Table of Contents

What Is A Saver's Credit?

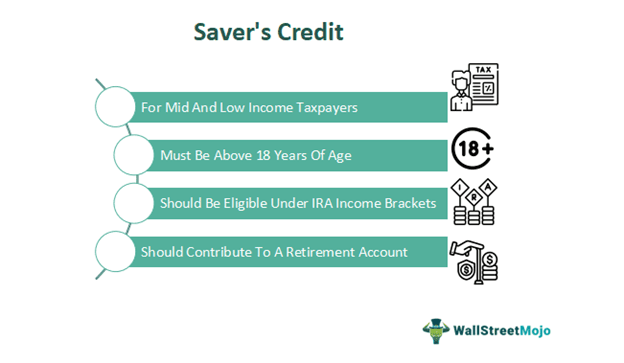

Saver's credit is short for retirement savings contribution credit. It is a non-refundable tax credit for low- and mid-income taxpayers who are contributing to a retirement account. Their income tax liability does not exceed $1,000 for single taxpayers and $2,000 for married couples filing jointly. For eligible individuals, the saver's credit limit allows them to save a significant amount of tax burden while filing taxes.

Individuals or couples who are eligible for these benefits could be investing for their retirement through 401k, 403 (b), simple IRA, 457 plan, or SEP IRA. However, the overall savings on the tax return might depend on the adjusted gross income. However, it is unfortunate that only 12% of Americans who are in the income bracket apply and avail of these benefits.

Key Takeaways

- The saver's credit or retirement savings contribution credit is a tax benefit offered to taxpayers with a modest range of income.

- The benefits are given to them provided they make contributions to a recognized retirement account.

- The retirement account could be a 401k, traditional IRA, 403 (b), 457 plan, or Roth IRA are recognized accounts.

- However, qualifying in the income slab as regulated by the IRS is mandatory.

- The IRS updates the Adjusted Gross Income (AGI) annually.

- Despite the scheme being introduced in 2002, only a tiny population utilizes the benefit.

Saver's Credit Explained

Saver's credit is a credit offered to individuals and married couples with moderate incomes that contribute a portion of their incomes towards retirement accounts like 401k, Roth IRA, simple IRA, or 403 (b).

However, it is essential to understand that only some are eligible for preferential saver's credit taxes. It is only applicable to individuals and married couples filing jointly who fall under the mid and low-income brackets.

The maximum tax credit for individuals and married couples filing jointly is $1,000 and $2,000, respectively. Moreover, there are a few criteria that a taxpayer must fulfill. The foremost requirement is that they must be above 18 years of age and not be full-time students.

Additionally, the taxpayer must not be claimed as a dependent on any other individual's tax return. Most importantly, their adjusted gross income, or AGI, must be within the limits set by the IRS. The limit for 2024 is $57,375 for the head of a household, $76,500 for a married couple filing jointly, and $38,250 for taxpayers of every other category.

The retirement savings contributions credit is to encourage individuals and couples to invest or save towards their retirement, irrespective of their level of income. By giving them a tax credit, the IRS not only pushes taxpayers toward financial strategy but also promotes financial security.

Who Can Claim?

To be eligible to claim the benefits of saver's credit taxes, an individual or married couple must be:

- Above the age of 18

- Should not be a full-time student

- They must have made retirement contributions within the same tax year as they are filing the return

- The taxpayer must not be claimed as a dependent on another taxpayer's tax return.

- Must fall within the income brackets set by the IRS.

How To Claim?

The first step is for a taxpayer to open a retirement account to receive benefits if they do not have one already. In the modern day, it is a matter of a few taps or clicks, and an account can be opened from the convenience of their houses or anywhere else.

Once a retirement account is up and running, a taxpayer can start making contributions from their income through their workplace 401k. The taxpayers can then proceed to make deposits into their Individual Retirement Accounts (IRA) within the permitted timeframe set by the IRS to be able to include the contributions within the same year.

At last, eligible taxpayers, based on their income limits and other criteria as mentioned above, can fill out Form 8880 to claim their credit. To get a basic idea of how much credit they will receive, taxpayers can use a saver's credit calculator.

Saver's Credit Rates For 2024

The AGI thresholds, as applicable in 2024 for different categories of taxpayers, are as follows:

| Type Of Filer | 50% Of The Contribution | 20% Of The Contribution | 10% Of The Contribution |

|---|---|---|---|

| Head Of Household | $34,500 or below | $34,501-$37,500 | $37,501-$57,375 |

| Married Filing Jointly | $46,000 or below | $46,001-$50,000 | $50,001-$76,500 |

| Other Filers | $23,000 or below | $23,001-$25,000 | $25,001-$38,250 |

How To Calculate The Value Of The Saver's Credit?

Despite the fact that there are multiple saver's credit calculators available online, it is crucial to understand how it work. Therefore, the calculation below is an attempt to ensure that this facet of the concept is also out of the way.

- The first step in the calculation process is to determine if the individual is single, filing jointly, or otherwise.

- Based on the type of filing, their AGI brackets shall be implied.

- Now, the next step would be to discover the amount contributed to an eligible account within the tax year.

- Based on the contribution and the AGI bracket, a percentage of the tax credit shall be applied as per IRS guidelines.

An essential factor to consider during calculations is that if the contributions are made through a 401k or any other retirement account that lets taxpayers enjoy a tax deduction for their contributions, it shall lead to the taxable income also being reduced by the contribution amount.

Limits

While the saver's credit taxes provide significant benefits, there are limitations as well. They are mentioned below.

- Adjusted Gross Income: The benefit is only available for taxpayers who fall under the mid or low-income bracket. Precisely, it is only for heads of households whose AGI is below $54,750, $76,500 for married filing jointly, and $38,250 for all other filing statuses.

- Age: The taxpayer must at least be 18 years of age.

- Contributions: The consideration for these credits is only applicable if contributions are made to any of the retirement accounts as mentioned by the IRS.

- Percentage: Depending on the filing status and the AGI, a certain percentage is fixed for each of the statuses.

Examples

With the conceptual and theoretical factors of a saver's credit income limits out of the way, it is time to address the practical aspect. The examples below shall help with the practicality and real-life application.

Example #1

Taylor works as a receptionist at ABC Inc. Her annual income adds up to $18,000. In the tax year 2024, she contributes $2,000 to her 401k.

As per the norms in 2024, she is eligible for a 50% tax credit as she is a single tax filer with an income below $23,000. Therefore, she receives 50% of her $2,000 contribution, which is $1,000.

Example #2

The IRS introduced the retirement savings contribution credit in 2002. However, the number of people who are aware of the benefits could be higher. Despite the fact that millions of taxpayers qualify for these benefits, they still need to fill out Form 8880. Even worse, most people are not even aware of such benefits.

In fact, in 2021, a mere 5.7% of eligible taxpayers applied and took advantage of the incentive to save for their retirement. Therefore, as a measure to improve the number of people applying and claiming benefits, the IRS allowed taxpayers to apply and claim benefits for their 2023 tax returns till April 15, 2024.

A study later found that the low turnout is due to the fact that the lower-income groups generally do not have any tax burden. Therefore, they need help to file a refundable tax credit.

Effects

- The effects of saver's credit income limits and tax credits are mentioned below.

- The foremost effect it has on low to medium-income taxpayers is that it reduces their tax burden.

- It encourages taxpayers to develop a long-term vision and save for their retirement.

- These benefits allow taxpayers to gather a more significant sum that can provide financial security post-retirement.

- It motivates taxpayers to increase their contributions and develop a habit of saving.