They both are versions of the Vantagescore credit score and have significant differences, some of which are given below:

Table of Contents

What Is VantageScore?

VantageScore is a consumer credit score released by three major nationwide credit reporting agencies: Equifax, Experian, and TransUnion. The score reveals the creditworthiness of the applicant. It is calculated based on factors such as credit mix and payment history, with each component given a different weight.

It is a score that can replace the FICO (Fair Isaac Corporation) score. VantageScore wanted to make it possible for more people to acquire a credit score, including college students and recent immigrants. These scores are widely used by vast sections of the population, such as credit card issuers, installment loan providers, and fintech lenders.

Key Takeaways

- VantageScore is a consumer credit score released by three major nationwide credit reporting agencies: Equifax, Experian, and TransUnion.

- The score reveals the applicant's creditworthiness. It is calculated based on factors such as credit mix and payment history, with each component given a different weight.

- It was introduced in 2006, and four models have been released to date, but the most popular by far has been its 3.0 version.

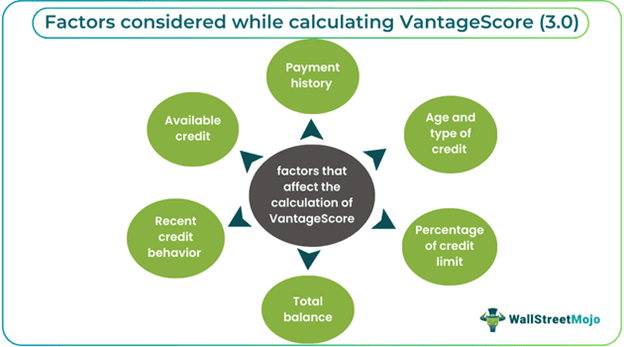

- Payment history, age and type of credit, percentage of credit limit, total balance, recent credit behavior, and available credit are factors considered when calculating scores.

VantageScore Explained

VantageScore was introduced in 2006, and four models have been released to date, but the most popular by far has been its 3.0 version. The credit scores are estimated based on data from the three major credit bureaus. The scoring technique includes modeling techniques such as machine learning, National Consumer Assistance Plan optimization, and trended credit data. VantageScore evaluates an individual's credit history similarly to FICO but weighs the components differently.

The popular vantagescore credit score version 3.0 is calculated on the following metrics.

VantageScore 3.0 weightage

| Factors | Weight age |

|---|---|

| Payment history | 40% |

| Age and type of credit | 21% |

| Percentage of credit limit | 20% |

| Total balance | 11% |

| Recent credit behavior | 5% |

| Available credit | 3% |

- Payment history: A consumer's payment history weighs up to 40% in the score calculation. A consumer who makes consistent payments helps build a strong credit score.

- Age and type of credit: Age and type constitute about 21% of consumer credit. This considered how long a consumer has successfully kept their accounts in good standing and whether they possess diverse revolving credit and loans.

- Percentage of credit limit: The percentage of consumer credit limit used accounts for about 20% of the score calculation. Hence, the rate of credit utilization is essential. The consumer can optimize this score by keeping their revolving credit accounts balance below 30% of their total credit limit.

- Total balance: The total outstanding balances of the consumer constitute 11% of the score calculation. In this section, consumers who keep their credit balances full can help boost their scores.

- Recent credit behavior: It constitutes about 5% of the score calculations. Applying for random new loans can invite harsh credit checks, which can lower scores. Applying for new credit can be avoided.

- Available credit: It accounts for 3% of the score calculation and is the amount left with the holder for this cycle.

Examples

Let's understand the concept with the help of some real-world and hypothetical examples.

Example #1

Suppose Dave, a salaried employee, wants to borrow money to purchase a plot of land. Since he does not have enough funds for the purchase, he decides to apply for a loan. The lender evaluates his creditworthiness by checking his VantageScore, which reflects his credit history and financial behavior. Dave has consistently paid his monthly dues on time and maintained his accounts in good standing. As a result, his loan application is approved without any issues.

Example #2

VantageScore Solutions conducted research in 2021 to examine consumers who fail to meet the minimum scoring criteria required by conventional credit scoring models. The study found that income has the most potent effect on scoreability. Consumers in low-income households (earning less than $50,000 annually) have significantly lower odds (less than 50%) of obtaining a credit score compared to those in higher-income households (earning more than $90,000 annually).

VantageScore 3.0 Vs. VantageScore 4.0

| Key Points | VantageScore 3.0 | VantageScore 4.0 |

|---|---|---|

| 1. Creation | It was released in 2013. | VantageScore 4.0 was relesed in 2017. |

| 2. Usage | It does not cover data from all three agencies for trended credit data. | It is the first and only scoring model to inculcate trended credit data from all three credit reporting companies. The data reflect changes in the behavior of credit over time. |

| 3. Significance | The VantageScore 3.0 strengthens the predictive ability to determine a borrower's reliability accurately. | VantageScore 4.0 uses machine learning to develop scorecards for borrowers with limited credit histories. |

VantageScore Vs. Fico Score

Some of the differences between the two are given below:

| Key Points | VantageScore | Fico Score |

|---|---|---|

| 1. Creation | All three credit bureaus Equifax, Experian, and TransUnion took part in creating it. | Individual bureaus create FICO (credit scoring model developed by Fair Isaac Corporation.) |

| 2. Composition | Even though they estimate scores based on similar factors, the level of importance given separately for each component is different. The consumer's payment history accounts for 40% of the credit score. | In FICO, the payment history accounts for 35% of the score. |

| 3. Good Ratings | A credit score of 700 or higher must be considered good under V. | A score of 670, at the very least, is required to be considered good under FICO |