Table of Contents

What Is Security Token Offering (STO)?

A security token offering also referred to as a tokenized IPO or STO is a digital token offered to individuals with the support of blockchain technology. These offerings show that there is a stake in a specific asset. The security token offering process facilitates digital funding while still adhering to regulations dictated by governments.

In simpler terms, an STO is a digital form of real-world, tangible assets like gold, stocks, or bonds. Therefore, they are considered fungible tokens and, thus, hold some monetary value. STOs came into the picture after the crypto market fell by $750 billion in 2018 to secure investments within the domain.

Key Takeaways

- Security token offerings are regulated and, thus, highly secure forms of raising funds in digital form.

- They are backed by underlying assets such as stocks, funds, bonds, or REITs.

- Unlike other forms of fundraising with blockchain support, these are regulated by respective national regulatory bodies that ensure that the investors and issuers follow the rules of the land.

- These funds eliminate the troubles of the traditional forms of investing, such as high-ticket size, authenticity issues, and liquidity.

- Moreover, there are no middlemen, such as brokerages or clearing houses, which reduces the cost of raising funds even further.

Security Token Offering Explained

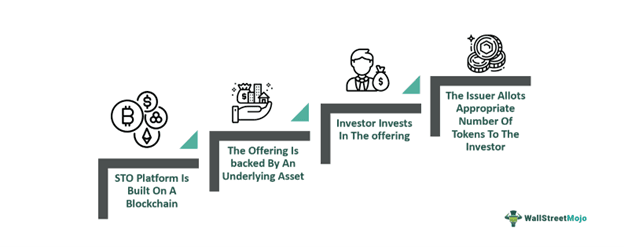

A security token offering or a tokenized IPO is the issuance of security tokens by issuing companies with the help of Distributed Ledger Technology (DLT), which is typically referred to as blockchain technology.

STOs, in more ways than one, are like the initial public offerings (IPOs) in the stock market. However, STOs are completed and conducted on the blockchain itself. From pricing to subscription, token allocation can be conducted on the blockchain itself.

Initially, the world of cryptocurrency used Initial Coin Offerings or ICOs to issue tokens. However, in 2018, the ICO bubble burst and wiped away a whopping $750 billion of the crypto market's market capitalization.

As a result, many regulatory bodies across the globe have started placing impetus on a more secure form of legislation for issuing tokens. As a result, multiple ICOs were irked by the less flexible format compared to the previously non-regulated process, which allowed more freedom.

The two major types of security tokens offered by security token offering platforms are- one is securities-based tokens. These tokens have either equity, debt, or a combination of both as underlying assets. The second type is an asset-based token, which has assets like infrastructure, real estate, oil, gold, silver, and other metals or agricultural produce as underlying assets.

Therefore, a more secure system concerning investments through blockchain is a welcome move for multiple regulatory authorities and investors across the world.

For users prioritizing compliance and asset security, platforms like Coinbase operating under regulatory oversight remain a common choice.

How to Participate?

Participating in any of the security token offering lists, investors can follow the steps mentioned below.

- The foremost step towards participating in an STO is to ensure the required KYC paperwork and other documentation, according to the regulatory system within the jurisdiction, is ready.

- Once the documentation is ready, it is relatively easy to create a digital wallet that is compatible with tokens.

- A digital wallet allows investors to then sign up with an application or platform that hosts STOs. After signing up, investors can link their digital wallets with the platform.

- After linking the wallet with the platform, investors can transfer or shift funds from their bank accounts to their digital wallets.

- The amount in the digital wallet can be used for investment in STOs. It is essential to understand that these are volatile assets. Therefore, it is critical to keep monitoring their movements and take action according to individual risk appetite.

Security Token Types

Security token offering platforms have different blends of flexibility and security. Therefore, investors must choose a platform that fits their style of investing. However, it is better to understand the three major types of STOs; they are:

- Contactless Tokens: Investors do not have to connect to a device in a contactless token action. Therefore, they do not have to produce an additional access code. Instead, they connect devices with the system wirelessly. The acceptance or denial of the code is on the basis of the network.

- Connected Tokens: Investors must physically connect the token to the system of their choice, like a fob or a smart card. Once the device is slid into the reader, the device conducts an automatic authentication process and provides access to the system.

- Disconnected Tokens: In this type of security token, there is no physical connection of anything with a device. However, investors might need to enter a code produced by the token. Two-factor authentication is a classic example of a disconnected token.

Examples

With the fundamentals and related information out of the way, it is also essential to understand the concept from the perspective of real-life application and practicality. The examples below shall address these angles.

Example #1

TwoPlus, an eco-friendly mobile battery manufacturer, wanted to increase its production facilities and expand into three more locations across the world. After meeting with the top management and accounting team, it was a unanimous decision to opt for an unconventional form of raising funds as they were extremely costly and time-consuming.

As a result, the management of TwoPlus decided to raise funds through STOs. Each token will be backed by its assets and the profits it will generate in the coming years. They completed the paperwork and launched an STO.

One hundred thousand people invested through the STO, and TwoPlus was able to raise over $10 million.

Example #2

Former SpaceX engineer-founded company LXDX became one of the first companies to sell stock through STOs in May 2023. These cryptocurrency tokens represented ownership in the exchange.

LXDX issued 5 million tokens to allow a dilution of ownership of 10 percent of the company. Priced at one Euro per token, the total valuation of the STO amounted to about $57 million.

Security Token Use Cases

The most common use cases of security token offering processes are:

- Real Estate: The traditional real estate market is illiquid. It isn't easy to sell them quickly and convert them into physical cash. However, real estate in tokenized form comes at a fraction of the price and can also be exchanged relatively quickly on the exchange.

- Commodities: The tokenization of commodities is becoming more and more popular across the globe. The risks of holding physical gold or silver carry a set of challenges relating to security and authenticity. Therefore, tokenization not only allows investors peace of mind but also allows them to be worry-free about the authenticity of their investment in commodities.

- Art: The global art market is one of the largest industries that work silently without making too much noise. Naturally, their ticket size is significantly larger than most industries. As a result, tokenization not only allows smaller investors to participate in the market but also makes the valuation of the artwork more transparent.

- Debt: Another type of tokenization that is gaining popularity among the global audience is debt. It refers to debt instruments such as bonds and even loans. These can be difficult to trade or transfer ownership to another individual. Therefore, tokenization allows trading or selling a fraction of the share of the debt to another entity or individual.

Benefits

The benefits of security token offering platforms are:

- Traditional investing methods are on the inflexible side and require heavy investments. However, the introduction of STOs helps with making investments more accessible to a larger audience.

- One of the most significant advantages of investing in STOs is that they are highly liquid. Orthodox assets or the assets that are underlying STOs, like real estate, could be highly illiquid. The tokenization leads to better trade due to the liquidity.

- Another significant advantage of using blockchain technology is that the transparency of the underlying asset is enhanced. This is especially true for art and other such products that do not have a clear price tag otherwise.

- Orthodox investments have brokers, custodians, or clearing houses. With STOs, these intermediaries are eliminated, and the process is much more streamlined.

- Unlike the previous solution from blockchain (ICOs), STOs have more clarity in terms of regulatory and compliance bodies of different regions.

Risks

Despite the benefits, there are still challenges that loom ahead of the emerging methodology of raising funds. The most prominent ones are:

- The regulations across the world are strict towards security token offering lists, and most governments and their finance ministries are warming up to the concept. As a result, the flexibility of these tokens is restricted.

- While most asset classes can be tokenized, their actual value might be difficult for investors to gauge.

- Since it is a relatively new concept, it isn't easy to convince people of its genuineness despite blockchain being relatively safer than traditional forms of processing payments.

- The fast nature and the anonymity these tokens bring with them can come at a high cost.

Security Token Offering Vs Initial Coin Offering

The differences between STOs and ICOs are:

Security Token Offering

- The security token offering process is a regulated form of raising funds that has a token that is backed by an underlying asset. It is also referred to as a tokenized IPO.

- The regulatory bodies regulate participants through Know-your-Customer (KYC) or AML verification steps.

- These tokens have underlying assets such as bonds, stocks, REITs, or other funds.

- STOs are considered highly secure and reliable forms of investing.

Initial Coin Offering (ICO)

- An initial coin offering is a method for raising funds that is not regulated. It is used to support or fund a new project through the blockchain-backed cryptocurrency.

- These offerings are not regulated at all. Therefore, most entities can raise funds.

- ICOs are not backed by any underlying assets like STOs.

- Since there is no regulation or compliance requirement, these offerings might be highly insecure.

Security Token Offering vs Initial Public Offering

The distinctions between STOs and IPOs are mentioned below.

Security Token Offering

- STOs are secure forms of raising funds. These blockchain-backed offerings are backed by underlying assets and are regulated through relevant regulatory bodies.

- Securities or assets such as REITs, bonds, stocks, and other funds back these offerings.

- Since there are no middlemen in the process, such as brokerages or clearing houses, the cost of curating an STO is relatively lower.

- The users must fulfill AML and KYC requirements to meet compliance and regulatory requirements.

Initial Public Offering

- IPO is a process of inviting funding for a particular company's purpose by diluting the ownership of the company. These shares are sold to both retained and institutional investors.

- There are stringent regulations imposed by governments depending on the country of the company's origination.

- Since there are multiple processes, middlemen, and regulations involved, the cost is considerably high.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.