs when the broker tries to adjust the price to attract investors to a particular stock. Thus, if there is a stock performing low or illiquid, the broker may again requote for its benefit.

#3 - Technical issues

Another major factor leading to such quotes is due to technical issues. In other words, there can be issues on the broking platform, leading to glitches in the stock prices. As a result, the trader may see a different price, and after correction, it might turn tough.

#4 - Slippage

Similarly, slippage may also result in requoting of stock prices that occurs due to some conditions. For instance, the broker may have a slow technology that consumes time to execute orders. As a result, the broker may requote the price and execute at the available price.

Examples

Let us look at some examples of requote to comprehend the concept in the best way possible:

Example #1

Suppose James is a trader who deals in intra-day trading on a daily basis. He usually trades in huge lots to book maximum profit from the market. Thus, James was able to earn about $50,000 as a profit in the past month. However, this week, the situation changed. James placed a buy order of 100 units of Stuny Ltd stock for $130 per share. This quote was the current market price trending in the market. But, when this quote reached the trading platform (broker), the market price rose to $135.

Now, when James received a requote request from the broker, he chose to go with the recent price. It means James will pay a total price of $13,500 instead of $13,000. He will incur a loss of $500 on this buy order.

Example #2

Another example includes Samuel, who owns a stock broking platform. On a daily basis, more than a million users trade on this platform. However, in some trading sessions, the screener does face some issues. Due to this issue, the traders were not able to execute their trades at their decided quotes. It was usually higher than the quoted price. And Samuel was having the ultimate benefit in this situation. In short, buy orders actually yield extra fees from requotes to the brokers. However, in the later stages, due to reduced user count, Samuel limited the requests to huge lot orders only.

How To Avoid?

Requotes in trading are a constant activity on the trading platforms. However, with certain measures, it is possible to avoid and reduce its occurrence to a maximum extent. Let us understand some measures:

#1 - Choosing the right broker or trading platform

The first suggestion given to traders is usually regarding the broker they are dealing with. As discussed above, these quotes majorly occur due to the technical problems faced on the platform. If they continue in the loop, the ultimate loss is borne by the trader. Therefore, it is best to choose a broking platform that has a glitch-free and sorted interface. It reduces the chances of these quotes.

#2 - Use of limit orders and stop loss.

Another solution advisable to traders is the utilization of limit orders. The name itself suggests setting a price range and trade execution under the same. And if the market follows a opposite trend, stop-loss is best to avoid any further losses. It ensures that the traders do not enter the loop of requotes.

#3 - Restricting trade during volatility hours

In addition, traders can also monitor the market volatility and trade likewise. It means that they must restrict their trade during such times and take a step back. The only purpose of this trade is that the market is very fluctuating, and quoting any stock can lead to a sudden fall in profits. Thus, it is advisable to avoid indulging in such sensitive environments.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.