Common Mistakes to avoid when opening a Demat account online

Table of Contents

Introduction

Previously, individuals used to hold physical certificates of financial instruments, like stocks and bonds, as proof of ownership of the securities, which made trading inconvenient. There was always a risk of damage or loss, and the process of buying and selling would take time as it required the transfer of physical certificates. Besides, there were other issues too. That said, these issues were eliminated with the introduction of dematerialization, which allowed investors to convert physical share certificates into electronic form through the opening of a Demat account.

Simply put, a demat or dematerialized account refers to an account that serves as a digital vault for storing financial instruments. This account removes the requirements for physical certificates and facilitates easy transactions in the securities market. In some countries like India, opening a demat account is mandatory if individuals want to buy and sell financial instruments.

If you wish to know the crucial details associated with such an account, you have come to the right place. In this article, we will help you understand how this account works in detail. Note that it is common for people to make some mistakes when opening a Demat account. So, we will also cover what they are and how to avoid them.

How Does A Demat Account Work?

Similar to any bank account that holds money, Demat accounts hold securities. When an individual buys a financial instrument, it appears as credit in the Demat account. On the other hand, if one offloads securities from their account, the assets appear as debits. The dematerialized financial instruments are held by Depositories on traders’ behalf, and Depository Participants or DPs operate these accounts, serving as their agents. Note that a Depository Participant can be a stockbroker, a bank, or a non-banking financial institution.

Individuals can open this account online conveniently by visiting the official website of the DP. After initiating the application process by clicking on the option that allows them to open the account, they have to provide the necessary documents. Typically, the documents required include proof of address and identity proof.

Once the processing is complete, the account becomes active. Individuals must remember that this account generally comes with a linked trading account. After they add funds to the account, they can log in using their credentials and start trading.

Here’s an example of how a trade may take place. Suppose an individual places a buy order, the stock exchange selects a seller who is seeking the exact quantity of the financial instrument and sends an order to the clearing house. The clearing house debits that quantity of the financial instrument from the demat account of the seller and credits the same to the Demat account of the buyer.

Besides making trading more convenient, a Demat account makes it easier for individuals to get money via the sale of securities. Also, after opening this account, one can get financial assistance from lenders against the financial instruments held in it. Additionally, it becomes more convenient to receive additional shares from bonus issues, stock splits, etc.

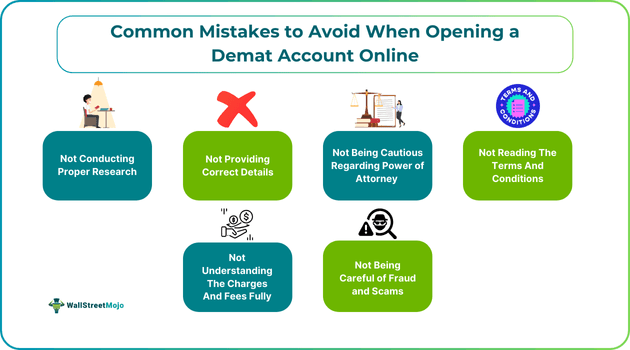

Common Mistakes To Avoid While Opening A Demat Account

Individuals must avoid these mistakes when opening a Demat account:

#1 - Not Conducting Proper Research

A common mistake new traders usually make when opening a Demat and trading account is picking a DP without carrying out sufficient research. Note that DPs have different features and charges. It is essential to compare such aspects to choose a DP that best suits the requirements. One might want to consider the following elements for avoiding Demat account errors related to Depository Participant selection:

- Commissions and fees: These charges can include various components, like annual maintenance charges or AMC, brokerage fees, and account opening fees.

- The reliability and user-friendliness of the trading platform: The platform of broker should be user-friendly. Moreover, it should be technologically advanced. Only then can it offer an optimal trading or investing experience. Ideally, the features offered should include access to research reports, market data, latest news, etc.

- Reputation and Regulation: Ensuring that the broker’s activities are regulated by a reputable organization is extremely important to avoid falling prey to fraudulent activities or poor experiences when trading.

- Customer Reviews: Lastly, individuals must check key insights like brokers’ ratings and reviews and compare them to determine which provider is providing the best customer support.

Additionally, one must consider the account type offered by the DPs before starting the online trading account setup. This is because the features typically vary from one account to another.

Not choosing the right DP may lead to an unsatisfying trading experience. Moreover, one may incur higher charges that will impact their gains.

#2 - Not Providing Correct Details

Individuals must go through the form carefully after entering all key details, like name, nominee information, phone number, and age. If the details provided are inaccurate, one may face issues later on when executing transactions. Also, if the contact information, for example, email ID, is incorrect, traders and investors will not get updates and messages related to their account activities.

#3 - Not Being Cautious Regarding Power of Attorney (POA)

POA refers to a legal authorization for the DP to operate the Demat account. Note that this authorization can be misused to carry out fraudulent or unauthorized transactions. For example, Securities might be sold without the account holder’s consent. Hence, one must be cautious about giving a POA.

#4 - Not Reading The Terms And Conditions

This is another avoidable mistake when opening a Demat account. The terms and conditions refer to a document outlining the obligations and rights of traders and investors. It also mentions the features, services, and charges and fees imposed by the broker. Hence, an important Demat account tip given by experts is to carefully go through the document and understand the details fully prior to signing the agreement with the DP. If individuals have any doubts or confusion, they must not hesitate to clarify with the DP. Additionally, individuals should consider keeping a copy of the document for future reference.

#5 - Not Understanding The Charges And Fees Fully

Failure to understand the different charges associated with Demat accounts, like transaction charges, annual maintenance fees, etc., will result in unanticipated costs. This can impact one’s financial or trading plan. Hence, a popular Demat account tip is to be aware of the fee structure related to the Demat account.

#6 - Not Being Careful of Fraud and Scams

Another common mistake when opening a Demant account online is not being aware of scams or fraud. Indeed, with time, fraudsters are now using advanced techniques to gain authorize access or steal funds. An example of such techniques is phishing, which involves sending fake messages, emails with the purpose of tricking users into revealing their classified information. Hence, individuals must make sure to visit the official website of the DP only to start the online trading account setup.

Conclusion

For individuals to reach their investment and trading goals, avoiding the above mistakes when opening a Demat account is crucial. We hope the tips provided in this article will help you choose the right account and steer clear of any issues during the account opening process.

That said, if you are still unsure about avoiding Demat account errors mentioned above, you may consider getting in touch with an expert to guide you.