Table of Contents

What Is The Securities Industry?

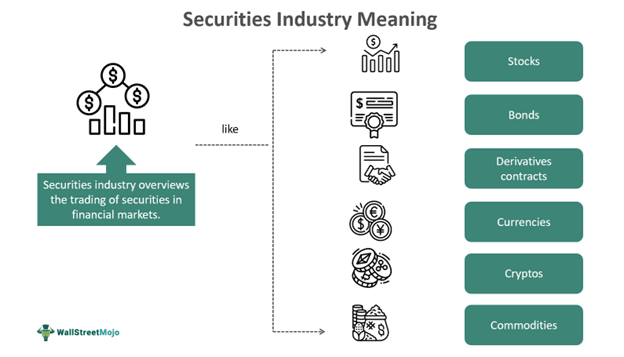

The securities industry is a term used for the financial services sector to describe an industry that enables the trade of financial securities in the market. The sole purpose of this industry is to regulate the market participants and ensure trade occurs in the best ethical way possible.

In general, the securities industry oversees and supervises the financial markets and their operations. It regulates the trade of stocks, bonds, currencies, and commodities. It also includes derivatives contracts like options, futures, and swaps. However, this industry constitutes a major part of the financial sector.

Key Takeaways

- Securities industry is a financial term used to describe an industry that regulates the trading of financial securities in the markets.

- The different securities include stocks, bonds, debentures, options, derivatives contracts, currencies, and cryptos.

- The key players in this industry are traders, brokers, investors, underwriters, investment advisers, municipal advisers, and exchanges.

- This industry is further regulated by the SEC (Securities and Exchange Commission), FINRA (Financial Investment Regulatory Authority),

- CFTC (Commodities Futures Trading Commission), and NFA (National Futures Association).

Securities Industry Explained

The securities industry refers to the broad term used for industry concerning the buying and selling of securities in the financial markets. These securities include stocks, bonds, options, commodities, and derivatives contracts. This industry tends to regulate the financial markets and exchanges that trade these securities daily. It also ensures that the regulations are rightly followed. As a result, there is a smooth flow of capital between issuers and investors (or traders).

In this industry, different financial markets are functioning on the global level. It includes the primary market, secondary market, equity and bond market, foreign exchange market, derivatives market, and commodity market. Each deal has varied financial security, which is further regulated by authorities. For instance, the primary market consists of issuers (freshly listed companies) who issue their shares for the first time. Later, these are further traded in the secondary market consisting of traders.

In the same manner, equity comprises company stocks, and the bond market includes debt instruments. They further incorporate derivatives markets, too. However, forex and commodity markets are distinguished as they deal in currency pairs and commodities (like wheat, cotton, and corn). Similarly, even the cryptocurrency market is inclusive of securities industry essentials.

Regulators

This industry has a set of regulators and authorities who overview the operations of the financial markets. However, they differ depending on the geographic location. Since every nation has its own regulatory body, let us understand them in detail:

- The Securities and Exchange Commission (SEC): One of the prime regulators in the United States, the SEC aims to supervise the trading of securities in the market. They oversee the trades and supervise the brokers, traders, investment advisers, and their activities. In addition, they also enact new rules and amend the existing ones if required. They protect the investors from illegal activities and maintain fair trade rules in the market. Furthermore, the SEC authorizes companies to list their stocks on the available exchanges.

- FINRA (Financial Industry Regulatory Authority): FINRA is a non-government organization governing brokerage firms and individual brokers. They enforce rules and regulations and ensure brokers follow them as per securities law. It was previously known as the Securities Industry Regulatory Authority (SIRA).

- Commodity Futures Trading Commission (CFTC): As the name suggests, the CFTC primarily caters to commodity trades and derivatives contracts. It also includes futures, options, and forward contracts. They oversee such trades and protect investors against fraud and manipulative practices.

- National Futures Association (NFA): Another self-regulatory body for the derivatives market is NFA. It tries to offer arbitration to investors against disputes held in forex and futures trades. However, firms and individuals trading in this market must adhere to the rules compiled by NFA.

Regulations

There are various securities industry acts released to regulate the trade of securities. They hold a major place in the regulations of the United States. Let us look at them:

- The Securities Act and the Securities Exchange Act: While the former focuses on regulating securities, the latter concentrates on exchanges, also. The existence of both acts further led to the foundation of the SEC in 1934.

- Trust Indenture Act of 1939: This act is primarily concerned with debt securities like bonds, debentures, and notes.

- Investment Company Act and Investment Advisers Act of 1940: It regulates the organizations and companies engaged in the re-investing scheme of securities like mutual funds and exchange-traded funds. It also requires companies to disclose their financial condition and policies during the initial or regular sale of stock to the investors.

Likewise, the Investment Advisers Act is for investment advisers who advise investors (clients) on securities. However, they need to register with the SEC and uphold at least $100 million in assets under management (AUM).

- Sarbanes-Oxley Act of 2002: This act came after the famous U.S. Senator Paul Sarbanes and U.S. Representative Michael G. Oxley who made it compulsory for companies to disclose financial statements to compact accounting fraud and similar activities, hampering investor's interests.

- Consumer Protection Act and Dodd-Frank Wall Street Reform: In 2010, former President Barack Obama signed this law as an effective measure to reform the U.S. economy. It provides a cushion in certain areas, such as financial products, regulation of credit ratings, consumer protection, transparency, and corporate governance.

- Jumpstart Our Business Startups Act (JOBS): Enacted in 2012, the JOBS Act tends to minimize the regulatory requirements for firms aiming to raise capital for their business in public capital markets. However, these securities industry acts are again regulated to avoid scams and fraud in the markets.

Key Players

Following are some of the securities industry essentials or key players in this sector. Let us look at them:

- Traders: It includes those investors who buy or sell securities on a frequent (or daily) basis. They trade on behalf of brokers and have no clients to cater to.

- Brokers or dealers: Brokers are those individuals or entities who trade securities on behalf of the customers. They act like agents between the exchange and the customers.

- Issuers: Issuers refer to individuals, corporations, investment firms, or government entities who primarily list securities on a trading exchange. They are first listed on the primary market and then traded in the secondary market.

- Investment and municipal advisers: These are advisers who provide financial advice regarding investments and securities to entities or investors. It includes financial planners, consultants, and financial advisers.

- Exchanges: It refers to the marketplace where stocks, bonds, commodities, or other securities are traded. Some popular ones include the Chicago Board of Trade and the New York Stock Exchange.

- Underwriters: An underwriter is a professional who assists issuers with selling securities. They are also known as investment bankers. Underwriters buy securities from issuers and sell them to the public.

Examples

Let us look at some examples that give us a securities industry overview for a better understanding:

Example #1

Suppose James is a businessman who owns a business in the logistics industry. Recently, he applied for the initial public offering (IPO) to raise capital for the operations. However, to list his company, he needs to follow certain SEC rules for securities listing. Some of the essentials include submitting the company's financial information to the SEC. Also, they need to register a prospectus stating the same for securities issuance. Once reviewed thoroughly, James was able to list his company on the stock exchange. For this process, he also hired Kevin to help with the share subscription. It means that if the shares are unsubscribed, the underwriter would purchase them.

After a week, these securities got listed in the primary market with a premium of 20%. Later, on the listing, the secondary market players got access to them. Now, these shares were tradeable and liquidable, but under the regulations of the SEC.

Example #2

According to the recent news update as of April 2024, the global securities industry may face a big timeline issue due to a misaligned T + 1 cycle. After India and China have made the changes, even the US, Canada, Mexico, and the United Kingdom are deciding on the same. At the same time, the market participants received an invitation from the European Securities and Markets Authority (ESMA) to shorten the settlement cycle. However, different time zones can create big hurdles in the settlements.