Table of Contents

What Is Budget Formulation?

Budget formulation refers to curating a financial plan for how a government or an organization shall apportion its finances to meet its objectives. The process typically involves figuring priorities, forecasting revenues, and gauging expenditures. The budget formulation and execution stage is critical for any business as it is a foundation for crucial business or government functions.

An efficient formulation helps a government or business have a fixed amount segregated for different functions, which helps them keep expenditures under control. Moreover, once they have a clear idea of the resources that shall be required within a specific time frame, they can plan their cash flow and debt more efficiently. However, sometimes, these budgets make these organizations inflexible and do not account for unforeseen developments.

Key Takeaways

- Budget formulation refers to the procedure that identifies the financial status of a business, project or government, allocating resources and managing expenses. It is a crucial link in the long-term financial planning and budgeting cycle.

- It ensures that the business or government can pre-empt the expenses that might come their way. As a result, they can plan their cash flow accordingly.

- If the company finds that the cash flow generated through its principal sources is not sufficient, it can also plan on acquiring debt.

- However, they must keep a certain amount as a buffer to meet positive and negative unforeseen developments.

Budget Formulation Explained

The budget formulation is the fundamental phase of the budgeting process adopted by most businesses, project management teams and governments globally. It is a structure specifying the forecasted revenues, corresponding resources, and income streams to help meet their financial goals.

For any organization or entity, determining the financial priorities is the foremost step in the budget formulation process. They can allocate resources and plan their cash flow based on these priorities. This stage is the foundation that helps build a formidable financial plan for these entities or organizations for a specific period.

Once priorities are set and resources are allocated, they can ensure that there is no overspending and that every department functions as per the pre-determined set of goals. This way, there is a common organizational destination in mind that everyone works towards.

As a result, the organization also understands the resources it would have to allocate within a period, typically a year. Therefore, they can induce cash flow according to the financial needs. Moreover, if need be, they can also explore their debt options to keep themselves on track with their financial goals.

However, these advantages may sometimes be disadvantageous to some businesses and organizations. The common criticism is that these techniques do not account for unforeseen developments. If the demand exceeds the expectations, the organization may not have the resources to meet them timely. Moreover, it might make the financial outlook of decision-makers inflexible.

While it is important to set clear financial parameters to develop financial discipline, it is equally crucial to keep enough buffer to cater to unforeseen circumstances, both positive and negative.

Budget Formulation In Business

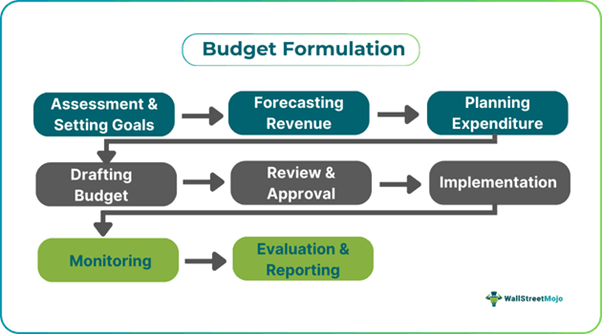

The budget formulation chart for a business differs from that of a government. The steps below show the process in detail.

- Assessment & Setting Goals: The foremost step is gauging the business's financial situation and setting budgetary goals to facilitate its financial growth. In this step, managers usually scrutinize historical financial statements, determine priorities and set goals according to organizational goals.

- Forecasting Revenue: Once the goals are fixed, the next logical step is to find the resources that generate the cash flow or revenue to meet or surpass those goals. Here, market conditions are studied, revenue trends are analyzed, and future revenue is forecasted.

- Planning Expenditure: While an organization may generate revenue, it may account for little if its expenditure is not as efficiently planned. An organization must plan its expenses to the smallest detail and account for operations, personnel, debt, and capital investments.

- Drafting Budget: Once expenditure and revenue are determined, the business uses its financial information to draft a detailed budget. The document must be clear and transparent, with information on allocation percentages, expense categories, and income sources.

- Review & Approval: The drafted budget is run through department heads, management, and the finance team to check for accuracy and thoroughness. Once adjusted according to the organizational goals, it is approved.

- Implementation & Monitoring: Once it is approved, the budget is implemented. Here, the budgeted and actual spending are compared, and financial performances are monitored.

- Evaluation & Reporting: The last step of the cycle is to scrutinize the budget's effectiveness and curate extensive reports. Financial indicators, key insights, and performance metrics are assessed to check their impact on the organizational goals.

Budget Formulation In Government

The budget formulation and execution in the government differs vastly from businesses. Different countries have different rules on the curation of budgets. Below is a description of the process followed in the United States of America.

- Requests: Federal government agencies put forth their requests to the White House OMB (Office of Management & Budget).

- Proposal: Based on the request of various agencies, the IMB curates a proposal for the president to consider.

- Submission: After much deliberation and scrutiny, the president proposes the budget to Congress. The proposal is typically made in January or February.

- Resolutions: After the president presents the budget, the Senate and the House pass resolutions determining the total approved spending levels for that financial year.

- Appropriation of Bills: The Senate and House Appropriations Committees build twelve appropriations bills that represent a unique area of the government.

- Negotiations: The Senate and the House negotiate the differences on the appropriations bills. The back and forth ensures that the government uses the taxpayers’ money more efficiently.

- Budget Signing: The president signs the bills into law and oversees different agencies executing their tasks according to the pre-determined budget.

Examples

Now that the theoretical aspects of the concept are well-established, it is time to discuss the practical applicability through the examples below.

Example #1

XYZ & Co and its managers gauged their company's financial situation at the end of the financial year and met for the yearly budget formulation and execution meeting. At the meeting, it was determined that the organization’s central goal in the upcoming financial year would be to increase the manufacturing capacity from 3 metric tons to 6 metric tons daily.

The expenses for the same were calculated, and the increasing demand for their product in the market and the selling trend was observed to be in their favor. Therefore, $100,000 was allocated towards extra personnel, $250,000 towards capital expenditures, and $25,000 towards marketing.

They also planned to cater to $750,000 worth of clients that they could not cater to due to a lack of production capacities. At the end of the year, they found that their budget was a booming success and doubled their profits from the previous year.

Example #2

The International Monetary Fund (IMF) is one of the major lenders to the government of Pakistan. However, in 2024, the IMF strongly suggested the government focus on bettering or nourishing the initial stage of formulating a budget. They also called for establishing more efficient fiscal institutions.

As per the IMF’s calculations the deviations from the budget proposed and budget used exceeded 50% in difference in fiscal year 2022-2023. These deviations in spending amounted to Rs.1910 billion, which is equal to almost 22% of the approved budget for the 2022-2023 fiscal year.

Benefits

Various reasons why a budget formulation chart is important for a business, project, or government have been mentioned in the article. However, a few of the most prominent points are:

- The foremost benefit of formulating a budget is that it gives every stakeholder of the organization an idea of the current financial situation and the collective organizational goal.

- It prevents the company from under or over-spending in areas that do not generate enough returns. Additionally, it also ensures that areas that are commonly decided as priorities get enough resources to thrive.

- The formulation helps businesses and governments to plan their cash flow. The growth of the financial plan need not suffer due to the misallocation of resources.

- If the company or the government needs to induce additional cash flow, they can use the expenditure forecast curated during this cycle stage to take on debt to facilitate growth.

- The actual expenditures and budgeted expenditure comparison can help businesses and governments keep track of their personnel following the plan. Otherwise, they can use this learning to curate next year's budget.