Table Of Contents

What Is A Gift Tax Return?

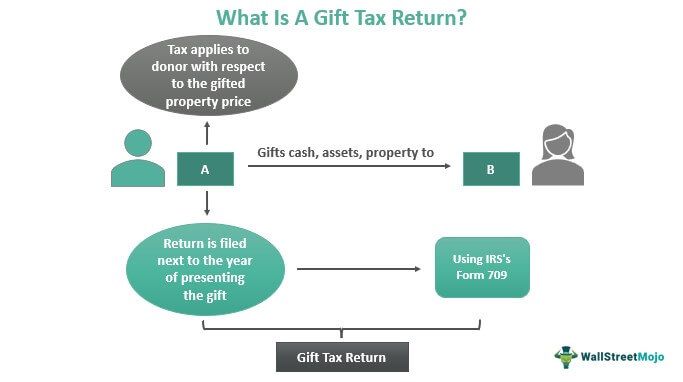

A gift tax return is the return filed against the tax that the authorities levy on the gifts that donors present to receivers. The one on whom the tax liabilities fall is the donor, not the recipient. The gift, however, can be cash, assets, properties, etc.

The gift tax return provision helps the Internal Revenue Service (IRS) to keep track of who gifted what to whom and worth what. The tax is levied based on the gifts offered in the previous calendar year. Hence, the return should be filed per the total price of the gifts presented throughout that year.

Key Takeaways

- A gift tax is a tax levied when a person presents a property or asset as a gift to someone while the latter does not make the payment following the fair value of such property or asset.

- Tax is levied on the person offering the gift (known as the donor) and not the gift’s receiver.

- The annual exemption limit per gift is $17,000, while the lifetime exemption limit is $12.92 million for 2023.

- The return must be filed even if the calculation falls above the annual exemption limit, even when the tax is not payable.

Gift Tax Return Explained

The gift tax return is filed using Form 709, which, if filled out this year, would reflect the gift-related details of the previous year. There are certain criteria that the gifts should fulfill to become eligible for the filing of taxes and returns. The gift tax is levied when one person gifts cash, assets, or property to another person for which the latter doesn’t have to pay anything. It is the former who buys it worth the face value. Thus, the tax is levied on donors on the money they spend on the gift.

The gift tax return form is used to inform the authorities of the transfers that occur concerning taxes applicable for gifts or generation-skipping transfers. In addition, it brings to notice the allocation of the lifetime generation-skipping transfers exemptions to transferred property while the giver is alive.

Gifts above the annual gift tax exclusion limit also need to be reported in return. This is because the gifts, although owing to the lifetime exemption limit, may not be taxed, but they do exhaust the lifetime exemption limit, and thus, it is necessary to report them in return.

One should ensure that when a gift is made to a trust, it becomes the present interest. If the same doesn’t qualify as current interest, it will not fall in the annual exemption limit and will remain taxable.

The US government has a gift-splitting provision that allows married couples to file their gift tax return collectively. This shows the contribution from both for the same gifts presented to recipients.

Requirements

The due date for gift tax return filing is April 15 of the year, next to when the gift is presented. So, for example, if one gifts something to someone this year, the return would be filed the next year. However, not all gifts are eligible for a gift tax return to be filed. For example, for a donor to file it:

- According to the 2022 guidelines, the gift should be worth more than $16,000. This is the annual limit per present. The limit has increased to over $17,000 for 2023.

- The lifetime limit to the gift price is $12.06 million in 2022, which will increase to $12.92 million in 2023.

Calculating the gift tax is quite a complicated affair. Hence, it is recommended to have a professional onboard to compute the same, considering the federal and local tax laws.

Example of Gift Tax Return

Let us consider the following example with two scenarios to understand the concept better:

Scenario 1

A person presents ten gifts to ten people worth $5,000 each during a relevant tax year. Here, the total value of gifts is $50,000. However, the annual limit for gift tax is $16,000 per person, and the limit is not on the total amount of gifts during the year. Hence, the liability to pay gift tax doesn’t arise as the annual limit price per gift does not exceed $16,000 during the year.

Scenario 2

Though the annual limit is not exhausted in the above case, the lifetime exemption limit is likely to get exhausted. This is because of the frequency of gifting of the donors. Thus, the lifetime limit, which is $12.06 million, seems to get exhausted, raising the need to file a gift tax return.

Exclusions

Individuals do not need to file a gift tax return if:

- Gifts are given to the spouse;

- Gifts are presented to a political organization for their utilization.

- Amounts are paid to educational institutions directly for meeting tuition fees;

- Payments are made to medical institutes directly or to medical insurance companies directly;

- Payments do not exceed the annual exemption limit of $16,000 (2022).