The accelerator and multiplier effects are two distinct economic concepts that emphasize the dynamics of economic activity and how specific changes can influence an economy. The dissimilarities between the two theories are as follows:

Table Of Contents

Accelerator Effect in Economics Explained

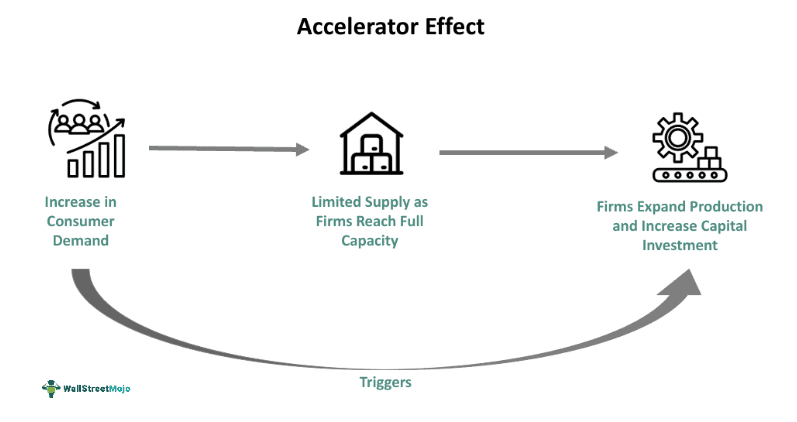

The accelerator effect is an economic theory that explains how changes in demand for goods and services can trigger corresponding adjustments in investment levels. As we know, a market is regulated by the demand and supply function. Thus, any rise in demand prompts a simultaneous increase in supply since as consumers start spending more on goods and services, businesses are more likely to increase their investments in capital goods such as machinery and factories to meet this heightened demand. Conversely, when demand decreases, companies reduce their investment to minimize loss. This is the negative accelerator effect.

It is often indicated by the fixed capital-to-output ratio, whereby increasing capital investment would result in a proportional rise in the company's output or production. This phenomenon helps to maintain a balance between demand and supply and can aggravate economic fluctuations. For instance, during an economic upswing, a surge in demand can lead to increased investment, further propelling economic growth.

Conversely, declining demand can result in reduced investment during a recession, potentially worsening the economic downturn. Thus, the accelerator effect is a significant concept in economic theory and policymaking because it emphasizes how changes in demand and investment interact, influencing economic cycles and the overall well-being of an economy.

However, it has various drawbacks in real-world implications. Investment decisions necessitate meticulous planning and prove challenging to halt once initiated. Since capital investment in infrastructure and other developments take time, say years of ongoing projects, pro-founding the risk of a slowdown in demand. Moreover, firms' optimism concerning their respective industries is pivotal in such decisions.

Accelerator Effect vs Multiplier Effect

| Basis | Accelerator Effect | Multiplier Effect |

|---|---|---|

| 1. Definition | It is an economic concept that demonstrates the changes in business investment in response to changes in consumer demand or GDP. | An economic theory elucidates how an initial injection of funds into the economy leads to multiple rounds of spending as money circulates through various economic sectors, leading to an ultimate rise in the nation's total income and production. |

| 2. Purpose | Explains how businesses adapt their production capacity to match changing demand, contributing to economic equilibrium | Illustrates how an initial injection of funds in the system can have a broader and far-reaching impact on overall economic activity |

| 3. Trigger | Fluctuations in consumer demand or spending patterns | Any initial change in spending, such as government-funded infrastructure projects or private sector investments. |

| 4. Effect | The change in GDP, directly and indirectly, impacts the capital investment. | The change in monetary injection has a disproportionate impact on the GDP. |

| 5. Causality | Explores the relationship between changes in consumer demand and subsequent business investment | Emphasizes the cumulative impact of spending changes throughout the economy, where an initial increase in spending sets off a chain reaction of economic activity |

| 6. Occurrence | Relatively swift or rapid, as businesses adjust their production capacity in response to changes in consumer demand | Unfolds over time as money flows through the economy, leading to successive rounds of spending |

| 7. Correlation | Although no direct correlation lies between the two, the multiplier effect somewhat influences the accelerator effect. | It indirectly triggers the multiplier effect. |

What Is The Accelerator Effect in Economics?

The Accelerator Effect refers to the economic theory, which states that an increase in the nation's gross domestic product (GDP), indicating an upsurge in the national income or output, often results in a proportional rise in the capital investment level in the country.

Hence, as the economy's demand for goods and services advances, business entities invest more in capital goods like factories and machinery to expand their production capacity to meet this high demand. However, a decline in the gross domestic product (GDP) or demand for products in the economy may trigger a fall in capital investment.

Key Takeaways

- The accelerator effect states that a rise in the nation's GDP stimulates the proportional acceleration in business capital investment and vice-versa.

- It is an economic concept that exemplifies a direct relationship between consumer spending and capital investment.

- Companies and investors use it to assess the risk of the investment opportunities and, thus, plan their investment strategies.

- It aids economists and policymakers in analyzing economic fluctuations and taking relevant fiscal and monetary policy measures for economic growth.

- It differs from the multiplier effect, which indicates how monetary injection in the economy stimulates a tremendous increase in national income.

Accelerator Effect Explained

Examples

The accelerated effect can be seen in different sectors, industries, or the overall economy. Let us now consider the following examples to understand the accelerator theory's role in an economic context:

Example #1

One can find the accelerator effect in companies within the technology sector that often allocate substantial resources to research and development (R&D) and infrastructure enhancements. These investments can result in developing groundbreaking technologies, products, and services, stimulating demand in related industries. This heightened demand leads to additional investments and contributes to economic expansion.

Example #2

This article, dated November 18, 2022, discusses the recent decline in speculative assets, including cryptocurrencies and tech stocks. This decline is attributed to disillusionment with the tech industry and rising interest rates. Despite the current rate increase, low interest rates will likely return due to the massive deficit spending during the COVID-19 pandemic.

The article also mentions the prevalence of the accelerator effect, where weak private investment demand influenced by demographics and slower technological progress, is a reason for persistently low-interest rates. According to the article, the era of cheap money is not necessarily over, and it is expected that the interest rates would revert to their previous lows eventually.

Diagram

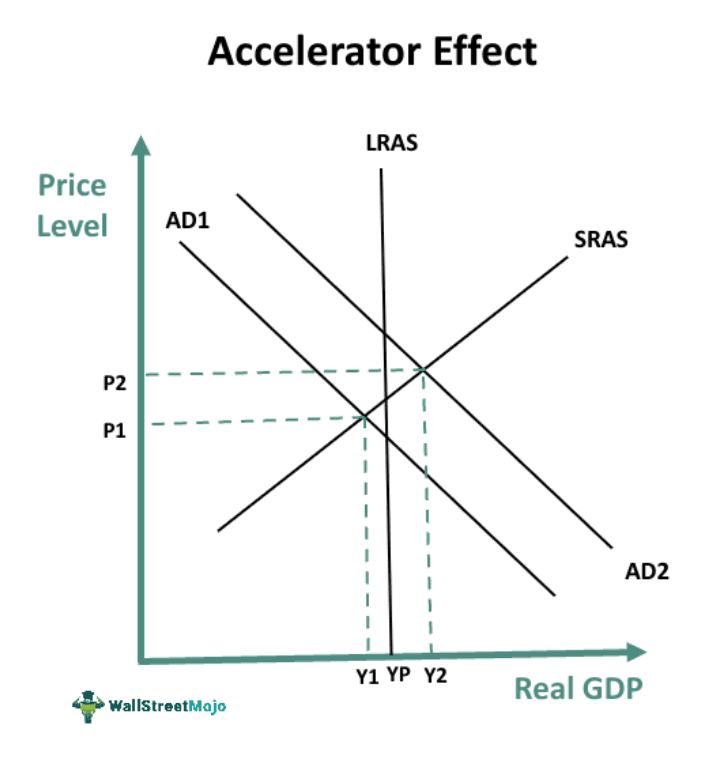

The accelerator effect can be represented by a positively sloping line on a graph, indicating that an increase in consumer spending tends to lead to a rise in business investments, while a decrease in consumer spending results in reduced business investments.

The accelerator effect diagram is as follows:

Where P1 is the earlier price level; P2 is the new price level when demand increases; Y1 is the previous national income or GDP; Y2 is the new national income or GDP; YP is the real GDP at long-run aggregate supply; LRAS is the long-run aggregate supply; AD1 is the previous aggregate demand; AD2 is the new aggregate demand; and SRAS is the short-run aggregate supply.

Importance

The accelerator effect is an economic principle of significance due to its role in explaining the connection between shifts in consumer demand and business investment. It is also considered essential for the following reasons:

- Business Investment: The accelerator effect tends to prompt businesses to invest in capital goods, such as machinery and equipment, to meet the rising demand, thus leading to economic expansion and job creation.

- Economic Cycles: It aids policymakers and economists in forecasting and managing economic cycles. High demand often results in increased business investments, potentially fueling an economic boom and vice-versa.

- Cyclical Unemployment: During stimulated demand and investment periods, job opportunities typically increase, reducing unemployment. Conversely, decreased investment during economic downturns can lead to job losses.

- Investment Planning: Recognizing the accelerator effect is crucial for businesses to plan their investments effectively. It enables them to align their production capacity with shifting consumer demand, preventing both under-investment and over-investment.

- Government Policies: Understanding the changes in economic demand and investments aids policymakers in making informed decisions regarding stimulus measures, tax incentives, or interest rate adjustments to stabilize the economy.

- Risk Assessment: Investors and financial institutions consider this theory while evaluating the prospects of different industries and businesses. It, thus, facilitates them in assessing risk and adopting suitable investment strategies.

Accelerator Effect Vs. Multiplier Effect

Frequently Asked Questions (FAQs)

1. What is the accelerator effect on aggregate demand?

2. How to calculate the accelerator effect?

3. How does the accelerator effect affect economic growth?

Get in Touch with our Experts!