Table of Contents

Cross-Subsidization Meaning

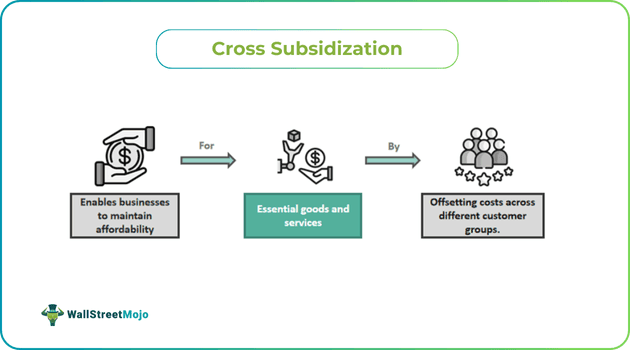

Cross-subsidization refers to the method of artificially lowering the prices of a commodity for one group of consumers by charging an increased price for the same commodity to another group. Its main purpose is to make products available to all at reduced rates, increase business growth in newer areas, and provide affordable health care to the old and poor.

Although cross-subsidization may look beneficial, it has specific negative impacts. These include high fares of transport, lowered wages of staff, and older vehicles plying on roads with lesser frequencies. Additionally, it results in reduced firm profits and increased financial risk due to loss-making services to the firm.

Key Takeaways

- Cross subsidization is the practice of charging a higher price for an identical item to one particular demographic or customers

- While artificially decreasing the price of an identical product for another specific population or consumers.

- Its primary aim is to stimulate company growth in additional regions, render services and goods cheaper for the elderly and the poor

- And spread its advantages to less densely inhabited areas.

- Common strategies include loss leadership, the razor and blade strategy, and trade-up strategy.

- The effect may lead to a rise in revenue growth, whereas its disadvantage is that it may eventually lead to revenue losses.

Cross-Subsidization Explained

Cross-subsidization involves a firm allocating profits from one product or geographical area to support another product or area that is experiencing losses. This practice ensures consistent supply and services to the masses and helps offset the financial impact of offering lower prices. Most social welfare schemes run by governments are based on this practice, such as cross-subsidization in healthcare, electrical consumption charges for industrial and domestic use, and railway ticket prices.

This concept revolves around determining product costs based on supply and demand at specific locations. In places with less demand, the company uses extremely strategic pricing strategies like cross-subsidization to keep prices lower and refrain from increasing the price.

This practice occurs for various reasons, including:

- The government instructs corporates to set the price of essential goods like wheat uniformly for social welfare.

- Corporates may use it to enhance their revenues from complementary products.

- Firms may want to allow their flagship products to survive the low demand or sales or sparse population.

There are three variants of cross-subsidization, each requiring two key conditions:

- Keeping the price of the base good low to trigger an increase in its sales volume while ensuring the higher purchase of related goods.

- Setting the price of more profitable goods higher to recover the lost revenue

Once these conditions are fulfilled, three cross-subsidization pricing strategies come into play:

Loss leadership

It is utilized in the retailing of goods, where the price of base goods remains at a lower level to attract price-sensitive customers. Meanwhile, other products, which are likely to be bought by customers, remain at higher profit levels and prices.

The razor and blade strategy

Here, the businesses keep the price of the base product lower to motivate the customer to buy a higher-priced complementary product.

Trade-up strategy

In this strategy, producers tend to keep their base goods at competitive prices. They anticipate that customers will increase their spending and purchase related products that are more profitable for the firm.

Implications Of Cross-Subsidization

Some implications of subsidizing one product to manage the other crop up are listed below:

- Companies must create a barrier of entry and exit for the profitable goods in the market.

- Base goods must be kept free from such barriers.

- The markets may even be left open to other rivals if the above conditions are fulfilled.

- The pricing of the base and profitable products must be managed well to ensure profitability for both products with the same margin.

Examples

Let us understand the concept using a few examples.

Example #1

Suppose three friends, George, Alex, and Noah, visit a restaurant to have lunch and order the following:

Alex's pizza costs $50

Noah's hamburger costs $40

George's hotdogs cost $60

If each friend pays fifty dollars each, then Noah subsidizes George for $10 as Noah pays $50 instead of his $40 meal cost. This illustrates cross-subsidization, where George benefits by paying only $50 for a $60 meal.

Example #2

Let us consider the electricity bills collected from industrial consumers and domestic electricity consumers. Normally, governments have kept the electricity charges for industrial consumers higher than those for domestic consumers. This disparity in charges allows electricity companies to use the profits earned from commercial electric consumers to cross-subsidize domestic consumers' electricity bills.

They do it by reducing domestic users' electricity consumption charges. Hence, the electricity charges for domestic consumption are reduced.

Example #3

In November 2022, the state-subsidized public transport of Germany raised the price of the ticket from 9 euros to 39 euros after the federal government decided to raise the cross-subsidization. Although the government's aim to benefit the poor was good, the steep hike made tickets unaffordable for the poorest citizens. Instead, the new ticket price benefits only the middle class.

Advantages And Disadvantages

Let us use the table below to understand the disadvantages and disadvantages of the concept:

| Advantages | Disadvantages |

|---|---|

| The effect may lead to a rise in revenue growth. | It may lead to revenue losses eventually. |

| It makes healthcare services affordable. | It may lead to a decrease in the market share of well-established products due to its price hike |

| It attracts more customers to buy products. | More sales of newly launched products may attract greater staff and effort in logistics, leading to losses in revenue for costlier products. |

| It greatly enhances the sale of newly launched products in a highly competitive market. | When attempting to balance the costs of expensive products, any price increase on cheaper items may drive customers toward more affordable alternatives |