Why KYC Practices In 2026 Might Need Reinventing

Table of Contents

Introduction

Know Your Customer or KYC refers to a process carried out by companies to verify the identity of individuals availing of their products or services. It is mandatory for financial institutions like banks and certain businesses to conduct KYC practices to prevent fraud and ensure compliance. Besides minimizing the risk of financial fraud, this process helps curb money-laundering activities and keeps both businesses and their customers digitally secure.

In simple terms, KYC is used to ensure that people accessing services online are who they say they are and serves as a barrier against fraud and any other kind of illegal activity.

However, many businesses in multiple industries can’t help but feel that KYC practices are more of a hindrance than a benefit. Indeed, they are of the opinion that, compared to other security methods, KYC practices are outdated and often cause unnecessary frustration for all parties involved.

If you wish to get the details of why there’s a growing desire for reinventing KYC processes across various sectors, you are in the right place. In this article, we will explore some key reasons reasons KYC practices in 2026 might need a revamp.

KYC Causes Global Confusion

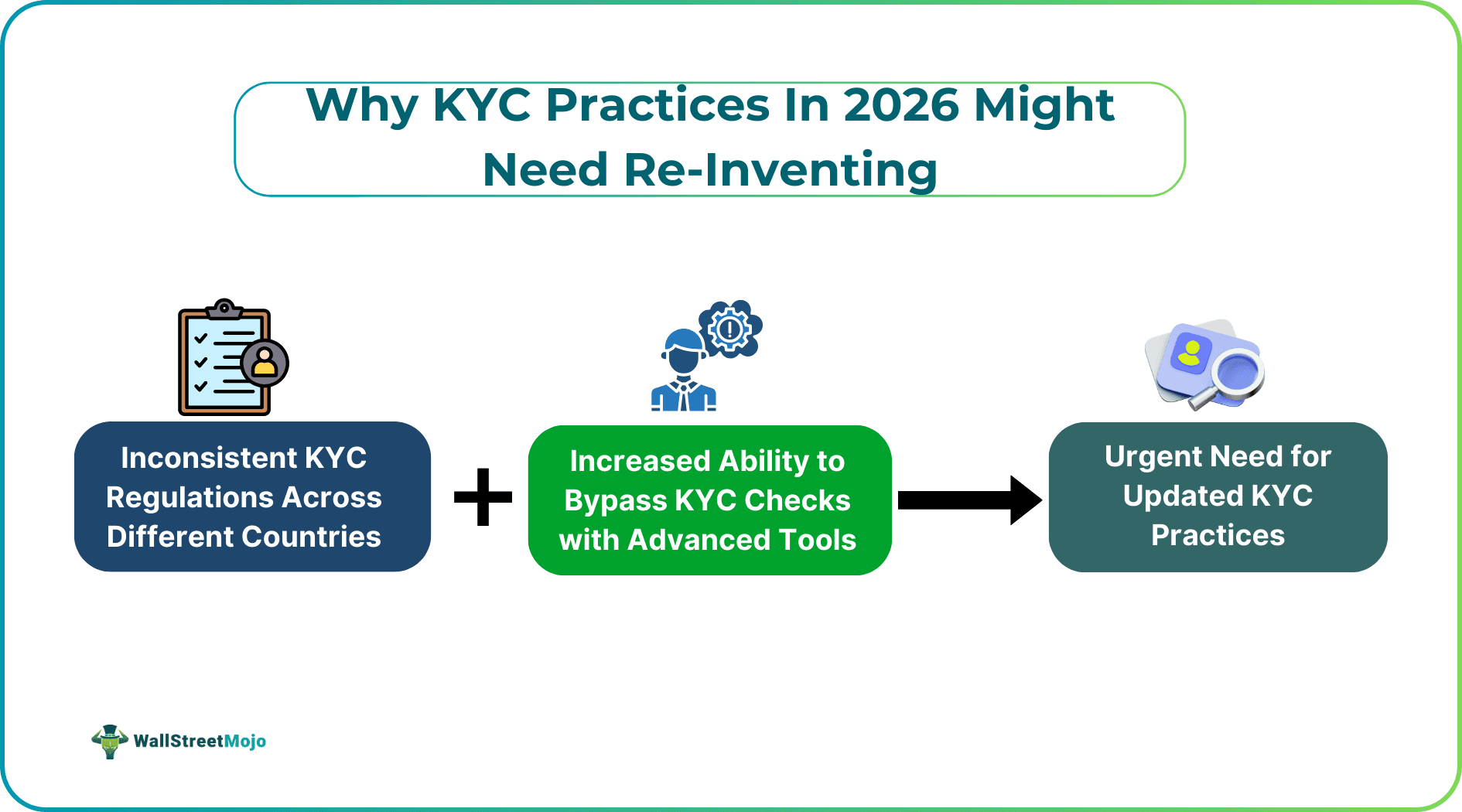

One of the primary reasons why KYC isn’t working anymore is the significant inconsistencies concerning global standards. For example, someone who is opening a crypto account in Singapore, a neobank in the UK, or an Australian online casino account is going to encounter different KYC rules with regard to digital identity verification. Every country has its own KYC legislation, and so each will set different thresholds or parameters to define what counts as sufficient identity.

Since KYC regulations change across nations, there’s a great deal of frustration around the purpose of KYC for businesses with global operations. Moreover, many experts are of the opinion that the current KYC practices in 2026 will be redundant, considering the growing use of tools like virtual private networks or VPNs. After all, anyone with a VPN can easily bypass geographical restrictions and access online accounts from anywhere in the world, and so having different sets of standards for every country just doesn’t make sense and leads to unnecessary confusion.

KYC Is Outdated

KYC practices were designed and developed for a different era. Technology moves incredibly quickly, and already, KYC has been left in the dust. Indeed, know your customer checks worked well when verification processes were paper-based. People could provide their passports, driving licenses and utility bills with ease and complete the registration process because that was the only way to authenticate one’s identity. There was hardly any other easily accessible process for authenticating one’s identity.

Now, however, we conduct most of our activities in the digital world, and paper is rapidly becoming redundant. Not only that, but it is also now incredibly easy for AI technologies to falsify these paper documents and illegally pass KYC checks.

On top of this, many customers regularly give up on the onboarding process when they are required to provide paper identification because of how inconvenient it has become. All of us know identification could be done in a way that is simpler and more effective. Hence, we resist the effort that it would take to complete the KYC process, which in turn can have a negative impact on the businesses that need to conduct it.

Crypto Offers a Better Alternative

There are already several alternatives to KYC that provide equal or better security services without all the hassle. A popular option among these is cryptocurrency. It may well be that one day crypto completely eradicates the need for KYC checks across the globe, but for now, it does offer a completely different authentication method that is simple, easier, and arguably more effective than traditional KYC methods. The nature of cryptocurrency, as a decentralized asset that does not rely on the input of third-party institutions for transactions to be processed, means that transactions are validated by code instead of other organizations. This leads to quicker and often cheaper transactions for users.

The alternatives are undoubtedly a key reason why businesses around the world are seeking an overhaul of KYC practices in 2026.

KYC Is More Vulnerable To Fraud And Crime Than Ever Before

When KYC was first developed, it was incredibly difficult to forge the identity documents that were needed to complete the verification process successfully. Criminals had to own hard-to-access, illegal forgery tools and every forged document took time and effort to create. Now, however, as generative AI has taken off, many malicious actors are using this technology to create hyper-realistic fake documents that pass KYC checks. Now, fraudsters aren’t trying to steal an ID, but instead are able to manufacture entirely new identities in a matter of seconds. KYC, as it is now, cannot do anything to combat this, and changes must happen in the future to create a more secure alternative.

Can KYC Practices in 2026 Be Reformed?

When we look at all this information, it isn’t difficult to see why people do not want outdated KYC practices in 2026. That said, the process still acts as a relatively secure barrier against digital threats, fraud, and money laundering. An ideal future of KYC would not be one in which the process is abolished entirely, but rather one in which it is effectively integrated with other modern security technologies. Already, in 2025, we are seeing a hybrid approach with KYC and decentralized identity checks and AI-assisted document analysis.

In an ideal future, we won’t see KYC die out, but rather evolve into something new that keeps pace with the rapid pace of modern technological change. There are already multiple systems that can work effectively alongside KYC to ensure greater levels of security. These systems involve using biometrics, decentralization, and multi-factor authentication. If KYC hopes to regain its place at the forefront of identification verification, it will need to make use of the available technology that surrounds it to update and improve its systems and keep up with a fast-changing digital world.