How Social Media Increases Fraud Risks in Financial Services

Table of Contents

Introduction

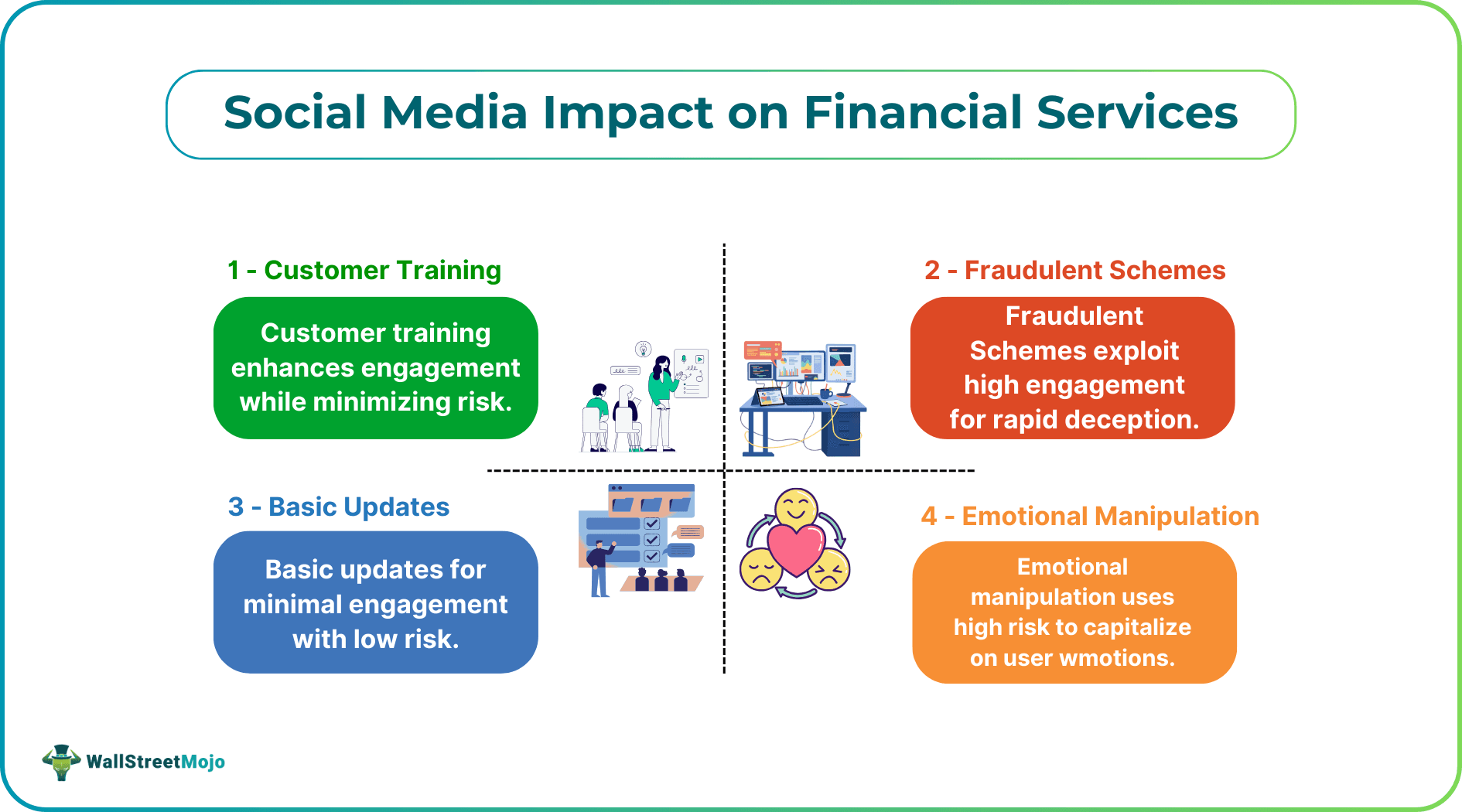

Social media has revolutionized the interaction of financial services with users. Facebook, Instagram, LinkedIn, and X provide the opportunity to communicate with customers in real-time, which makes banks, fintech apps, and insurance companies active on these platforms. They can update, train users, and create trust more than ever before. The immediacy, reach, and level of engagement presented by social media make it an important marketing and customer interaction tool.

Simultaneously, the same features make social media an ideal breeding ground for fraud. This is especially susceptible to financial institutions since they deal with sensitive information and money. Social media is a risk accelerator of fraud as it allows scam artists to access large numbers of people within a very short time, mislead, and capitalize on the emotional reactions of the users and the companies in most cases, as time elapses.

User Vulnerability and Emotional Manipulation

They are often used by fraudsters to abuse emotions to influence the user, said Indie Basi, Company Director at Wade Building Supplies. Pushes that are sent out to create urgency, fear, or excitement can lead users to make decisions hurriedly without verification. Such expressions as exclusive investment opportunity or act now before it is too late are meticulously designed to override the rational judgment.

Studies on consumer behavior on social networks show the use of emotional appeal in promoting high chances of being caught by fraud. Social media is meant to draw attention within the least time, and as such, the user is more susceptible to manipulation. The marketing departments need to balance the content that interests the users and the security of the users because the campaigns should not indirectly expose the users to fraud.

Rafay Baloch, CEO and Founder of REDSECLABS, says fake accounts can appear, disappear, and return before security teams ever catch up, giving scams time to grow without touching bank systems until it’s too late. He explains that the strongest defense isn’t louder warnings or longer policies, but visibility and discipline. Social platforms must be treated as live risk surfaces, not just marketing channels, with teams actively watching for impersonation and rehearsing responses like real incidents. For individuals, his rule is simple: pause before you respond. Any message that creates urgency deserves verification through a separate channel. His overlooked insight is clear—trust should never move faster than verification, and slowing things down on purpose prevents more fraud than most tools ever will.

Brand Impersonation Risks

One of the most typical threats of social media to financial services is brand impersonation. Fraudsters duplicate logos, coloring, text messages, and the general tone of the brand to look authentic.

By following the rules of digital marketing compliance, financial organizations are able to minimize their exposure. Social accounts are to be monitored continually, users must be educated, and suspicious accounts must be reported to ensure credibility and user protection.

Inigo Rivero, Managing Director of House Of Marketers, says social platforms amplify trust—and fraudsters are quick to borrow it. In his experience, scams work because they look native to the feed: fake bank ads copy real creatives, cloned executives sound familiar, and “support” replies show up exactly where customers already ask questions. Detection often lags because content moves faster than verification, allowing bad actors to blend into normal engagement before teams respond. He notes the damage isn’t just financial loss, but hesitation, churn, and increased scrutiny when brands appear slow or silent. His key insight is simple: treat social as a live service channel, lock down official accounts, rehearse fast takedowns, and always verify outside the app—because fraud feeds on speed, but trust survives on pause.

Paid Ads and Influencer Marketing Weaknesses

The niche marketing of financial services has necessitated influencer marketing as a means of simplifying complex products and finding people in niche markets. Paid social media promotions enable brands to increase their message fast and effectively.

Joosep Seitam, Co-founder of Socialplug, adds that speed is often the biggest vulnerability on social media. He points out that users tend to trust familiar formats and fast-moving content, which gives scammers an advantage. Brands that slow down communication, verify links, and consistently remind users where official interactions happen reduce the likelihood of fraud taking hold.

Nonetheless, they may cause a greater risk of fraud unintentionally, unless implemented adequately:

- Influencers can advertise unverified or false products.

- Scammers can mimic paid campaigns and come up with counterfeit websites or landing pages.

- False information can lure the consumer to provide personal data.

Through proper execution of social media marketing strategies, transparency, exposure to fraud, and protection of the brand and the users become transparent.

The Role of Marketing Teams in Fraud Prevention

Marketing departments not only have an impact on visibility but can also contribute to being exposed to fraud. Very captivating campaigns can unwillingly become victims of scammers.

The strategies to be effective are:

- Checking the social media accounts for fake accounts or suspicious activity.

- Training users on scam and phishing techniques.

- Checking influencer promotions and sponsored advertisement campaigns.

- Immediate response to fraudulent accounts or post reports.

Using reputable market analysis enables the marketing department to take the initiative to detect weaknesses and protect the brand as well as the end users.

Dmitriy Shelepin, Founder and Head of SEO at Miroimind, says social media has shifted from a visibility tool into a real risk surface for financial services. In his experience, fraudsters succeed by copying trusted brands, impersonating executives, and running polished ads that look legitimate because platforms reward speed and engagement, not verification. The manipulation starts long before money moves—in comments, DMs, and shared posts—so by the time a transaction looks suspicious, trust has already been handed over. He notes the damage goes beyond financial loss, leading to weakened brand credibility and rising scrutiny. His key insight is simple: fraud thrives on timing, not better lies, and awareness only works when both brands and users slow down, verify sources, and treat urgency as a warning sign.

Training Users to Mitigate Risk

One of the most powerful guardians against social media fraud is education. Users can learn how to: Brands can post, make guides, and videos that will teach them how to do it.

- Locate false accounts and phishing.

- Check authentic financial propositions.

- Securely use internet investment and payment sites.

The dissemination of social media financial information enables users to be more empowered and minimize chances of scams, and enhance long-term credibility. Education and marketing campaigns foster trust, although they encourage responsible use of social platforms.

Regulatory Direction and Conformance

Following financial laws is also necessary in reducing cases of fraud. Clear communication, confirmed communication channels, and ethical methods of advertisement safeguard both the users and the brands.

Compliance with financial regulations in the financial sector ensures that the campaigns are driven by the law and are trustworthy. Non-compliance will result in fines, penalties, and reputation.

Suspicious Activity Surveillance and Reporting

Lending institutions and marketing teams are encouraged to undertake vigorous monitoring of social media in an attempt to detect potential fraud. The counterfeit accounts or fake identity of a brand will often contain fake information that will confuse the user to enter sensitive financial information that will be used by the fraudsters. To identify them at an early stage, one has to actively check the activity of a specific account, its interactions, and suspicious relations.

Among the major steps that may be implemented to track and report the suspicious activity, there are:

- Conducting a regular check on the social media accounts to identify fake accounts or abnormalities.

- Creating account set-up alarms on abnormal activity, messages or account creation attempts.

- Training the internal teams to identify fraud and phishing.

- Teaching users to flag suspicious accounts or posts on the platform and brand.

With such practices, financial institutions would be able to respond promptly to prevent the possibility of massive fraud and safeguard the user and the reputation of the brand. The swift reporting and escalation processes also contribute to making sure that the content of fraud is eliminated as soon as possible, exposing victims less.

Integrating Education into Marketing Campaigns

As an education, it is important in alleviating the susceptibility of users to social media fraud. Financial brands can include educational content within their marketing campaigns, and it will empower the latter to prevent risky practices on the internet. An aggressive approach like this is not only what will ensure the safety of consumers but also create brand trust and credibility.

The best methods of incorporating education into campaigns are:

- Publishing educational instructions and tips on how to identify phishing and fraudulent financial deals.

- Providing practical examples of fraud to increase awareness among users.

- Emphasizing optimal steps toward safe communications and the sharing of personal data.

- Use of short videos or infographics that clearly and concisely explain risks.

Educational campaigns will make users aware of all the tricks that a fraudster may employ on social media and minimize the chances of getting into the trap of making impulsive decisions that can cost them a lot. It also enables brands to show their interest in protecting the users, to build long-term confidence.

Leveraging Technology for Fraud Detection

High-tech is a friend of fighting social media fraud. Artificial intelligence (AI)-driven security tools and machine learning algorithms can process the interactions between the user, identify suspicious content, and make threats or notifications in real-time. This ensures that people respond quickly to inhibit the spread of scams.

AI-based monitoring, pattern recognition, and tracking of URLs are among the measures that can be adopted by financial institutions to detect suspicious activity. Automated systems can be used in combination with human control, which improves the accuracy and allows the brands to not only have a safe social media presence but also interact with them.

Building Long-Term Trust Through Transparency

Social media communication should be open to protect the users and build brand credibility. Clearly and frank communications regarding products and services, and on issues related to security, make the users know that the brand cares about their safety.

Sain Rhodes, a real estate expert and analyst at Clever Offers, explains that transparency is one of the most effective safeguards against social media fraud. She emphasizes that brands should clearly communicate what information they will never request publicly and how users can verify official accounts. When expectations are set upfront, users become less vulnerable to impersonation tactics and more confident in legitimate brand interactions.

Some of the measures that can be taken to make transparency are providing real references, being transparent about the process of data collection, and responding promptly to the issues of fraud or fraud incidents. The regulars of transparency stimulate responsible interaction and make sure that the users are more willing to rely on the brand and less likely to become a victim of social media fraud.

Future Outlook: Marketing under the Security

The use of social media will dominate as a marketing tool in financial services. Platforms are improving fraud detection, but the companies need to incorporate security into any campaign.

Transparency and social media scam prevention techniques, combined with user education, guarantee responsible growth and decrease the risk of fraud. Tight coordination of the marketing and security departments safeguards the customers and builds trust in the long term.

Final Verdict

There are unprecedented marketing opportunities for financial services through the use of social media, but the potential for fraud is also high. Learning about these risks, training users, conducting campaigns, and following the concepts of ethical marketing are the measures that help to reduce them so that financial brands will be able to use the full benefits of social media and protect their users.

Manageable social media marketing not only results in an expansion of the business, but also creates credibility and trust, which is the most valuable asset in the financial industry.