Table Of Contents

What Is Accounts Payable Credit or Debit?

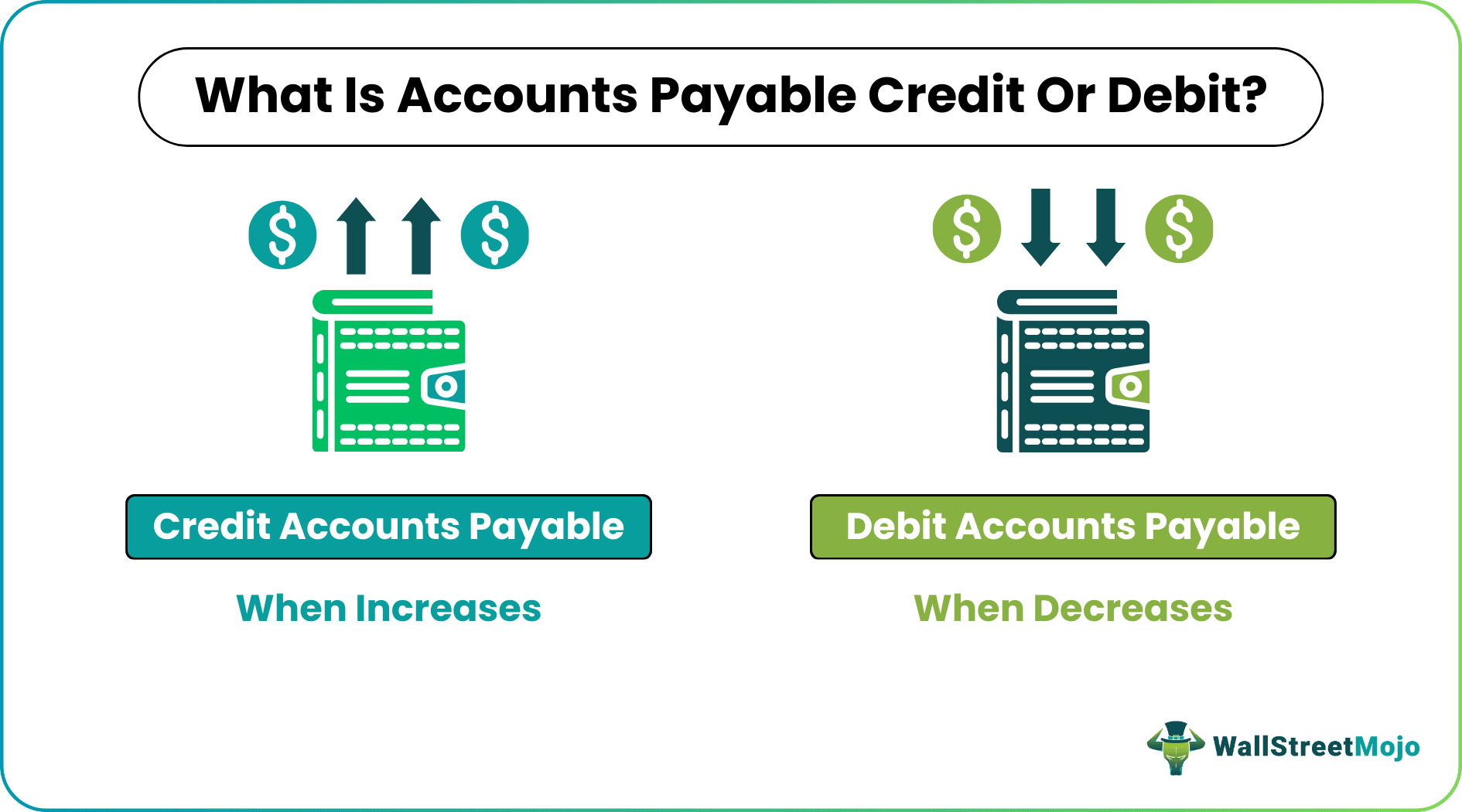

Accounts payable are the current liabilities that the business shall settle within twelve months. Accounts payable account is credited when the company purchases goods or services on credit. The balance is debited when the company repays a portion of its account payable. Since it is a liability account, it must show a credit balance.

These entries are based on the double-entry system of bookkeeping. The common question of whether accounts payable credit or debit in balance sheet can be cleared with a simple understanding of any amount being owed like account payables or accrued revenue (short-term liabilities) or mortgages payable (long-term liabilities) shall be recorded under liabilities of the company.

Table of contents

Accounts Payable Credit or Debit Explained

The journal entries for accounts payable debit or credit is shown below -

If a company buys some assets from a vendor and promises to pay after one month, Account Payable gets credited. Below will be a general entry for the same:

After one month, the pays the amount back to the vendors by cash. That means their liability will go down or will get debited. So below will be a general entry for Account Payable Debit:

Accounts Payable in Video

How To Record?

Let us understand the concept of entering accounts payable credit or debit in balance sheet with the help of a few examples. These examples shall give us a practical outlook of the concept and its related factors.

Example #1

Let’s say Company XYZ is buying inventory, a current asset worth $500 from its vendor. It has promised to pay back the amount in one month. So, in this transaction, the Account Payable account gets the credit, and the inventory account gets debit. Below is the journal entry for Account Payable Credit:

After one-month, Company XYZ will pay back the amount with cash. That means the cash amount will go down or get credited; on the other hand, the side Account Payable will get debited. Below will be accounting for the same:

Example #2 (IBM)

We will understand this concept from 2017 to 2018 for companies in the below practical example. IBM is an American Information technology multinational company headquartered in New York. Below is the Balance Sheet for IBM for the year 2018:

Source: www.ibm.com

As we can see, in 2017 Account Payable for IBM was $6,451 million, while in 2018, it increased to $6,558 million. Though we cannot say how many transactions happened that year, overall, since it is increasing, it is an example of Account Payable Credit for IBM.

Account Payable Credit for Year 2018 = 6558-6451 = $107 Mn.

Example #3 (Walmart)

For the second example, we will take the example of another American multinational company, Walmart. Walmart is a US multinational retail organization headquartered in Arkansas. Let’s see its balance sheet below:

Source: s2.q4cdn.com

As we can see, in 2017 Account Payable for Walmart was $41,433 million, while in 2018, it increased to $46092 Mn. Though we cannot say how many transactions happened in that year but overall since it is increasing hence, it is an example of Account Payable Credit for Walmart.

Account Payable Credit for the Year 2018 = 46092-41433 = $4,659 Mn.

Example #4 (Apple)

Let’s investigate Apple’s annual report to find out whether its Account Payable got credited or debited in the last one year. Apple is a US multinational company that designs and develops mobile and media devices and personal computers and sells many kinds of software. Below is the balance sheet snippet of Apple's annual report for 2018:

Source: s22.q4cdn.com

As we can see, in 2017, Account Payable for Apple was $44,242 million, while in 2018, it increased to $55,888 Mn. As we can see that its business is growing, and having a high account payable is, in a way, a good sign that the company is handling its cash policies in a good way. Since Account Payable is increasing, that means it got credit in 2018

Account Payable Credit for the Year 2018 = 55888- 44242 = $11,646 Mn.

Example #5 (Amazon)

For our next example, we will investigate the balance sheet of Amazon, an American multinational company focusing on e-commerce, cloud computing, and artificial intelligence. Below is the balance sheet snippet of Amazon's annual report for 2018:

Source: Amazon.com

As we can see, in 2017, Account Payable for Amazon was $34,616 million, while in 2018, it increased to $38,192 Mn. As we can see that its business is growing, and having a high account payable is, in a way, a good sign that the company is handling its cash policies in a good way. Since Account Payable is increasing, that means it got credit in 2018

Account Payable Credit for Year 2018 = 38192-34616 = $3,576 Mn.

Accounts Payable Vs Accounts Receivables

Both accounts payable and receivable arise out of transactions of a business where they have either purchased or sold assets, products, or services on credit. Let us understand the differences between them through the comparison below to completely understand the concept of issuing an accounts payable credit or debit memo.

Accounts Payable

- It refers to the amount a company owes to its creditors or vendors against the purchase of an asset, raw material, or product.

- It arises due to credit purchases.

- It results in a cash outflow for the company.

- It is featured under the current liabilities section of the balance sheet.

- Sale tax payables, trade payables, and interest payables, among others are accounted for under this sub-head.

- It ultimately indicates that an amount is outstanding/ to be paid.

Accounts Receivables

- Accounts receivable refers to the amount owed to the company by its customers.

- It is an outcome of the company selling its products or services on credit.

- As a result, it induces a cash inflow for the company.

- It is featured under the current assets of the company’s balance sheet.

- Trade receivables and non-trade receivables are accounted under this sub-head.

- It is an indicator that the amount has to be collected from customers.

Recommended Articles

This has been a guide to Accounts Payable Credit or Debit. Here we explain how to record them, examples, and compared it with accounts receivables. You may learn more about accounting from the following articles –