Table Of Contents

What Is The Advance-Decline Ratio?

The advance-decline ratio is a technical analysis of the stock market trends. First, the nature of market securities is analyzed, like whether the securities are bought or sold in excess, to determine whether the market is growing positively or negatively. It can be calculated daily, fortnightly, monthly, quarterly, or per requirement or type of investor.

Table of contents

- What is the Advance-Decline Ratio?

- The advance-decline ratio is a stock market trends technical analysis. The market securities nature is determined first, like whether the securities are bought or sold in surplus, to analyze if the market is positively or negatively growing.

- One must calculate it daily, fortnightly, monthly, quarterly, or per requirement or type of investor.

- One must calculate it by comparing the stock or securities value that increased to the stock or securities value that decreased in the past figures.

- The ratio calculated on the trend basis and by the results of the advance-decline balance is the type of the advance-decline ratio.

Explanation

The market securities analysis helps investors decide whether to buy or sell the securities. The advance-decline ratio can prove more beneficial if used with other company parameters. The ratio is calculated by comparing the number of securities or stocks that increase to the number of securities or stocks in decreasing trend.

It helps determine the upcoming trend in the market, which proves very beneficial for the investors to plan the investment accordingly. Furthermore, it is also useful to determine whether the newly incorporated companies or small companies are performing as per market trends or whether it is beneficial to invest in those companies.

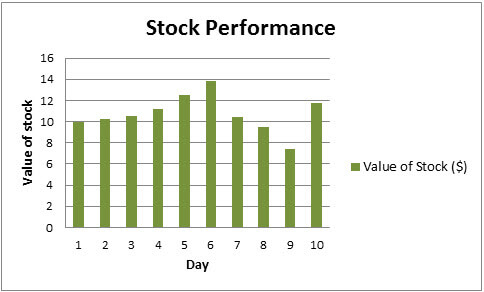

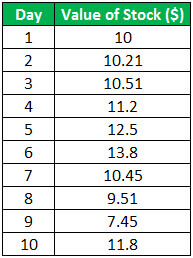

In the above chart, the value of a stock increases until day 6, after which it declines for the next three days, and on the 10th day, its gain increases from the previous day. So, out of 10 days, the number of declining trends is three, and in the remaining seven days, there is an advancing trend. Therefore, it will be the number of advancing trends divided by declining trends, i.e., 7/3 or 2.33. It shows that the stock is overbought. Since the ratio is greater than two, it shows that the stock is at a higher increasing trend.

Formula

The advance-decline ratio is calculated by comparing the value of stock or securities increased to the value of stock or securities decreased in the past figures. The figures may be taken for one day to any period it wants to calculate.

Advance-Decline Ratio = The Number of Advancing Stock / The Number of Declining Stock

Where,

Much advancing stock refers to some stock or securities increasing, like the increased value. Conversely, the number of declining stocks refers to the number of stocks or securities in decreasing trend, i.e., the value of which has been reduced compared to the previous value.

Interpretation of Advance-Decline Ratio

- It is calculated by dividing the value of shares in an increasing trend by the value of shares in a decreasing trend. Next, it determines whether the particular stock is growing or declining in the industry. Finally, it is compared with the company's stock in which the investor wants to invest.

- If the ratio is equal to or less than one, the stock is said to be in a stable or declining trend.

- If the ratio is greater than one, then the stock is at an increasing trend.

- If the ratio is greater than two, the stock is at a higher increasing trend.

- Traders can estimate the market based on results or value from the formula above.

How Does it Work?

The investor compares the advance-decline ratio with the market trends and the company's trends in which he wants to invest in, determining whether his investment will be fruitful or whether to buy or sell the security. The ratio determines the upcoming market trend, which helps the investor utilize the investment to earn the maximum profit. It can be calculated for any period.

Examples

Example #1

The latest market trends of the given stocks determine the advance-decline ratio.

Solution:

Advance-Decline Ratio = The Number of Advancing Stock / The Number of Declining Stock

- = 5 / 3

- = 1.6667

The market is said to be on an increasing trend.

Example #2

The market value of single stocks for the last ten days is calculated below.

Advance-Decline Ratio = Number of Advancing Trend / Number of Declining Trend

- = 7/3

- = 2.33

Thus, this is greater than two, showing that stock is at a higher increasing trend.

It is possible to explain the concept with the help of a chart from TradingView, as given below. In this chart, The ratio has been used to detect whether the market is in an uptrend or a downtrend. Overall, in the chart the area which show and uptrend will have the a positive value as per the indicator. It will be the opposite in case of negative value.

However, even though it is a good indicator, a trader should use it in combination with other useful indicators so that there is clarity in the process and there is proper confirmation.

Types of Advance-Decline Ratio

- Ratio Calculated on a Trend Basis: In calculating the advance-decline ratio on a trend basis, the stock value of the past few days is compared. If the overall result from most days shows an increasing trend, then it is said that the market is at a growing trend, and positive results from the investment are expected. For example, the stock shows an increasing trend seven days out of 10 days; then, the stock is on a rising trend.

- By the Results of Advance-Decline Ratio: If the result or value of the advance-decline ratio is greater than one, then the market is said to be increasing. If the ratio is lower than one, then the market is said to be a decreasing trend.

Advantages

- Beneficial for Investors: This helps the investors plan the investment to earn the optimum profits.

- Determines the Upcoming Market Trend: This helps determine whether the stock is overbought or oversold. Hence, it helps the investor and potential investor decide whether to buy or sell.

- Direction for Investment in Small Companies and Start-Ups: The advance-decline ratio of a stock is compared with the projected ratio of start-ups to determine whether start-ups will profit in the long run.

- The Base for New and Loss-Making Companies: It helps new companies, small companies, and loss-making companies perform better to cope with market trends.

- It protects the investor from wrongful decisions.

- It is one of the most powerful tools if combined with other trends.

- It can be calculated for any period.

Conclusion

The advance-decline ratio is calculated based on technical analysis. It is beneficial for investors to decide whether to invest in the company or not. It determines the future market trend based on current market trends. A formula calculates the number of stocks increasing in value and the number decreasing in value.

Then the ratio is compared with the market index to determine the accuracy. If the ratio is greater than one, the trend increases; if the ratio is lower than one, it decreases. The ratio can be calculated for any period.

For professional-grade stock and crypto charts, we recommend TradingView – one of the most trusted platforms among traders.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

Suppose the advance/decline ratio is equal to or less than one; the stock is a balanced or declining trend. On the other hand, if the balance is more significant than one, the store is at an increasing trend. In addition, suppose the ratio is more important than two; the stock is at a higher increasing trend.

The number of advancing shares divided by the number of decreasing shares is known as the advance-decline ratio. It can be calculated for various time frames, including a day, a week, or a month. The balance can be used independently to determine if the market is overbought or oversold.

Advances refer to the number of stocks closing at a higher price than the previous day's close. In contrast, declines refer to the number of stocks closing at a lower price than the last day's close.