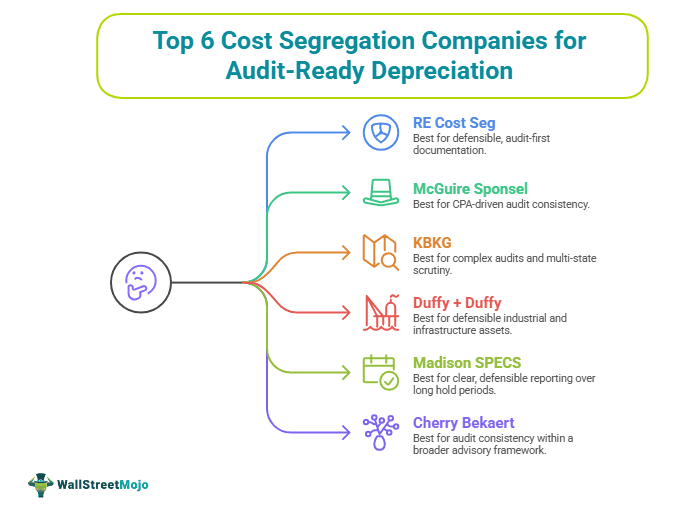

Top 6 Cost Segregation Companies for Audit-Ready Depreciation

Table of Contents

Why Audit Readiness Is What Separates the Best Cost Segregation Companies

About a year ago, I was consulting with a private equity group preparing for what was expected to be a routine IRS review. The depreciation positions themselves were never the issue. Instead, the examination quickly centered on documentation quality. Asset narratives lacked depth. Cost sources were summarized rather than traceable. Photographic support was incomplete. The study was not aggressive, but it was vulnerable. The review stretched on for months, consuming internal time and delaying unrelated planning decisions. In the same audit cycle, another asset moved through with minimal friction, supported by clear engineering workpapers and well-substantiated classifications that required little explanation.

That contrast reflects a consistent reality. Most cost segregation risk does not come from assertive positions. It comes from weak support. The strongest cost segregation companies design studies to be examined, not merely filed. This article focuses on firms that emphasize audit readiness, documentation discipline, and long-term defensibility in 2026, and how owners can evaluate those qualities before engaging a provider.

Quick Take: The Most Audit-Ready Cost Segregation Companies for 2026

#1 - RE Cost Seg: Best For Defensible, Audit-First Documentation

- Engineering-backed workpapers

- Clear asset narratives

- Built for long-term review

#2 - Sponsel: Best For CPA-Driven Audit Consistency

- CPA-aligned reporting standards

- Predictable documentation packages

- Clean audit handoffs

#3 - KBKG: Best For Complex Audits And Multi-State Scrutiny

- In-house engineering teams

- Deep audit defense experience

- Consistent national methodology

These firms stand out not for aggressive positioning, but for documentation discipline and audit resilience. The sections that follow break down how owners should evaluate audit readiness and review additional firms that consistently deliver studies designed to withstand scrutiny in 2026.

How To Evaluate Audit Readiness In A Cost Segregation Study

Audit readiness is often overlooked in cost segregation because many owners assume studies will never be closely examined. In reality, depreciation schedules are frequently reviewed years later during audits, refinances, transactions, or internal due diligence. When that happens, the strength of the underlying methodology and documentation matters far more than the initial depreciation total.

The best cost segregation companies design studies to be reviewed, not just filed, emphasizing engineering-based support, clear workpapers, consistent classification logic, and coordination with tax advisors. The considerations below outline what owners should evaluate to determine whether a study is built to withstand scrutiny over time.

#1 - Engineering-Based Support Is The First Line Of Defense

Audit-ready studies begin with the engineering discipline. Site inspections, construction document review, and use-based asset classification provide the factual backbone that supports depreciation decisions. Firms that rely too heavily on estimates or templates may still deliver acceptable numbers, but they leave gaps when assumptions are questioned. Owners evaluating audit readiness should ask how engineering conclusions are documented and reviewed internally.

#2 - Documentation Quality Matters More Than Aggressiveness

Most audit issues stem from weak documentation, not overly aggressive positions. Clear asset narratives, traceable cost sources, and reconciliations back to original basis reduce friction during review. Well-prepared studies allow auditors to follow the logic without interpretation or guesswork. When documentation is thin, even conservative classifications become harder to defend.

#3 - Consistency Across Assets Reduces Exposure

For portfolios with multiple properties, inconsistency is a hidden risk. Different assumptions, formatting, or classification logic across studies can invite questions during broader reviews. Firms with standardized methodologies and reporting formats make it easier for CPAs and auditors to assess positions across assets without re-learning the logic each time.

#4 - CPA Coordination Strengthens Audit Response

Cost segregation does not stand alone during an audit. Providers that coordinate closely with CPAs help ensure responses are timely, consistent, and technically sound. Owners should understand whether audit support is included, how quickly documentation can be produced, and who is responsible for interfacing with tax advisors if questions arise.

#5 - Long-Term Usability Is Often Overlooked

Audits do not always happen immediately. Studies may be reviewed years later, after refinances, renovations, or ownership changes. Reports that are clearly structured and well-documented remain defensible over time, even as teams and advisors change. This long-term usability is one of the strongest indicators of true audit readiness.

Cost Segregation Companies Known For Audit-Ready Work In 2026

#1 - RE Cost Seg: Best For Defensible, Audit-First Documentation

- Founded: 2022

- Headquarters: Houston, TX

Why RE Cost Seg is the best cost segregation service: RE Cost Seg builds studies with the assumption that they will eventually be reviewed.

The firm emphasizes engineering-based methodology supported by detailed asset narratives, clear cost sourcing, and reconciliations that tie directly back to the original basis. Reports are structured to be CPA-ready and audit-ready from the outset, reducing friction if documentation is revisited years later during an IRS inquiry, refinance, or transaction.

What strengthens this audit-first posture is how deliberately assumptions are documented. Engineering judgments, cost allocations, and asset groupings are explained in a way that allows third parties to follow the logic without interpretation. For owners who want studies that remain defensible even as teams and advisors change, this level of clarity materially lowers long-term risk.

#2 - McGuire Sponsel: Best For CPA-Driven Audit Consistency

- Founded: 2007

- Headquarters: Indianapolis, IN

McGuire Sponsel is great for owners who want cost segregation executed within a disciplined, CPA-led framework.

The firm’s studies are engineering-based and designed to integrate seamlessly into CPA workflows. Documentation standards are consistent, predictable, and easy for tax advisors to support during review. This consistency is particularly valuable for portfolios with multiple assets, where uniform methodology reduces questions and exposure across filings.

McGuire Sponsel’s long-standing focus on CPA partnerships also shows up in how audit support is handled. Responses are coordinated, documentation is familiar to tax professionals, and handoffs are clean. For owners who prioritize smooth audits and minimal back-and-forth, this predictability is a meaningful advantage.

#3 - KBKG: Best For Complex Audits And Multi-State Scrutiny

- Founded: 1999

- Headquarters: Pasadena, CA

KBKG is frequently chosen for portfolios facing heightened audit scrutiny due to size, geographic spread, or structural complexity.

With in-house engineering teams and deep experience across multiple jurisdictions, KBKG delivers studies built to hold up under layered review. Its standardized methodology and detailed workpapers support audit defense across states, making the firm a strong option for institutional owners managing complex portfolios.

KBKG’s value in an audit context is scale with control. Studies are produced under a centralized framework that limits variation across properties, reducing the risk that inconsistent assumptions trigger broader questions. For multi-state owners, that uniformity can materially reduce exposure during expanded reviews.

#4 - Duffy + Duffy Cost Segregation Services: Best For Defensible Industrial And Infrastructure Assets

- Founded: 2002

- Headquarters: Westlake, OH

Duffy + Duffy is particularly effective for assets with complex systems and infrastructure that require precise documentation.

The firm combines accounting expertise with construction engineering and cost estimating, producing studies grounded in IRS guidance and relevant case law. This depth is especially valuable for industrial and manufacturing properties, where audit risk often stems from misclassified systems or weak support for retirements and dispositions.

What distinguishes Duffy + Duffy in an audit setting is how granular the support tends to be for major building components. Systems are broken out, documented, and explained in a way that allows reviewers to trace classifications back to physical assets. That level of specificity can be critical when infrastructure-heavy properties are examined.

#5 - Madison SPECS: Best For Clear, Defensible Reporting Over Long Hold Periods

- Founded: 2004

- Headquarters: Lakewood, NJ

Madison SPECS is a strong option for owners who want cost segregation reports that remain clear, readable, and defensible long after the initial filing.

The firm operates exclusively in cost segregation and emphasizes engineering-based studies supported by site inspections, blueprint review, and photographic documentation. Asset schedules are structured so that classifications and assumptions remain understandable even years later, without requiring institutional knowledge.

From an audit-readiness standpoint, this clarity matters. When ownership changes, advisors rotate, or a study is reviewed long after delivery, readable documentation reduces friction and misinterpretation. For long-hold investors, that durability is often as valuable as the depreciation itself.

#6 - Cherry Bekaert. Best For Audit Consistency Within A Broader Advisory Framework

- Founded: 1947

- Headquarters: Richmond, VA

Cherry Bekaert is well-suited for organizations that want cost segregation embedded within a broader accounting and advisory environment.

As a national CPA and advisory firm, Cherry Bekaert approaches cost segregation with an emphasis on documentation discipline and alignment with audit and assurance standards. Studies are engineering-based and designed to integrate smoothly with ongoing tax compliance, financial reporting, and audit processes.

This integration can reduce audit risk by keeping depreciation positions consistent with how the organization documents and defends other tax positions. For middle-market companies and institutional owners that value centralized oversight and conservative execution, this alignment provides an added layer of comfort during review.

Choosing An Audit-Ready Cost Segregation Partner In 2026

Audit readiness is not about preparing for the worst. It’s about building studies that remain credible under any level of review. The companies highlighted here share a commitment to engineering discipline, clear documentation, and consistent methodology, qualities that reduce friction whether a study is examined during an IRS inquiry, a refinance, or a transaction years later.

The right partner is the one whose process matches your risk profile and portfolio complexity. Some owners benefit most from CPA-led consistency, others from deep engineering support for complex assets or multi-state exposure. What matters is choosing a firm that designs studies to be reviewed, not just filed.

In 2026, the best cost segregation companies understand that defensibility is a form of value. When documentation is clear, assumptions are traceable, and reports remain usable over time, depreciation becomes a durable advantage rather than a lingering risk.