Top Skills and Courses to Launch Your Career in Quantitative Trading

Table of Contents

Introduction

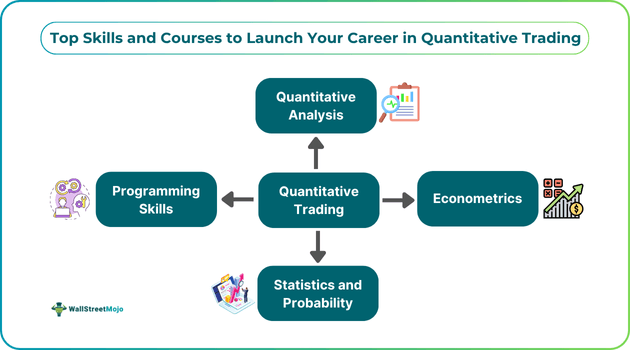

Quantitative trading, otherwise called quant trading, leverages mathematical models and computations to analyze financial data, driven by behavior in financial markets. While traditional trading methods involve the use of human intuition and market sentiments, quant trading works using definite data from quantitative analysis and algorithmic computations. It integrates AI, deep learning, and alternative data to analyze stock prices and their movements.

What Is Quantitative Trading?

Quantitative trading is a method of trading that uses mathematical models and quantitative analysis to analyze stock prices. One must possess sufficient quantitative trading skills, which involve identifying a strategy, executing it, and performing risk. It involves using computing systems with Perl, C++, Java, and Python for trading. Large financial institutions employ quantitative trading as they deal with large transactions and thousands of trading with securities. Recently, more individual investors are turning to quantitative trading.

What Roles Can You Aim For?

The architects behind trading strategies involve "Quants." Quants are typically CFAs, MBAs, and Ph.D. holders in areas such as computing and finance at reputed institutions. Compensation in financial hubs in New York and Chicago begins as high as $100K. One with proven work experience as a seasoned trader, even without these degrees, can start out in small-sized firms as junior analysts and work their way up the ladder.

Those interested can also seek out competitive quantitative finance courses to stay ahead in the competition.

Hence, one can typically start as shown below.

| Career Role | Base salary |

| Quantitative analyst (entry-level, big firms) | $100K – $160K |

| Quant trader | $120K – $175K |

| Quant developer | $120K – $180K |

| Execution strategist | $130K – $200K |

| Financial data scientist | $130K – $200K+ |

Let us look at each of the roles in brief.

#1 - Quantitative Analysts

One can work as a quantitative analyst at an entry level in a big firm. Typically, a person should hold a CFA, MBA, or Ph.D. in finance, mathematics, or computer science from a top institution. These analysts should work on financial markets using time-series models, regression, and hypothesis testing to make trading decisions. Their help lay the foundation for building new quantitative trading strategies.

#2 - Quant Traders

Want to know how to become a quantitative trader? A person can be promoted from an analyst to this role or must possess exceptional trading acumen to land it directly. Quants employ tools like time-series models, regression, and hypothesis testing to make rational trading decisions. Quants develop and implement their own algorithms on data in real time and can use a strategy that aligns with their objectives.

#3 - Quant Developers

Quant developers are specialists who help build, optimize, and maintain the algorithms and infrastructure used by trading teams. They are program-focused and must be proficient in languages like Python, C++, and Java to ensure trading systems are quick, reliable, and scalable.

#4 - Execution Strategists

They improve the strategy's performance with their extensive knowledge in market microstructure. They design routing algorithms and adjust execution tactics based on real-time market conditions. Besides possessing superior quantitative trading skills, they must work in high-frequency environments. They are mainly used to streamline the trading process.

#5 - Financial Data Scientists

A financial data scientist acts as a link between finance and technology to help firms make informed and profitable trading decisions. Such persons use data science techniques to analyze financial markets. They can successfully predict trends and improve trading decisions.

The Three Pillars Of Quant Trading Strategies

Quantitative trading operates on a structured framework. Let’s do a deep dive into the three pillars of quant trading strategies:

#1 - Statistics and Econometrics

These are considered the fundamental building blocks for quantitative trading. Some of the key statistical concepts used include regression analysis, probability theory, time series analysis, and so on. It is important to develop a meticulously designed trading strategy to analyze financial data and manage risk.

#2 - Financial Computing

Financial computation uses historical and real-time data and helps analysts gain insights that are usually missed by traditional traders. It is the programming backbone of quantitative analysis. It uses computational tools and programming languages like Python and R, besides data handling and algorithm design.

If your knowledge of advanced topics like algorithms is limited, it helps if you can learn a course like Automated Trading for Beginners to gain valuable knowledge. Also watch out for courses on quantitative finance training if you wish to boost your financial knowledge.

#3 - Back Testing and Market Data

After designing a trading strategy, one must test it before implementation and check its efficacy. The developed model undergoes a rigorous testing process called back testing. Here, the strategy is applied to past historical market data to assess its performance in past market conditions. This step helps in validating how effective the strategy will be in the future besides identifying any shortcomings that can be corrected.

Why AI and Machine Learning Are Becoming Core to the Modern Quant Stack

The use of AI and machine learning in quantitative finance has improved the overall precision of the developed strategies. AI systems can interpret large volumes of data with ease, thereby making financial predictions more accurate for real-time market analysis and decision-making . Using AI in automating financial processes has helped reduce operational costs and eliminate human errors.

Deployment of advanced AI and machine learning techniques can help improve trading strategies that are capable of handling more volatile markets.

So, Where Do You Begin?

To bag any quantitative trading role, one must have a mix of financial acumen, programming skills, and data analysis expertise.

A Ph.D., an MBA or master’s in finance related subjects are effective entry points to become quant traders.

One must learn concepts like statistical modeling, algorithm design, and market microstructure, and learn to apply AI and machine learning to them for a distinct advantage in today’s fast-paced markets.

One can always seek out structured learning programs offline or online from reputed institutes to build the required skill set through hands-on training in strategy development, back testing, and execution.

Final Thoughts

Quantitative trading and its associated jobs are very lucrative and challenging and require the multiple domain knowledge. One must possess a right mindset and multifaceted quantitative trading skills, knowledge, and temperament. Though it appears daunting, with the right mix of skills for quantitative trading and a positive attitude, it is an excellent choice for entering the exciting world of quantitative trading.