Introduction To AI In Stock Market Prediction

Table of Contents

Introduction

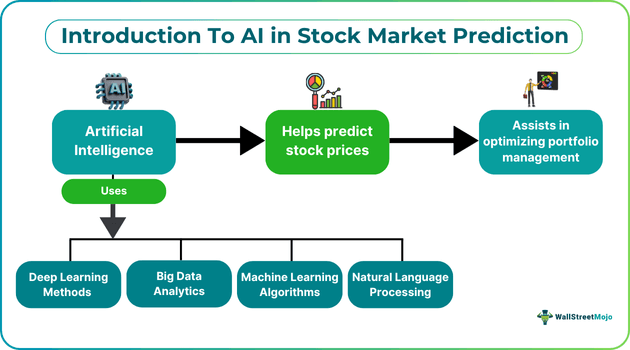

Artificial Intelligence, or AI, is gaining significant traction across various industries. Even individuals and organizations operating in stock markets are now leveraging it to fulfill their objectives. Indeed, hedge funds, mutual funds, and investment firms are increasingly utilizing AI-powered predictive models that are able to make predictions concerning stock market trends. Precisely, the AI algorithms analyze news, market sentiment, events, and historical data to forecast the price movements of stocks with a high level of accuracy.

Simply put, AI stock prediction is revolutionizing how investors and analysts predict price movements. Given the introduction of different AI-based tools, one does not need to spend a significant amount of time conducting technical analysis and fundamental analysis. Moreover, they need not make decisions based on assumptions or gut instincts. They can make the most of AI for stock analysis to improve the accuracy of price predictions and navigate the complex market landscape.

Key Takeaways

- AI stock market predictions have become a game-changer for investors and analysts as they no longer need to carry out extensive research or make decisions on the basis of gut feelings.

- Predictions based on AI help in portfolio optimization, technical analysis, and risk management.

- There are various benefits of using AI for stock price predictions. For example, it helps in saving time and money. Moreover, it can help make improved trading and investment decisions.

- The heavy reliance of AI on historical stock data is a noteworthy challenge concerning AI stock price predictions.

How Does AI In Stock Market Prediction Work?

AI for stock trading involves using data-backed insights, which minimizes the reliance on intuition for making decisions. This approach improves the accuracy of the estimated price movements and makes investors and analysts more confident.

The models that carry out AI stock prediction mitigate financial risk through a detailed analysis of the market conditions and different risk factors in real-time. Such models are free from human emotions, cognitive biases, or any psychological factors. As a result, AI models offer an objective perspective, which can aid in making the right decisions.

AI for stock market projections factors in individuals’ financial goals, risk appetite, and preferences to provide personalized recommendations. Customized strategies play a key role in improving customer. Moreover, they promote trust and help make informed investment-related decisions.

Advancements In AI For Stock Market Prediction

Let us look at the following pointers to get a clear idea about the advancements in AI stock price prediction.

- Sentiment Analysis: This type of analysis involves using AI to analyze social media conversations, financial reports, news, etc., to understand market sentiment. Analysts and investors can take the market sentiment into account to make accurate price predictions.

- Natural Language Processing Or NLP: NLP algorithms play a crucial role with regard to AI stock price prediction by extracting actionable insights from high-volume data. These insights allow market participants to focus on important data points to predict price movements in the stock market with accuracy.

- Machine Learning Algorithms: These algorithms analyze historical data concerning stocks to spot patterns associated with price changes, thus providing statistical insights for decision-making. Based on such insights, predicting prices becomes easy.

- Big Data Analytics: Big data has played a key role in evolving AI for stock analysis. AI systems go through large volumes of unstructured and structured data to reveal correlations and patterns, which help market participants predict price movements better when compared to conventional analysis.

- Deep Learning Methods: AI systems utilize deep learning methods to analyze patterns in company announcements, financial reports, and historical data. The analysis uncovers key insights that allow individuals to predict stock prices.

Use Cases Of AI In Stock Market Prediction

Let us look at the use cases of AI for stock market projections.

- Optimal Portfolio Management: AI models analyze historical stock market volatility and data and help make adjustments to a portfolio, utilizing predictive analytics. Moreover, these models can suggest effective diversification strategies to minimize risk.

- Algorithmic Trading: This type of trading involves using AI to trade on the basis of pre-defined rules. The AI systems analyze market data to predict future price movements, and based on these predictions, setting the rules is possible. Algo trading can minimize the possibility of mistakes and can result in the execution in the timely execution of buy and sell orders.

- Risk Management: AI helps in assessing and predicting possible stock market risks. It looks into multiple elements influencing the prices of stocks. Based on the risk analyses, investors can make informed decisions to safeguard their portfolios from losses.

- Technical Analysis: Algorithms backed by AI have the capability to carry out the analysis of the Relative Strength Index, Bollinger bands, and other technical indicators to help project price movements accurately.

- Trading Based on Events: AI for stock analysis analyzes different events in real time and provides predictions regarding the possible effects of the events to improve decision-making.

Benefits

Let us look at the benefits of using artificial intelligence for stock market forecasts.

- AI reduces the time taken for research and helps avoid human errors.

- This technology helps in the identification of patterns related to stock market data, which helps make better investment decisions.

- AI stock prediction tools can assist in risk management and help avoid making emotional decisions.

- Using AI for stock trading can significantly lower costs.

Challenges

Let us look at the challenges associated with AI stock price prediction.

- AI relies heavily on historical data. While past data can provide accurate predictions, geopolitical conflicts, unprecedented events, regulatory changes, and other factors may result in past strategies not working.

- Software errors can occur, which can lead to losses.

- With AI tools, there is a possibility of data breaches.