Top Generative AI Use Cases Transforming Investment Banking

Table of Contents

Introduction

Generative artificial intelligence, or genAI, is proving to be a game-changer for investment banks worldwide. According to an estimate published by Deloitte, the top 14 investment banking organizations can increase their productivity by 27% to 35% with the help of generative AI solutions. As a result, the revenue per employee concerning front office operations will rise by US$3.5 million by 2026.

With the growing adoption of such tools, aspiring investment bankers and people already working in the industry need to master generative AI applications. Only if they develop the required knowledge and skills through certification programs like the Generative AI for Beginners Course can they remain relevant, considering the growing competition in a fast-evolving landscape.

If you are wondering how generative AI in investment banking is making a difference, you are in the right place. This article will cover the top use cases in detail and also compare the scenario before and after the adoption of artificial intelligence in the industry.

Top Use Cases

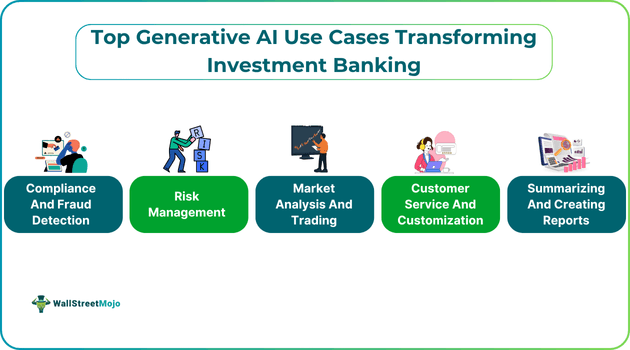

In this section, let us look at the noteworthy applications of generative AI in investment banking.

#1 - Compliance And Fraud Detection

AI tools for investment banking can play a key role in helping organizations detect fraud and ensure compliance. Indeed, AI systems can analyze transactions in real time to spot anomalies and suspicious activities instantly. This enables organizations to keep confidential data safe. Also, it helps fulfill regulatory requirements and steer clear of legal issues.

#2 - Risk Management

A key use case of generative AI in finance, especially investment banking and trading, is risk management. AI models assist in risk management as they have the capabilities needed to predict and evaluate financial risks accurately. Indeed, with the help of generative AI applications, it is possible to assess different scenarios and their impact on investment portfolios. This can help investment bankers in taking measures that can reduce the risk.

#3 - Market Analysis And Trading:

Generative AI tools like ChatGPT for analysts and traders can help with multiple tasks. For example, such solutions can enable them to conduct research and analysis. This, in turn, allows analysts to provide recommendations and traders to formulate effective strategies. As a result of the increasing use of generative AI in investment banking tasks like these, dependence on traditional time-intensive methods is decreasing; This is playing a key role in saving both time and money.

#4 - Customer Service And Customization

AI-powered PDF chatbots, like the one built in the Generative AI for Beginners Course, can help resolve common queries instantly. Moreover, similar chatbots and virtual assistants can provide customized advice and recommendations regarding specific aspects. This use case can improve the experience of clients and play a key role in building stronger relationships.

#5 - Summarizing And Creating Reports

With the help of generative AI applications, investment bankers can automate financial report creation and save a significant amount of time. Advanced AI systems have been specially designed to generate accurate information within seconds. Note that it is also possible to summarize financial reports and present them in a better way for stakeholders for faster decision-making.

Before vs. After AI

The following table provides a clear idea of the difference generative AI in investment banking is making.

| Before AI | After AI |

|---|---|

| Investment banking professionals spent hours on research and analysis. | Using Gen AI tools for research and analysis, investment bankers can save a significant amount of time and resources. |

| Previously, investment bankers had spend time staying updated regarding the latest regulatory changes. | With the help of AI, investment bankers can now become aware of the regulatory changes within seconds. |

| Previously, fraud detection was challenging and time-consuming as individuals had to check transactions and activities manually. | With the help of AI-powered solutions, spotting anomalies and analyzing transactions and activities for suspicious behavior has become a lot easier. |

| Before the adoption of AI tools, creating accurate financial reports and collecting key data for key stakeholders used to be a time-consuming task. | With AI-powered tools, gathering data and creating reports have become straightforward tasks. With the help of prompt engineering, it is now possible to complete these tasks quickly. |

| Before the integration of AI-based solutions, risk management was conducted manually by investment bankers based on detailed analysis of historical data. Moreover, they had to monitor portfolios on their own, conduct market analysis to figure out possible risks. | Now, with the help of AI-based tools, investment bankers can track past data and changes taking place in the dynamic economic environment in real time. Moreover, these tools can even help in predicting any negative events. These capabilities combined improve risk management efficiency. |

Mini Demo Idea

In this section, let us look at an example to develop a practical understanding of a key use case of generative AI in investment banking.

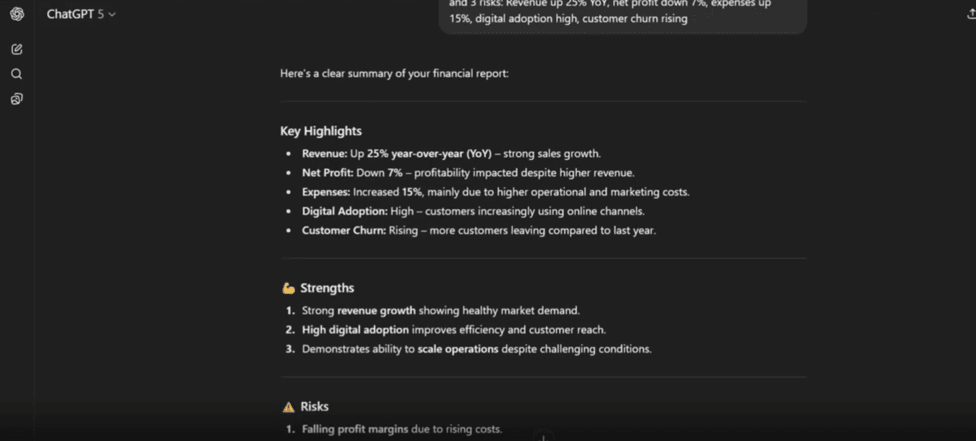

Source: Generative AI for Beginners Course

The above image shows that by creating an effective prompt, one can turn financial data into an effective summary, highlighting vital information for effective decision-making.

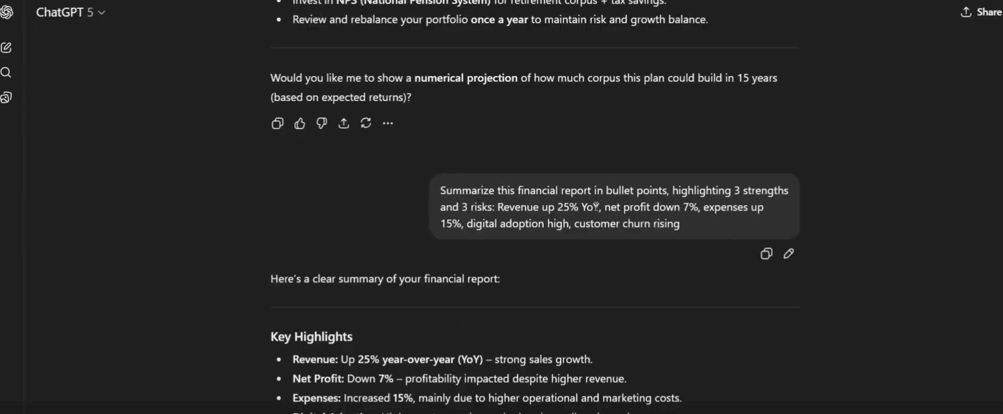

Source: Generative AI for Beginners Course

The course video also explains that by adding specific words, like in bullet points,” individuals can ensure that the output generated by genAI tools like ChatGPT is concise and ready for presentation.

Learner Success Story

After completing his MBA in finance, David Thompson faced multiple rejections from different companies in the financial sector, including investment banks. After analyzing the job market, he realized that he had everything except for the practical knowledge and skills concerning AI, which are must-haves considering the current landscape.

That said, since he lacked tech-related knowledge, he was intimidated by the mention of artificial intelligence and related terms in the job description. He did not know how to proceed with regard to developing the necessary skills. That’s when he came across the Generative AI for Beginners Course on WallStreetMojo. Seeing that it is made for people who do not have a tech background, he decided to enroll in it, and we can surely say that he does not regret making the decision.

By taking the course, he was able to become familiar with key genAI-related terms and understand the AI use cases in finance, retail, and other spaces through practical examples. What truly took his skills and knowledge to the next level was the guided project on developing a genAI-powered chatbot.

The certificate of completion that demonstrated his new skills helped him get shortlisted for organizations, including an investment bank. That said, it was the hands-on experience gained through the project that helped him showcase his knowledge with clarity during interviews and was key to getting the offer letters from multiple companies.

Conclusion

With the growing use of generative AI in investment banking operations, equipping yourself with practical skills concerning artificial intelligence is no longer an option. Rather, upskilling in AI is what can help you gain a competitive edge in the current job market. So, enroll in the Generative AI for Beginners Course today and gain the skills necessary to build an illustrious career in finance.