Table of Contents

What Is Finovate?

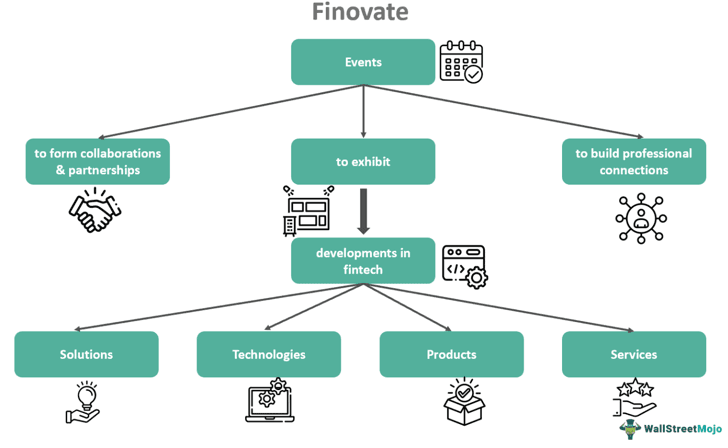

Finovate is a series of conferences and events that focus on showcasing innovative financial technology (fintech) solutions and startups. These events provide a platform for fintech companies to present their latest products, services, and technologies to a diverse audience. It plays a key role in driving innovation in the financial services industry.

It brings together a wide range of stakeholders in the fintech ecosystem, including startups, established financial institutions, venture capitalists, and technology experts. These events offer opportunities for creating industry alliances and partnerships, allowing startups to connect with potential clients and investors. Valuable connections that facilitate revenue generation through technological innovation are made possible.

Key Takeaways

- Finovate is a platform where cutting-edge fintech solutions are presented, offering important input about the growth expected in financial technology.

- Attendees can see firsthand how technology is changing and shaping the industry.

- These events offer professionals in the fintech space varied opportunities to connect, collaborate, and build partnerships within the industry.

- The networking aspect is crucial for developing professional relationships and exploring potential collaborations.

- Fintech startups have the opportunity to pitch their ideas to potential investors, making Finovate a platform for securing funding and partnerships.

- It helps attendees stay informed about industry changes.

Finovate Explained

Finovate is a pivotal stage for the financial technology (fintech) industry, where emerging companies take center stage to announce and display their revolutionary products and services. The emphasis is on live, real-time demonstrations that allow handpicked fintech startups the opportunity to present their offerings, generate interest, and enable revenue growth. For instance, Finovate Europe 2024 is expected to host 36 demonstrations from various companies worldwide.

This methodology encourages innovation and prompt feedback from a diverse audience, ranging from financial institutions and investors to industry experts and the media. Beyond the presentations, these events provide valuable networking opportunities that help build worthwhile connections among professionals, potential collaborators, and investors.

These conferences also serve as a hub for industry dialogues and insights, equipping attendees with a comprehensive understanding of fintech trends. With its widespread media coverage, attractive investment possibilities, and robust digital footprint, Finovate has substantial influence in the industry, promoting pioneering financial technologies and bringing them into the spotlight. Promising startups can find their footing in the industry through continued participation and insightful interactions with experts and industry leaders at such events.

Through panel discussions and keynote speeches by industry experts, these events offer input related to industry trends. It is possible to gather extensive information and a comprehensive view of new or evolving technologies through such events. Finovate enables participants to understand regulatory developments, consumer behavior patterns, competitor movements, and growth opportunities. These events can help them make strategic decisions in business.

It is a great platform to engage with thought leaders and understand global opinions, views, and perspectives regarding technological innovation, fintech products, and emerging technology solutions.

History

Finovate, founded in 2007, has been instrumental in the fintech industry's evolution. Its journey began with the ambitious goal of creating a remarkable event in financial services technology. In its inaugural year, Finovate gathered 20 of the most innovative companies, including well-known names like Mint, Lending Club, and Prosper. This event set the stage for what would become a defining moment in the history of fintech.

Following its initial success, Finovate expanded its reach. In 2008, a Bay Area event was organized, and in 2011, it entered international markets with a London event. Singapore was the next stop in 2012, marking its global presence. In 2014, the launch of FinDEVr, a conference series for fintech developers, further demonstrated its commitment to promoting innovation. The success of FinDEVr led to expansion, with events added on both the East and West Coasts.

2017 was a significant year for Finovate. It not only continued its international expansion with events in Hong Kong but also broadened its model to include regional and global themes and topics related to financial markets. This change allowed for lively discussions with industry leaders about the evolution of financial services and their impact on providers and end-users.

The Finovate brand continues to grow, providing news, networking, and insights through various channels, including blogs, social media coverage, podcasts, digital webinars, and more. The brand's impact on the fintech industry is undeniable, with a legacy of showcasing over 2,500 innovations at more than 55 conferences . It remains at the forefront of fintech, consistently offering a glimpse of the future of financial technology.

Programs

Finovate programs typically include a variety of elements designed to showcase, promote, and discuss innovative fintech solutions. These programs may vary from one Finovate event to another, but some common components include:

- Live Demonstrations: The hallmark of Finovate events is live demonstrations by selected fintech companies. Each company is given a brief time slot to showcase its product or service in real-time, highlighting its features and benefits.

- Innovator Showcase: These events feature a curated selection of innovative fintech companies that have the opportunity to present their solutions. These companies are usually carefully vetted to ensure their products align with the event's focus on cutting-edge technology.

- Speaker Sessions: Keynote speakers and panel discussions led by industry experts often provide valuable insights into the latest fintech trends, challenges, and opportunities. These sessions offer a broad perspective of the ongoing developments in the industry.

- Investor Pitches: Many startups use Finovate as a platform to pitch their ideas and innovations to potential investors, including venture capitalists and angel investors, to secure funding.

- Networking Opportunities: Finovate events offer attendees ample opportunities to network with like-minded professionals, potential industry partners, and industry insiders. Building professional associations is key to growth in fintech.

- Finovate Awards: Some Finovate events feature awards to recognize the most innovative and promising companies and products presented during an event. These awards can provide additional recognition and credibility to the winning companies.

- Fintech Expo: Some events include an expo where companies can set up booths to showcase their products and interact with attendees outside of the live demonstration format.

- Finovate Conference: Multiple planned sessions offer fintech companies a platform to present their products and services to financial institutions, investors, technology experts, and the media.

Examples

Let us study some examples in this section to understand how these events can kickstart a company’s innovation journey in fintech.

Example #1

A May 2024 Finovate event update about Monzo, a UK-based challenger bank, talks about how companies can raise funding through such events.

The recent fundraising efforts of Monzo paid off, with the bank being able to secure $190 million (£150 million), adding to the previous total of $426 million (£340 million). This Series I funding came to $616 million (£490 million), with Monzo's valuation being $5.2 billion (£4.1 billion). It was one of the largest funding successes in Europe's fintech sector since 2023.

With reputable names backing Monzo, the company plans to use these funds to develop new products and expand on a global scale. The United States is Monzo's focus for international expansion. This aptly shows how Finovate can help companies grow their business through funding.

Example #2

In the ever-evolving field of banking technology, incumbent banks face the challenge of keeping pace with rapid changes in customer expectations and the emergence of digital-first competitors. Legacy systems, outdated thought processes, siloed teams, and employee resistance to change present significant hurdles.

During the FinovateFall 2023 conference in New York, experts discussed strategies for digital acceleration in established banks. Overcoming legacy obstacles was identified as a major challenge, with TD Bank's Jo Jagadish emphasizing the need for both modernizing the technology stack (tools and platforms used for software development) and making substantial investments to replace legacy technology.

Wells Fargo's Jazz Samra stressed the importance of shifting focus from products to services to meet customer needs. Journey orchestration (a plan to deliver quality, unified customer experiences) and fintech partnerships were highlighted as essential for incumbents looking to remain competitive.

While partnering with fintech firms is seen as valuable, striking a balance between building capabilities in-house and leveraging external partnerships based on core business needs was recommended. Kevin Brown of Onbe emphasized the importance of understanding client pain points, seamless integration with banks and defining the success metrics in such partnerships.

Example #3

The Finovate Awards 2023 celebrated outstanding achievements in the dynamic field of fintech. These awards recognized both established institutions and emerging stars for their remarkable contributions to the industry.

Finovate Award Winners were chosen from a group of exceptional finalists, demonstrating innovation, customer-centricity, and significant impacts across fintech. The honorees included CAIS for Best Alternative Investments Solution, SoFi for Best Digital Bank, and 1Kosmos for Best ID Management Solution, among others.

The awards also acknowledged leaders like Mike Massaro of Flywire and innovators like Rochelle Nawrocki-Gorey from SpringFour. The Top Emerging Fintech Company title went to Union Credit, showcasing the forward-thinking spirit of the fintech community.