Table of Contents

Surplus Definition

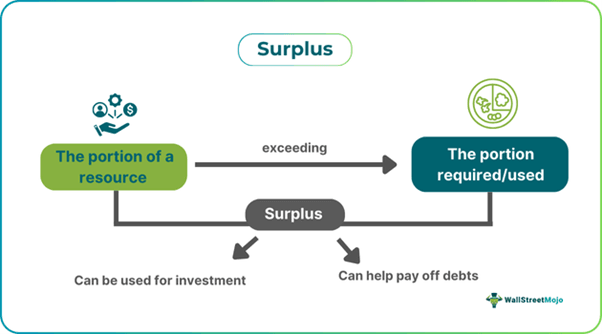

Surplus refers to an amount of a particular resource or asset over and above the portion utilized or required. In the context of accounts, organizations can utilize the excess amount for different purposes. For example, they can utilize the funds to pay off debts or make investments.

This excess amount may include capital, profits, goods, and income. In other words, the concept applies across a variety of aspects concerning a business’s operations. For example, it may materialize if a business’s income exceeds the expenses or if its inventory exceeds the immediate requirement. There are different types of surplus, for example, consumer, producer, budget, and inventory.

Key Takeaways

- Surplus meaning refers to the amount of resources that remain once the period of usage is complete. Individuals can utilize the excess resources for reinvestment purposes. Alternatively, they can use the assets to repay debt.

- A key difference between deficit and surplus is that the former is generally negative for any organization, while the latter can be negative or positive, depending on the context.

- Some common reasons why businesses may record a surplus include supplier constraints, inaccurate demand estimation, and technological advancements.

- Noteworthy consequences of recording the excess amount of resources include negative cash flow and decreasing prices.

Surplus Explained

Surplus meaning refers to a portion of an asset that is in excess of the amount actively utilized. In the case of accounts, businesses can reinvest the amount or utilize it to fulfill financial obligations. Also, an organization keeps the surplus funds to meet unplanned expenses or deal with financial emergencies.

As noted above, this concept applies to multiple aspects related to running a business. In the context of profit or income, the excess amount is clearly desirable. However, it is not always desirable. For example, let us consider the context of goods or manufacturing. If a business’s products go unsold, resulting in surplus inventory. This excess stock can cause an organization to incur losses.

In specific sectors that involve perishable goods, for example, food or beverages, the products expire if kept beyond a specific duration. Hence, any loss generated from unsold items is permanent. That said, in the case of businesses that depend on seasonal sales, having excess inventory is necessary to fulfill demand during the peak season.

Types

As one can get an idea from the above section, there can be different kinds of surplus. Let us look at them to develop an improved understanding.

- Product/Inventory: The excess amount of products or inventory materializes if the manufacturing company makes more products than what the consumers demand.

- Consumer: This arises if the products’ price drops below the amount the customer is ready to pay for them.

- Producer: It materializes when a producer sells its products for an amount higher than the minimum amount at which they were willing to make the sale.

- Budget: In this case, a government, household, or business records income over and above its budgeted expenses.

- Trade: This indicates that a country’s exports outweigh the imports.

- Retained Earnings: This refers to an organization’s excess profit not yet distributed among shareholders or utilized for any other purpose.

Causes

Let us look at some of the common reasons why this excess amount may materialize.

- Inaccurate demand projection: If the estimated demand for a product is inaccurate, a business may end up having excess inventory.

- Supplier Constraints: Sometimes, a company may end up with excess stock if suppliers cause any workflow-related issues.

- Inefficient Inventory Management: Poor inventory management can also result in excess inventory.

- Government Subsidies: Such subsidies can decrease costs, which can result in a company’s income exceeding the budgeted expenses.

- Technological Advancements: Technological innovations may decrease the costs of a company. As a result, the organization may end up having surplus funds.

- Easing Trade Regulations: This may allow the companies to benefit from economies of scale. The reduction in costs may allow the company to have an income over and above the expenses.

Consequences

Let us look at some consequences of a surplus.

- The excess amount of resources leads to an imbalance in a product’s demand and supply. In other words, the product cannot move efficiently through a market.

- An excess amount of inventory can severely impact an organization’s profit and cash flow. After all, the entrepreneur could utilize the money tied to the stock in other key areas of the business.

- If this phenomenon materializes if a new business radically increases supply, the consumers can benefit in the short term. Nevertheless, over the long term, this may lead to the business increasing its prices and developing monopoly power.

- When organizations record excess inventory, they try to clear their inventory quickly. As a result, they decrease their product’s prices to attract more buyers.

- From the accounts standpoint, a surplus can allow organizations to pay off their liabilities or utilize the funds for reinvestment.

Examples

Let us use a few examples to understand the topic.

Example #1

Suppose Company ABC is a t-shirt manufacturing company. The analysts of the organization predicted that there would be a significant rise in the demand for Christmas-themed t-shirts. Hence, the owner of the organization, Sam, gave orders to increase production by over 50% compared to other months in the year to fulfill the demand.

However, it turned out that the prediction was inaccurate as customers predominantly demanded Christmas-themed sweaters instead. To attract more buyers and clear the surplus inventory quickly, Sam decided to lower the prices. This strategy was effective as a lot of consumers decided to purchase those t-shirts because of the attractive prices.

Example #2

According to Bloomberg calculations, China’s trade surplus will hit the $1 trillion mark if it keeps widening at its year-to-date (YTD) growth rate. In the first 10 months, the nation’s goods trade surplus jumped to $785 billion, per data released in the first week of November.

With China relying more on its exports to compensate for its lack of domestic demand, the lopsided picture resulted in a pushback from an increasing number of nations. Moreover, it is likely that the Trump administration would impose tariffs to minimize the of imports from China. Various nations have already imposed tariffs against certain goods from China, like electric vehicles and steel. Such tariff barriers can help nations safeguard their domestic producers.

Surplus vs. Deficit

Understanding the key differences between deficit and surplus is vital for individuals new to these concepts to avoid confusion. So, the table below shows how they differ.

| Surplus | Deficit |

|---|---|

| This occurs when a portion of a resource remains after the fulfillment of the requirement concerning that asset. | A deficit occurs when a resource falls short of the amount required. |

| For example, it occurs when the income of an organization exceeds the projected expenses. | An excess of expenses over income is an example of a deficit. |

| A surplus may or may not be a negative thing for an organization. It depends on the context. | Generally, a deficit is negative for organizations. |