Table Of Contents

Introduction To Fintech Innovations In Cash Flow Management

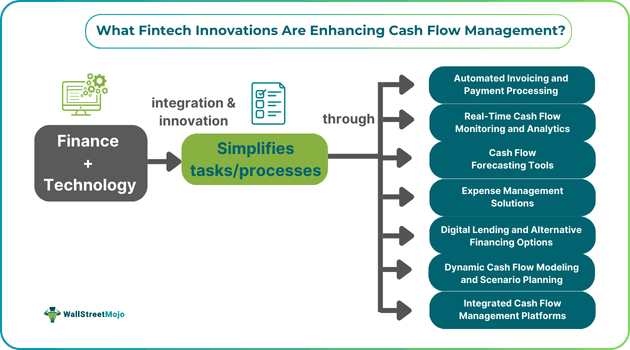

Managing cash flows effectively is what ensures the smooth running of a business. With technological advancements influencing the finance sector, cash flow management has become quite easy as no manual recordkeeping is required anymore. However, before we discuss how the fintech innovations for cash flow management work for modern businesses, let us gather a brief understanding of what cash flow management is and how crucial it is for new businesses and the circulation of funds.

In layman's terms, cash flow management is the entire process of tracking, controlling, and planning the utilization of funds along with its movement both into the company accounts and out of the company books for business operations and activities. Efficient cash flow management includes forecasting future fund requirements and parallelly making sure the company has sufficient funds at all times to meet any unexpected needs or expenses. With time, technology has played its role in revolutionizing the way cash flow management works. It has helped businesses streamline their fund management, offering tools for expense management solutions and better use of income sources.

Many fintech platforms offer personal finance solutions to individual users and help them track expenses, offer plans for employees' personal financial growth, and lend services and loans like VIVA finance. When it comes to assisting small to large businesses, fintech innovations have introduced automated processes, real-time insights, and risk management, thereby also uplifting precision, accuracy, and efficiency with strategic control over business finance.

Fintech Innovations For Cash Flow Optimization

#1 - Automated Invoicing and Payment Processing:

Automated invoicing is used with software to make payment processing easy, swift, and efficient with minimal manual intervention. In a nutshell, it automates tasks related to billing, invoicing, and digitalizing buy orders and receipts, along with data validation, approval routing, and the overall payment process. It offers real-time insights and eventually leads to boosting cash flow management. Above all, with less human intervention, there is significantly less room for human error.

For a small business that receives hundreds of invoices monthly or weekly, manual processing will be tiring, time-consuming, and vulnerable to human error. In such instances, an automated payment and invoice processing system led by fintech innovations for cash flow management extracts key information from each invoice, matches the details, and aligns everything for swift payment processing.

#2 - Real-Time Cash Flow Monitoring and Analytics:

Real-time analytics is a digitized setup that uses tools to assess and respond with real-time information about bills, invoices, payroll details, purchase orders, and receipts. It helps businesses monitor and track cash flow to understand where it was received and where it has been spent. Fintech innovations for cash flow management have dramatically changed the way businesses operate with real-time cash flow monitoring.

It eliminates the limitations that traditional cashflow management had, such as manual processes, lack of real-time visibility, inaccuracy, and tiring and time-consuming activities with limited scenario planning, and replaces them with data quality and integration and advanced AI-powered analytics, promoting data-driven culture and technology scalability.

#3 - Cash Flow Forecasting Tools:

One important establishment of fintech innovation in cash flow management is cash flow forecasting tools. These tools help companies forecast future cash flow needs and simultaneously notify them about any financial risks that can sabotage future business operations due to a lack of cash flow planning and insufficiency of funds.

Forecasting cash flow using these tools helps businesses plan and be fully prepared to mitigate risks through automated daily cash projections and AI-based data-driven decisions. Numerous fintech platforms offer a wide range of services that help companies enhance their cash flow management.

#4 - Expense Management Solutions:

Fintech innovations have brought a big shift in employee reimbursement processes through expense management solutions. With a proper expense management framework, companies eliminate the need for paperwork, minimize errors, and reduce handling expenses as the processes become highly automated with negligible human effort required.

Fintech platforms and software offer expense management services, which automate the whole process of recording, tracking, and payment approval for reimbursable expenses incurred by employees while working on company operations, attending meetings, traveling, and lodging. These expense management systems are customizable to align with different company reimbursement policies. Hence, they automatically know which bills and invoices are to be approved and which are not to be entertained.

Such software, along with an accounting system or ERP, can offer additional benefits. For example, it removes the need for accounting staff to generate manual expense report data. As soon as the expenses are approved, they are scheduled for payment, saving time and effort.

Fintech innovations coupled with expense management save time, reduce human intervention and errors, simplify processes, improve compliance, and boost productivity. Some key features of expense management include:

- Tracking employee receipts

- Allowing employees to use smartphones to click on receipts

- Check for policy violations

- Enable companies to change policies when necessary.

#5 - Digital Lending and Alternative Financing Options:

The next big thing that fintech innovations for cash flow management brought in, not only in cash flow management but also in corporate finance, is alternative lending options and digital lending services. It majorly focuses on personal finance, where fintech platforms have data of various people and based on their credit score, creditworthiness, and repayment history, the fintech platforms offer small to medium loans that are easily accessible, paperless, and, most importantly, come with different offers and unique interest rates. There are dozens of financial platforms and websites that can grant you loans without having to visit the bank with low and no documentation required.

The main benefits of digital lending and alternative financing are hassle-free access to money, lower and reasonable interest rates, flexible return policy, considerable terms, and easy monthly payments compared to traditional forms of lending, mortgage, and credit services, like pledging jewelry or keeping collaterals. Fintech today not only replaced cash payments with online payments but has successfully marked its presence in lending options compared to banks and other financial institutions.

#6 - Dynamic Cash Flow Modeling and Scenario Planning:

Fintech has always prioritized risk management for businesses. With scenario modeling, the tool creates a series of hypothetical situations that enable a company to understand how different aspects and variables can impact its cash flow. This single innovation helps businesses make better decisions, foresee potential risks, and be prepared to face them or, more conveniently, prevent them.

On the other hand, dynamic cash flow modeling is another innovation that fintech innovations have given companies to incorporate into their cash flow management processes. Cash flow has always been observed as the lifeblood of any business. Dynamic cash flow modeling offers early warning signals about a company's future business health. In short, both scenario planning and dynamic cash flow modeling provide significant support to risk management.

#7 - Integrated Cash Flow Management Platforms:

At the beginning of fintech, multiple cash flow management platforms offered limited services. They were not well integrated with other software, online tools, and applications, which made businesses use multiple platforms. However, this innovation made processes complex because management kept switching between platforms for different services. Many leading cash flow management platforms identified this problem and resolved it.

With time, fintech platforms have become extremely well-integrated, and you can actually operate your entire cash flow management from just one platform, saving a lot of time and effort and simplifying processes.

Conclusion

The only way to see and acknowledge the fintech innovations in enhancing cash flow management is to imagine an office where everything is done manually. The employees have to wait long hours to file reimbursements. There is no system installed for payroll, invoices, bills, receipts, and purchase orders. Every single record is registered using paper in heavy piles of files. Thus, every single activity takes time because the file has to be searched manually on shelves, the data has to be matched, and the processing has to be done manually again. Hence, it takes days, and even weeks, to process.

Today, fintech has completely changed the way companies operate using AI tools, applications, and well-integrated software that automates tasks and processing operations. Every single fintech platform today has something unique to offer. All you have to do is match your needs and become a part of the revolution that fintech innovations for cash flow management have brought in.