Table of Contents

What Is Arbitrage Free Term Structure Models?

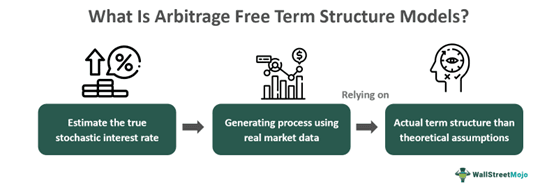

Arbitrage-free term structure models are the mathematical exemplification that explains and predicts the behavior of interest rate changes over the period, thus ensuring that there are no possibilities of making risk-free or completely secured gains by the investors in the financial markets.

In other words, it assumes that the assets' market prices reflect the accurate picture and that investors cannot exploit market inefficiencies to make riskless profits. Such term structured models are widely used in the financial sector for multiple purposes, including pricing and risk management of fixed-income securities, interest rate derivatives, and structured products.

Key Takeaways

- The arbitrage-free term structure models gauge the actual interest rate-generating process by assuming that the market prices of the securities are fair and no arbitrage possibilities arise from market inefficiencies.

- These mathematical models facilitate option pricing, interest rate derivatives, hedging, interpolation, and risk management of fixed-income securities and other structured products.

- Some standard no-arbitrage models are the Ho-Lee, Black-Karasinski, and Hull-White models.

- Since these models work on crucial and actual market information such as long-term investment prices, risk premiums, and short-term interest rate expectations, the result highly depends on data reliability and availability.

Arbitrage-Free Term Structure Models Explained

Arbitrage-free term structure models or the no-arbitrage models provide a framework to gauge the value of the derivatives, fixed-income securities, and other investment products by adjusting the assets' market prices to the extent the investors cannot avail any arbitrage chances in the financial markets. Arbitrage is making a profit on the securities by betting on the market inefficiencies, I.e., buying an asset at a lower price in one market and immediately selling it in the other market at a premium price.

There are various types of arbitrage-free term structure models, as explained below:

- Ho-Lee Model: It is the foremost no-arbitrage model, and it is based on the changes in the market's expectation of future interest rates of the bond options, swaptions, and other fixed-income securities.

- Black-Karasinski Model: The BK model determines the interest rate movement based upon a single source of randomness; thus, it is widely used for zero-coupon bonds.

- Hull-White Model: It is applied for the interest rate and pricing of the derivatives since it provides the function of the overall yield curve.

However, it is essential to note that these models have limitations and are subject to various assumptions and simplifications. Thus, the accuracy and usefulness of these models depend on the quality and availability of data. Also, the appropriateness of the model assumptions is sensitive to the specific market conditions.

Examples

Let's understand the concept with the help of some examples.

Example #1

The arbitrage-free term structure models like the Ho-Lee model help to adjust the market price of the zero-coupon bonds to a level where there is no chance that the investors can make a profit by buying the security in one market at a discounted price and selling it in another market at premium price simultaneously to earn the marginal profit.

Example #2

Suppose a security's spot price is $27 while the call option is to be exercised at $21. Also, the annualized continuously compounded risk-free security rate is 12% for a one-year maturity period.

Solution:

S - PV(X) = S - X/(100 + r)T = 27 - 21/1.12 = $8.25

- S is the security's spot price;

- X is the exercise price of the security;

- R is the security's annualized continuously compounded risk-free rate and

- T is the maturity period.

If the market price of the call is $14, then,

Buy the call at $14 and sell short the security at $27. Also, invest at $18.75 ($27 - $8.25)

Thus, when the security's call price is more than $8.25, it is arbitrage-free.

Arbitrage Free Term Structure Models Vs. Equilibrium Term Structure Models

The two prominent interest rate movement models are the arbitrage-free and equilibrium term structure models. Let us now walk through the various distinctions between the two:

| Basis | Arbitrage Free Term Structured Models | Equilibrium Term Structured Models |

|---|---|---|

| Overview | It is a true or real interest rate-generating process that assumes no arbitrage possibilities exist in the financial market. | It anticipates the stochastic process indicating the bond market's short-term interest rate variations or yield curves. |

| Considers | Crucial and actual market information such as investment price in the long run, risk premium, investors' short-term interest rate expectations, etc. | Macroeconomic variables |

| Assumption | Market prices of assets reflect the real picture, and there are no chances of the investors booking profits on market inefficiencies. | Interest rate assumption |

| Term Structure | Exact fit | Closest possible or best fit |

| Interaction with other models | Can work in isolation | It cannot work in isolation since it is an assumed structure |

| Parameters | The parameters of equilibrium model varies with time. | Remains constant |

| Arbitrage | It ensures that the model price is equal to the market price of an asset. | Consistent model prices |

| Difficulty level | Difficult to compute and construct | Comparatively easy |

| Applications | Option pricing, interest rate derivatives, hedging, interpolation, risk management of fixed income securities and other structured products | Comparing and selecting securities, hedges, and analyzing the under or over-pricing of securities. |

| Examples | Ho-Lee Model, Black-Karasinski Model, Hull-White Model | Dothan and Cox Model, Vasicek Model, Ingersoll and Ross Model |

| Limitation | The accuracy of results relies upon the data availability and quality. | Doesn't base on any reliable market data; instead considers the macroeconomic variables and prices over the period. |