Personal Loan Eligibility Criteria: A Complete Breakdown For First-Time Borrowers

Table of Contents

Introduction

A personal loan has become a go-to option for many people around the world seeking quick access to funds. Since this form of financial assistance comes with no end-use limitations, individuals can utilize the money to meet different types of expenses. For instance, they can take a loan to purchase a gadget, meet expenses resulting from medical emergencies, or fund a vacation.

Individuals can repay the loan amount with interest over a certain period via equated monthly installments or EMIs according to the terms agreed upon with the lender. While this type of financial assistance improves accessibility to funds, there are certain loan qualification requirements that one must meet to get the loan sanctioned. If you wish to know about these requirements, you have come to the right place. This first-time borrower loan guide will provide comprehensive knowledge regarding personal loan eligibility criteria.

What Is Personal Loan Eligibility?

Personal loan eligibility refers to the ability of a person to be able to take a personal loan from a lender by fulfilling specific criteria or requirements. It does not make sense for individuals to apply for a personal loan without meeting such criteria, as the lender will reject the application. We’ll discuss such requirements in detail in the next section of the first-time borrower loan guide.

If you are looking to figure out whether you are eligible for this type of loan quickly, you can consider using a personal loan eligibility calculator. This online tool is available for free on various websites; it offers the following benefits:

- It allows one to evaluate how much one can borrow responsibly.

- The calculator helps in financial planning prior to initiating the application process.

- It helps make an informed decision and increases the chance of getting a loan, and that too on favorable terms.

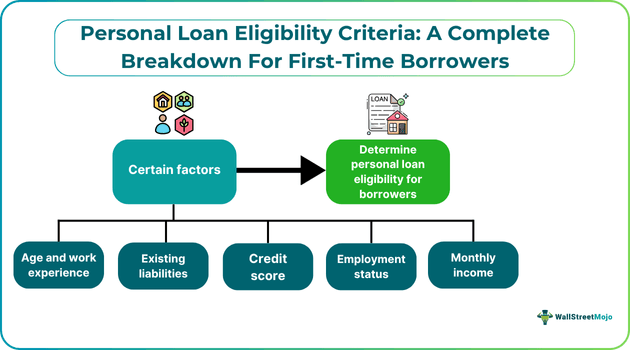

Key Factors That Decide Your Personal Loan Eligibility

Let us look at the loan qualification requirements that one typically must meet to get access to funds.

#1 - Age

Most loan providers set the maximum and minimum age limits for applicants. Usually, individuals aged between 21 and 60 are eligible for this type of loan.

#2 - Employment Status

Borrowers check the employment status of individuals to determine whether they qualify for a loan. Generally, a non-employed individual with no income cannot get this form of financial assistance. On the other hand, a salaried individual working in a private or public company can find it easy to qualify for a personal loan. Also, self-employed individuals earning regular income can be eligible. That said, both salaried and self-employed people must fulfill the other personal loan eligibility criteria to get access to the funds.

#3 - Monthly Income

Another key factor in the personal loan checklist for eligibility is monthly income. Lenders assess applicants’ monthly income to evaluate the latter’s repayment capacity. A lower monthly income indicates low repayment capacity. On the other a higher income every month suggests that the borrower has a better repayment capability. Note that it is vital to have an adequate and stable monthly income to fulfill this eligibility criterion. Since self-employed individuals may not have a fixed monthly income, banks take their income patterns into consideration.

#4 - Credit Score

The next element in the list of personal loan eligibility criteria is the credit score. This three-digit score denotes an applicant's creditworthiness. A borrower's repayment history and past credit behavior form the basis of the score. Generally, the higher the score, the better the chances of getting financial assistance. Also, having a great credit score can help in getting a loan on favorable terms. In most cases, lenders require a credit score of more than 750 for loan approval.

#5 - Work Experience

Lenders check the employment history of a salaried individual to assess the credit risk and determine the eligibility of borrowers. When an applicant has worked in a particular organization for a long period, it is a sign that the applicant has income stability. This increases the chances of getting loan approval.

For self-employed individuals, lenders check the stability of the business. In other words, they check the period for which the self-employed person has been carrying out operations related to their profession or business continuously.

#6 - Existing EMIs Or Liabilities

Another crucial aspect that loan providers check is existing financial obligations, which can be existing EMIs or any kind of financial commitment that impacts one’s disposable income. In this regard, the debt-to-income ratio is a key metric for lenders to assess. It compares the recurring debt repayments against the gross income earned every month. Generally, lenders consider a debt-to-income ratio of less than 35% acceptable. That said, the lower this ratio, the better one’s chances of getting financial assistance. Also, a low ratio can help in negotiating better loan terms.

We hope now you have the answer to your question, ‘how to qualify for personal loans?’ That said, remember that the eligibility criteria typically differ across lenders.

Common Documents Required To Prove Eligibility

Fulfilling the personal loan eligibility criteria is not enough to get a personal loan. Individuals must submit specific documents as well. Let us find out what they are.

For Salaried Individuals

- Proof of identity

- Age proof

- Salary slip

- Bank statement for the past 3 months

For Self-Employed Individuals

- Identity proof

- Address proof

- Proof of office address and business ownership

- Financial statements attested by a chartered accountant (CA)

- Income tax returns of the previous two years

Note that the personal loan checklist for documents may vary slightly for different lenders according to their requirements.

Ready To Apply For A Personal Loan

Now that you know how to qualify for personal loans and which documents you need to submit, you can contact a lender and initiate the application process. If you are confused about which loan provider to choose, comparing the following aspects associated with the lenders may help:

- Interest rates

- Tenure

- Fees

- Loan amount

- Application process

- Reviews

- Online services

- Customer service

Before applying, it’s wise to compare loan offers from different lenders. SuperMoney’s personal loan comparison tool lets you review rates, terms, and eligibility requirements side by side to find the right fit for your financial goals. Once you figure out which one is the best loan provider, you can apply for a personal loan online to get access to funds.

Final Thoughts

A personal loan can be an extremely convenient option if you wish to convert big-ticket purchases into easy EMIs. Moreover, it can even help you cover any expenses that may arise due to an emergency. By knowing the personal loan eligibility criteria and the list of documents required beforehand, you can ensure a hassle-free application process and get access to funds quickly.