Customer Experience in Banking: Strategies for a Seamless And Personalized Journey

Table of Contents

Introduction

A strong banking experience depends on harmony, i.e., how well all things complement each other. Every message, transaction, and conversation provides an indication of how well a bank understands its customers and what is important for them. If each step feels smooth and personal, trust grows naturally. That said, when the process feels broken or repetitive, even customers with whom the company has a longstanding relationship start pulling away.

According to Forrester’s 2024 US Customer Experience Index, 39% of U.S. brands reported a decline in customer experience quality. This shows how challenging it is to meet expectations on a consistent basis. For banks, sustained success comes from connecting multiple aspects, such as data, thoughtful design, and human service into one clear and cohesive journey that provides support to customers at every stage.

In this blog, let us explore strategies that bring these elements together: unified systems, insightful analytics, and service models designed for lasting customer loyalty. But first, let us understand the meaning of customer experience in banking.

What Is Customer Experience in Banking?

Customer experience in banking is the sum of every interaction a person has with their bank. It reflects how easily they can manage their finances, get support, and feel recognized at different stages of their relationship.

Key elements associated with customer experience in banking are as follows:

- End-to-End Interactions: Every step counts, from opening an account to handling daily transactions or solving an issue. Each experience shapes how much customers trust the bank and how satisfied they feel.

- Omnichannel Touchpoints: Customers experience a connected journey across app, web, branch, and contact center. Hence, they never have to provide the same information at different touch points.

- Relevance and Timing: Another key element is responsible data usage. His help ensures organizations recognize needs early and offer support when it’s most useful.

In a market where most banking products feel similar, customer experience becomes the real difference-maker. The way a bank connects its systems, simplifies steps, communicates, and offers customer-centric financial services clearly builds loyalty over time.

The Key Drivers Of Exceptional Banking Experiences

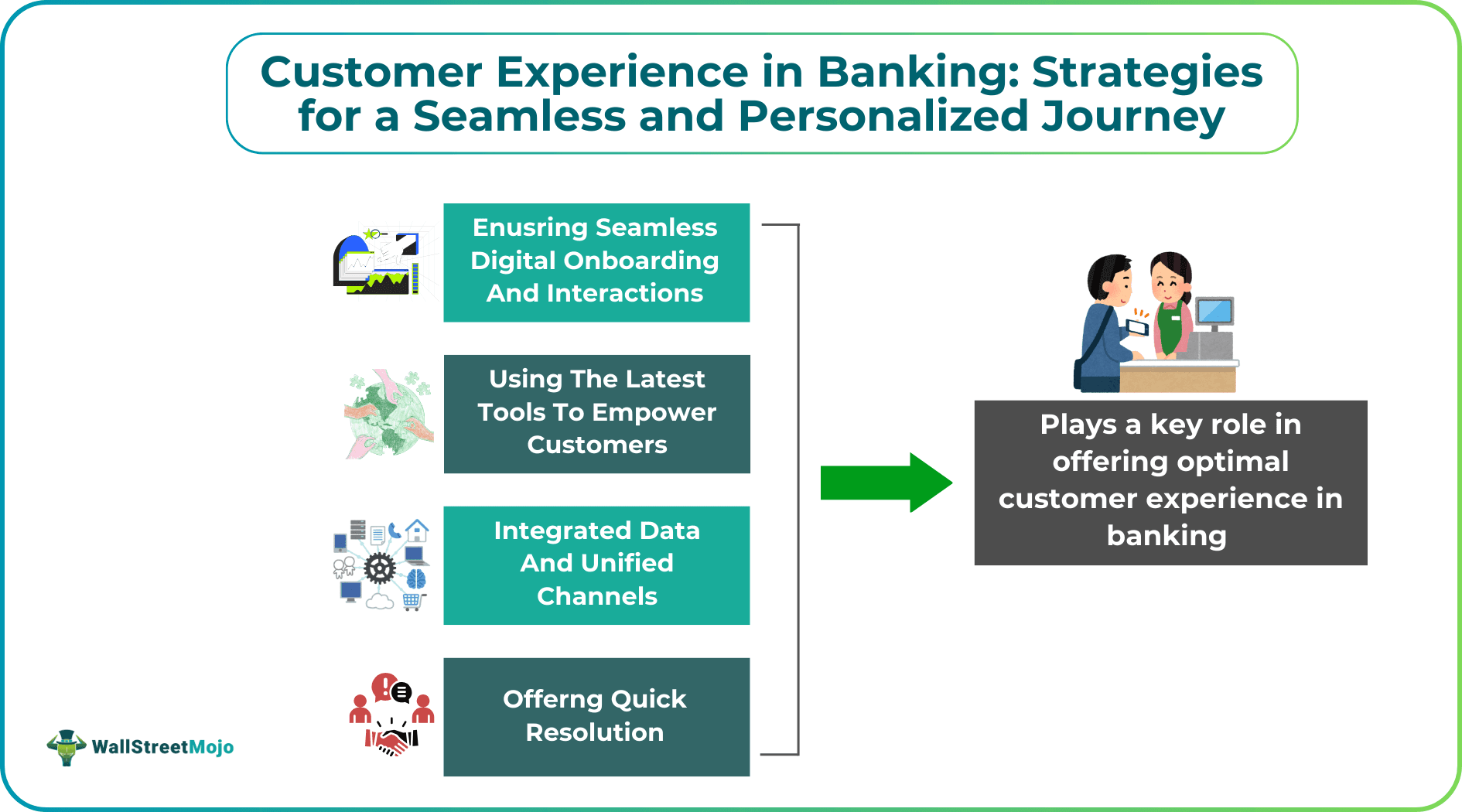

Creating a seamless digital banking experience comes down to a few essentials that shape how customers interact with and trust their financial institution. In this section, let us dive into those important aspects that influence the overall banking experience for customers.

#1 - Seamless Digital Onboarding And Interactions

A simple start helps build confidence. When customers can open accounts, confirm details, and complete transactions without any hassle, it creates trust early on. Clear and intuitive digital experiences make customers feel guided and supported from the first interaction.

#2 - Contextual Relevance And Personalization

Personalization shows customers they are seen and understood. Forrester’s Digital Experience Review: North American Mobile Banking Apps, Q4 2024 found that 65% of U.S. banking customers want to complete any financial task through a mobile app.

That shows how much customers value flexibility and experiences designed around their habits.

#3 - Integrated Data And Unified Channels

Customers expect one continuous experience across every touchpoint. When systems share information between apps, branches, and service teams, interactions feel connected and consistent.

#4 - Quick Resolution And Human Empathy

Speed alone doesn’t define good service. What customers notice is the balance between efficiency and care. With the right context, teams can give a response promptly while still making the experience personal and sincere.

The Role of Technology in Enhancing Customer Experience

Technology now defines how banks deliver value to customers. It enables faster service, informed decisions, and experiences that feel personalized and consistent.

#1 - Digital Tools That Empower Customers

Automation, apps, and self-service tools have simplified routine banking. Customers can handle most tasks immediately without waiting for assistance. Studies on digital banking link these features to better engagement and long-term satisfaction.

#2 - Personalization And Predictive Insights

Using artificial intelligence or AI tools and analytics, banks can now recognize individual preferences. These tools can help implement personalized banking strategies and suggest products or solutions that address real needs rather than rely on generic offers.

#3 - Smooth Integration Across Channels

Unified data systems ensure that every interaction builds on the last one. Customers can switch between channels without gaps or confusion. The ability to offer this kind of connected experience is now a major competitive advantage in retail banking.

#4 - Speed, Security, And Human Connection

Most service issues can be resolved with a few clicks, but reassurance still comes from a person. Customers notice when someone listens and explains, not just when the process runs smoothly. Well-designed tools make those meaningful touchpoints easier to deliver.

Challenges In Delivering Consistent CX in Banking

Even with new technology, many banks still struggle to keep their customer experience consistent. Tools improve, but connecting the pieces behind the scenes remains tough. In this section, let us explore the noteworthy challenges businesses face when it comes to delivering a consistent customer experience in banking.

- Legacy Systems And Data Silos: A lot of banks still run on systems that don’t communicate with each other. Without a single picture of the customer, agents spend time searching for context instead of solving problems

- Disconnected Channels: Apps, websites, and branches don’t always work together. A customer might explain the same issue to three different teams because information isn’t being shared

- Perception Gaps: Research from the Amdocs Studios 2025 CX20 Global Study shows 80% of banking leaders feel confident about their customer experience or CX, but only 24% of customers agree. It’s a clear reminder that perception inside an organization doesn’t always match what customers feel

- Process Complexity: Simple requests can feel slow when verification steps multiply or responses take too long

Closing these gaps starts with a better connection between systems and people. When data flows freely and teams share accountability, customer experience in banking naturally improves.

Future Trends in Banking Customer Experience

Across the industry, banks are rediscovering the value of blending technology with human understanding. Personalization, design, and empathy are no longer separate ideas but parts of the same customer promise.

#1 - Mobile-First and Omnichannel Journeys

Customers move between apps, websites, and branches all the time. They expect everything to work together, not as separate experiences. To meet that demand, banks are tightening the links between digital and in-person touchpoints. Hence, customers don’t have to start over each time.

#2 - Hyper-Personalization And Data-Driven Service

Analytics and AI now help banks spot patterns in customer behavior. With those insights, it is now possible to share suggestions or offers that match what someone is already trying to achieve. The goal isn’t to sell but to be useful in the moment.

#3 - Empathy, Human Connection, and Technology Blend

Speed and efficiency still matter, but listening and caring matter more. Banks are finding ways for technology to handle tasks quickly so people can spend more time building relationships.

#4 - Agile Models And Next-Gen Platforms

Cloud technology gives banks the flexibility that older systems couldn’t. Updating products, introducing new features, or making adjustments based on market shifts can now happen without slowing service.

The Path Forward For CX In Banking

In the current landscape, evaluating customer experience in banking has become one of the most reliable ways to measure success. Every interaction, from a simple app login to a detailed conversation with support, adds to how customers perceive value and trust.

The banks that thrive connect their systems, respond with intent, and make every exchange feel thoughtful. Digital tools create efficiency, but it’s empathy and consistency that leave a lasting impression.

The future belongs to financial institutions that treat every part of the banking customer journey as an opportunity to understand and support their customers better.