Table of Contents

Expansion Phase Definition

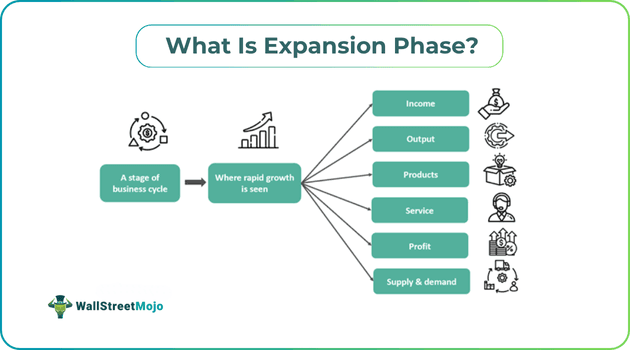

The expansion phase defines the stage of a business cycle where rapid growth is observed in income, output, products, services, production, profit, supply, and demand. It is the very first stage of the business cycle and, in general, represents the expansion of a business in the market.

The expansion phase is a positive process, and it continues to grow as long as all the economic indicators favor the process. Apart from this, there are three more stages in a business cycle that determine the position of a company in the market. From an economic perspective, during expansion, there is high consumer confidence and an increase in investments and expenses, and people are quickly paying off their debt.

Key Takeaways

- The expansion phase is the first stage of a business cycle, referring to a high increase in profit, cash flow, production, supply, and demand of goods and services.

- There are mainly four main stages in a business cycle: expansion, peak, contraction, and trough.

- However, recession and depression are subparts of the contraction phase, and the recovery phase is anticipated after the trough.

- Once the cycle ends with the recovery phase, the whole cycle starts again with the expansion phase for an economy or a business showcasing growth and stability.

- The opposite of the expansion phase is the contraction phase, where the economy declines, the cash flow becomes stagnant, and inflation and unemployment rise till they reach the trough.

Expansion Phase In Business Cycle Explained

The expansion phase in business cycle refers to the first phase of a business or economic cycle. This phase is followed by three different phases: peak, contraction, and recovery. The expansion phase of the economic cycle or business cycle plays a crucial role because it is the first phase of the entire cycle and is also regarded as the growth, boom, and prosperity phase. The business cycle primarily has four phases: expansion, peak, contraction, and trough. However, the third phase of contraction has two subparts: recession and depression. It is believed that after the cycle reaches the trough phase, it reverts to making a recovery so that this phase can start once again.

It typically lasts two to three consecutive quarters in which the interest rates are low, and so is unemployment. The market activities escalate to a higher level with better cash flow, consumer confidence, production, supply, and demand of goods and services.

One of the most important aspects of this phase is that consumers and borrowers have ease in paying back loans and clearing off debts on time. In a nutshell, every economy or business likes to remain in this phase as long as possible because it not only attracts more business and economic growth but also elevates the whole organization and country to a different level of prosperity and market expansion.

Characteristics

The characteristics of this phase from both the company's and the economy's perspective are:

- The gross domestic product continuously grows for two or three quarters.

- The company is making big investments and planning and implementing new projects.

- There is high supply and demand in the market for products and services; people are spending more. The production is at a high level.

- The interest rates are low, there is positive cash flow, there is a rise in employment and revenue, and companies have high consumer confidence.

- It records positive growth, with each economic indicator favoring the business and economic growth.

- The equity market, along with other financial markets, typically performs well.

Examples

Below are two examples of this phase:

Example #1

Suppose a fictional country with a good economy. Now, when the economy enters the expansion phase, every single aspect and indicator is favoring growth, and the interest rates are decreasing. Still, employment has increased, and there is high cash flow in the market. Every citizen is making a purchase, the businesses are flourishing, new projects are taken, and the market is prospering.

The country's stock market is in a bull run; people have started making huge investments, not only in equity but in other financial assets and instruments such as housing, insurance, mutual funds, automobiles, and so on. The supply and demand of goods and services are hiked. Companies are producing better than before, and the whole economy of the country looks promising, so much so that foreign investors are getting attracted to it.

This phase will carry on till its peak, from where eventually it will start to fall, moving to the third stage of contraction, which is the opposite of the expansion stage. It is a simple example of an expansion phase of economic cycle.

Example #2

McDonald's is all set to open nearly 10,000 new stores across the globe. It will mark its most rapid expansion phase in history. Currently, the McDonald's valuation is attractive, and many investors believe it is trading at a less fair price. Right from the start of 2024, McDonald's stock performance has been weak, with other shares underperforming in the US equity market, but its growth is highly accretive to investors.

Speaking of the expansion phase, McDonald's franchise has deeply penetrated the market, and the management projected plans for the fastest store expansion in its history with 10000 new stores by 2027. Nine hundred of those store locations are in the US, approximately 7000 are in the International Developmental Licensed markets (IDL), and about 1900 are in the internationally operated markets. The following 4 to 5 years are very crucial for McDonald's expansion.

Expansion Phase Vs Contraction Phase

The critical differences between the expansion and contraction phase are:

| Expansion Phase | Contraction Phase |

|---|---|

| Expansion is the growth and positive phase in a business cycle. | The contraction phase is the opposite, with negative economic growth and decline. |

| It is the first phase in the business cycle. | Meanwhile, contraction is the third phase, which means that after only a business has achieved expansion, it falls towards the contraction phase. |

| During this phase, a company forecasts increased growth, explores new areas, makes new profits, and generates revenue. | In the contraction phase, the company is challenged with declining cash flow and income and is struggling to survive in the market. |