Table of Contents

What Is A Sustainable ETF?

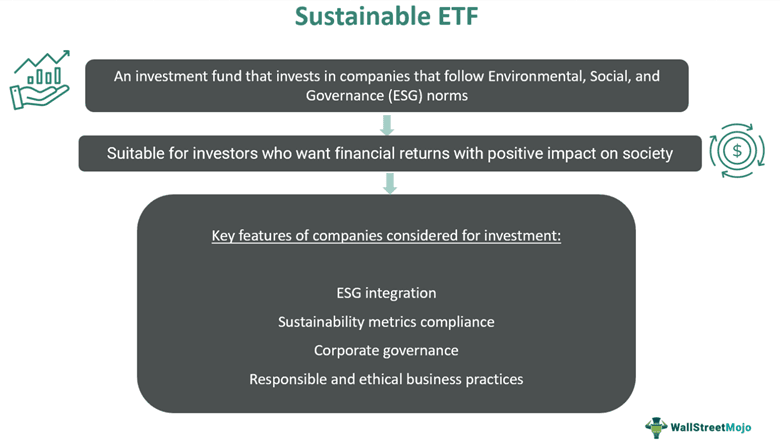

A Sustainable ETF refers to an Exchange-traded Fund (ETF) that invests in the stocks of companies that abide by sustainability principles and Environmental, Social, and Governance (ESG) guidelines. This investment vehicle aims to include stocks of companies that focus on corporate best practices like environmental sustainability, carbon footprint reduction, clean energy, water conservation, etc.

Investors may choose to invest in sustainable ETF funds to align their portfolios with sustainability objectives. Such a strategy allows them to select the stocks of companies that follow ethical practices and deliver good returns on investment. These assets may prove beneficial as investments in ESG are steadily gaining popularity. However, investors must keep associated risks in mind while making investment decisions.

Key Takeaways

- A Sustainable ETF is an exchange-traded fund where fund managers invest in the stocks of companies that focus on sustainability

- and Environmental, Social, and Governance (ESG) practices. They are also called ESG ETFs.

- Environmental, Social, and Governance (ESG) ratings enable investor decision-making,

- as investors prefer putting their money in highly rated stocks that align with their social and environmental goals.

- Investors usually analyze fund composition, historical fund performance, expense ratio, liquidity, diversification, and ESG approach before choosing an ESG ETF.

- A major disadvantage is the level of risk associated with such funds in volatile market conditions.

Sustainable ETF Explained

Sustainable ETFs are Exchange-traded Funds (ETFs) that primarily focus on sustainable and Environmental, Social, and Governance-based (ESG-based) stocks. They are also called ESG ETFs. They include the stocks of companies that focus on sustainability practices and transparency. Such companies follow ethical practices and comply with relevant laws and guidelines. These may include aspects like carbon emission control, planned resource usage, ethical strategy & approach, gender equality, risk management, good labor practices, diversity and inclusion, and various other matters that support effective corporate governance.

Due to their focus on earning returns while supporting sustainability and ESG practices, investors feel confident about the performance of such funds if a company’s ESG performance is noteworthy and aligned with standards. They believe similar effects will be visible in the corresponding ETFs.

Typically, investors invest in companies that align with their ESG area of interest. They invest in causes that they care about and want to promote to generate positive social and environmental impacts. Thus, creating the right sustainable ETF portfolio is an investor’s ultimate goal. Some of the best sustainable ETFs include iShares ESG Aware MSCI USA ETF, Vanguard ESG ETF, Vanguard ESG International Stock ETF, and others.

Sustainable ETF funds work on ESG ratings that assess and rate companies based on their environmental, social, and governance practices, in addition to the management of risks and opportunities. ESG ratings are the points allotted to companies for their contribution to environmental and sustainable practices. They represent how successful companies have been in managing the environmental, social, and corporate governance risks and opportunities.

The most preferred ESG risk rating and score is given by MSCI USA, where a higher rating indicates a lower risk on investment. It ranges from CCC to AAA, indicating the level of a company’s performance on ESG metrics. Thus, companies with AA to AAA ratings indicate an ethical and suitable corporate culture. Therefore, investors consider ESG ratings a crucial tool for making investment decisions.

ESG ratings further depend on ESG factors that steer a company’s performance, such as the industry or sector in which they operate, investor preferences, thematic focus (energy, water, diversity, gender equality, etc.), board governance, and regulatory environment, among others. For instance, companies that optimize the use of natural resources and reduce carbon footprints may receive positive ratings. Similarly, the relationship between a company and its stakeholders or compliance with guidelines, regulations, and industry standards has an impact on ratings.

How To Choose The Best ETF?

Building the most sustainable ETF portfolio requires careful deliberation and consideration. In this section, let us study the steps investors can follow to choose the best ETFs.

- Portfolio composition: The primary metric used to evaluate global sustainable ETFs is portfolio composition. It offers an overview of the companies, industries, and ESG ratings associated with such ETFs. Investors may feel confident about investing in such ETFs that comprise companies with positive or AAA ratings.

- Historical performance: An ETF’s historical performance plays a crucial role in determining its ability to bounce back in fluctuating market conditions. It helps analyze whether an ETF can survive volatile markets. Thus, if a global sustainable ETF has exhibited poor performance in the past, investors may avoid such ETFs. Tracking the consistency of returns over a period is also important here.

- Expense ratio: It refers to the costs associated with managing ESG ETFs. If this cost is high, it typically lowers investment returns with time. Investors consider an expense ratio of not more than 1% suitable for most sustainable ETFs.

- Liquidity: Liquidity is another key factor that impacts a sustainable ETF portfolio. If an ETF fund is not liquid enough, investors will find buying and selling challenging. Highly liquid funds are easier to trade than illiquid funds. They also face fewer fluctuations and market swings during trading sessions than illiquid funds.

- Diversification: Along with fund composition, it is important to consider diversification. A diversified portfolio may reduce risks in volatile markets. Funds that concentrate on a specific industry or sector may be vulnerable to market fluctuations and result in losses.

- ESG approach: Many of the best sustainable ETFs follow a defined asset allocation methodology. Fund managers select companies with strong ESG-driven principles and goals. Depending on the area of interest a fund focuses on, fund managers prioritize suitable assets.

Examples

Let us study some examples of such ETFs in this section.

Example #1

Suppose Kelly, an investor passionate about clean energy, is interested in investing in sustainable exchange-traded funds. She is looking for good returns, keeping environmental objectives in mind. However, she is unable to choose the right investment vehicle. Hence, Kelly hires Nancy, a financial advisor, to select the best sustainable ETFs in the clean energy area of work.

Nancy helps Kelly select specific sustainable ETFs under the category Kelly wants. She recommended a fund with an expense ratio of 0.15%. The fund had a good MSCI ESG rating. Thus, Kelly did not need to worry about the returns from this ETF. She was also satisfied with the kind of work the companies did in their field and the social impact they had over the years.

We can see that Nancy gave Kelly appropriate sustainable ETF investment advice after considering Kelly’s investment profile, goals, and objectives.

Example #2

According to a February 2024 report, some of the top sustainable ETFs saw massive outflows in 2023. In 2023, sustainable exchange-traded funds exhibited significantly adverse performance, driving investors to pull money back from ETFs. A huge amount, adding up to $5 billion, was withdrawn in the fourth quarter of 2023. Many ETFs failed to retain investors, with big names like Goldman Sachs closing its $7.64 million climatic ETF after two years of launch.

The article closes on an optimistic note, stating that sustainability will be the focus of the future, with ETFs expected to perform well in the coming years. This illustrates the popularity of such investments in current and future markets.

Advantages And Disadvantages

Sustainable or ESG ETFs have gained major popularity in recent times. However, there are some cons to consider before investing in them. Let us understand them.

| Advantages | Disadvantages |

|---|---|

| These ETFs offer investors a sense of safety about a company’s corporate practices and sustainability goals, thereby assuring them of the safety of their invested amounts. | The volatility and risks associated with such funds may be high due to market movements, investor sentiment, changing regulations, etc. This particularly applies because the focus is on earning high returns in line with specific ESG criteria. |

| Investors believe that exchange-traded funds in this form can bring higher returns than normal funds since these companies are unlikely to engage in unethical practices or undertake undue risks that can hamper their financial performance. | These funds may force investors to incur additional costs such as maintaining ESG standards, undertaking research to restructure ESG portfolio allocations, etc. |

| These funds offer extensive diversification through multiple allocations across different companies and sectors. | The demand for these funds may drop significantly in certain periods of market volatility and negativity, causing a decline in returns. |