Table of Contents

Tax Amnesty Definition

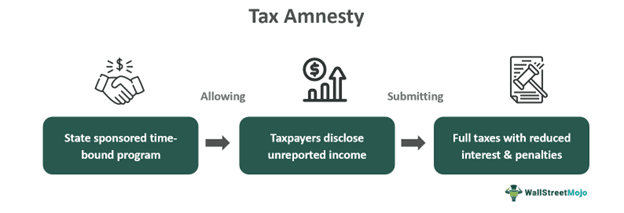

Tax amnesty refers to a time-bound program offered by different states allowing taxpayers to disclose past hidden income voluntarily. This program enables taxpayers to submit full taxes with reduced interest and penalties. It encourages corporations and individuals to declare their wealth through voluntary compliance while increasing tax revenues & base.

U.S. state government forgoes late-filing penalties and sanctions, motivating individuals to correct anomalies in tax returns and pay taxes in full. Some tax amnesty programs in the U.S., such as streamlined compliance procedures, help delinquent taxpayers complete their tax filings. These programs allow them to avoid severe penalties for non-willful conduct.

Key Takeaways

- Tax amnesty is a U.S. state-sponsored program. It allows taxpayers to voluntarily disclose hidden income, submit full taxes, reduce interest and penalties, and increase tax revenues.

- The requirements include paying a portion of the taxes, meeting historical tax filing conditions, withdrawing from tax obligations, and submitting amnesty application deadlines.

- Additionally, taxpayers must pay outstanding taxes, comply with program rules, and request installment payment plans if needed.

- It generates government revenue, often meeting a few percentage points of the total target. However, its long and short-term compliance effects are uncertain, contributing to ambiguous impacts.

Tax Amnesty Explained

Tax amnesty allows taxpayers to declare unreported or partial revenue from previous tax periods without prosecution or penalties. It encourages reluctant taxpayers to voluntarily disclose past underreported or undisclosed assets or income to tax authorities. As a result, taxpayers or corporations are saved from legal prosecution and forgiven of the tax debt. Moreover, governments successfully recover the evaded tax and increase their revenue collection base.

Although tax amnesty programs may produce extra revenue for states in the short term, they may adversely affect future tax compliance as taxpayers might expect more such amnesty programs. In the long term, it may encourage tax evasion and make the system biased towards a section of taxpayers more than others. Nevertheless, tax amnesty 2024 programs work to resolve economic crises, improve tax compliance, and increase tax revenues swiftly.

Federal tax amnesty programs tend to affect government tax collection, taxpayer behavior, and overall tax adherence levels in the general population and corporations. Furthermore, it impacts public opinion regarding unfair tax systems and may also affect future tax regulations and tax policies.

Requirements

Every tax amnesty program has to qualify suitably to resolve past tax obligations as per below requirements:

- Tax evaders must pay a portion of their previously owed taxes.

- They have to show that they meet the conditions of incorrectly filing taxes or non-filers historically.

- Taxpayers have to show that they have discontinued or withdrawn from all proceedings or litigations related to tax obligations concerning the amnesty application procedure.

- The amnesty application has to be submitted within the specific deadline stipulated by the tax authorities running the program.

- Taxpayers have to pay the outstanding tax in full plus interest before the end of the amnesty period.

- Taxpayers have to comply with all the amnesty program rules and regulations set by the authorities.

- Taxpayers not able to pay their tax liability in full have to submit their financial status to request an installment payment plan for their tax obligations.

Examples

Let us use a few examples to understand the topic.

Example #1

Let us assume that a resident of Old Angeles, Johnny, failed to file his tax returns for the last two years. Hence, a total tax of $10000 was accumulated under his taxpayer profile. However, to his luck, the American state of Texas initiated an amnesty of tax program to settle all their outstanding tax debts.

Hence, Johny saw it as a one-time opportunity to remove all tax obligations by:

- Paying only the principal amount of $10000 without any penalties or interest charges accumulated.

- He also negotiated an installment plan to pay all outstanding debts over a period, bypassing penalties of tax obligations.

As a result, Texas recovered huge revenue from people like Johnny, which was used for welfare programs and administrative purposes.

Example #2

An article published on November 3, 2023, discusses the amnesty of tax programs offered by the Kenya Revenue Authority (KRA) until June 30, 2024. It aims to provide relief on interest and penalties relief on tax debts applicable up to December 31, 2022. The program offers the following:

- It offers a full waiver on interest and penalties to taxpayers who pay their full principal tax by June 30, 2024.

- It comes with flexible payment plans for those who have principal tax outstanding. Here, the taxpayer can become eligible for the amnesty program if they recommend a payment plan for committing to settle all upcoming tax debts.

As a result, the program, much like the Philippine estate tax amnesty, is a lifetime opportunity for Kenyan taxpayers to resolve their due taxes and avoid further penalties.

Advantages And Disadvantages

| Advantages | Disadvantages |

|---|---|

| It generates revenue for the government, often to the tune of a few percentage points of the total stipulated target. | It has uncertain compliance effects in the long and short term, leading to ambiguous impacts. |

| It brings tax evaders into the tax net, improving the tax compliance rate. | It has the potential of fluctuating revenue implications in the short and long term. |

| It raises the yield of a given tax in the absence of structural change. This makes it a cost-effective solution during a recession or financial crisis | It raises false hopes of periodical amnesty of taxes to tax evaders and the general public at large, leading to a tendency to non-compliance with tax paying on time as per law. |

| It decreases the effective tax rate disparity of past tax-evading citizens, ensuring a fair playing field for all. | Since it allows accounts receivable to join in an amnesty of tax, it may lead to revenue loss arising from waived penalties. |