Building A Smarter Retirement Plan: Balancing Growth, Income, And Longevity Risk

Table of Contents

Introduction To Modern Retirement Challenges

Retirement planning has been subject to a significant transformation over the past few decades, influenced by longer life expectancy, shifting economic cycles, surging healthcare costs, and the slow disappearance of conventional pensions. While older generations could depend heavily on the benefits offered by employers and predictable interest-bearing investments, retirees, in the current landscape, have to navigate a far more complex financial environment. Indeed, various aspects, such as market volatility, changing tax laws, and personal spending patterns, play important roles in determining whether savings will last through an extended retirement.

For many households, retirement may span thirty years or more, meaning planning must account not only for growth but for resilience across different market cycles. This complexity requires a deeper understanding of certain elements, like risk, portfolio structure, and flexible income strategies. It also calls for a mindset shift. Individuals need to understand that retirement is no longer a single event, but a long-term process that requires regular assessment and adaptation.

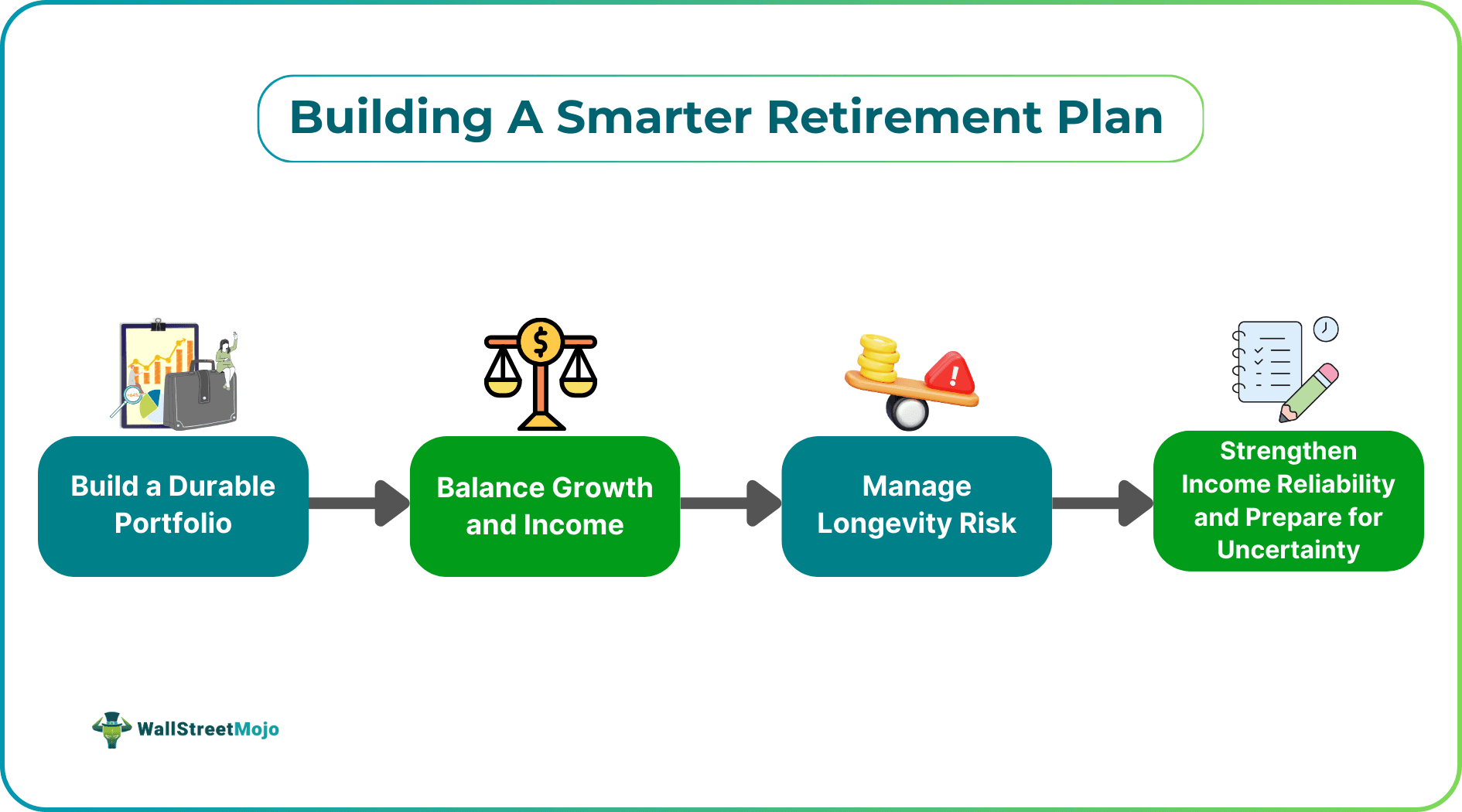

Building a smarter retirement plan capable of supporting stability, income, and peace of mind involves more than following rules of thumb. It requires thoughtful integration of financial knowledge, personal goals, and practical decision-making.

Understanding Long-Term Returns, Sequencing, And Building A Durable Portfolio

A central component of successful retirement planning is understanding how investment returns behave over extended periods. While average returns are useful for long-term projections, real-life markets rarely deliver returns in a linear manner. For example, a retiree may experience years of strong gains followed by periods of stagnation or unexpected downturns. This variability introduces what is known as sequence-of-returns risk, where the order of annual gains and losses has a powerful impact on the sustainability of a portfolio once withdrawals start.

A couple of retiree portfolios may grow at the same average rate over thirty years, yet if one suffers substantial losses early in retirement, the cumulative impact of withdrawing during downturns can leave far less principal available for future compounding. Individuals who are looking to build a portfolio that can weather the unpredictable nature of markets must recognize this risk.

Simultaneously, retirees must consider whether their projected investment choices realistically align with their financial goals and risk tolerance. Tools such as the internal rate of return calculator can help in this regard. Individuals can use such tools to assess long-term investment assumptions or compare different portfolio projections. It’s not meant to guide the retirement planning strategy by itself, but it provides clarity about whether expected returns are sufficient when weighed against future income needs.

Portfolio construction serves as the backbone of retirement security. Traditionally, retirees have relied on a blend of equities for growth and bonds for stability. However, with longer life expectancy and evolving market conditions, many investors find they require more diversified sources of return. This may include dividend-focused equities, real assets, short-term bonds, and even alternative income sources like rental properties.

The key to creating a smarter retirement plan is not merely diversification, but purposeful diversification. This means choosing assets that behave differently during varying market conditions to reduce concentrated risk. The ultimate goal is simple: to ensure the portfolio grows enough to keep pace with inflation while generating reliable income across multiple decades.

Integrating Behavior, Flexible Withdrawals, And Risk Protection

Although the mathematical aspect of retirement planning is crucial, the behavioral component is equally crucial. Human instincts often work against long-term investment success. During market downturns, emotional decision-making may push retirees to minimize equity exposure or shift into overly conservative positions, locking in losses and limiting future growth.

In contrast, periods of strong market performance can tempt retirees into taking more risk than they originally planned. Managing these psychological pressures requires a disciplined approach and a clear understanding of how different spending strategies can smooth the retirement experience.

One approach that has become popular among retirees is flexible withdrawal planning. This strategy involves making adjustments to the spending on the basis of the market performance instead of withdrawing a fixed amount every year.

In strong market years, retirees may safely spend slightly more, while in weaker years, they temporarily reduce withdrawals to safeguard portfolio longevity. A simple way to visualize how such adjustments impact long-term outcomes is by using tools such as the retirement withdrawal calculator. This tool enables individuals to test different spending patterns, return assumptions, and time horizons. It serves not as a prescriptive model, but as a way to measure a retirement plan’s resilience under different conditions. Hence, if you are looking to build a smarter retirement plan, you should definitely consider using this tool.

Risk protection also extends beyond investments. Longevity risk, outliving one’s savings, continues to be one of the most significant challenges for retirees. Healthcare inflation, unexpected medical events, and long-term care requirements can all strain even well-prepared portfolios. Anticipating these possibilities early and integrating them into a long-term financial plan is key to ensuring effective longevity risk management and ensuring retirement income planning remains effective even in the face of unanticipated costs.

Strengthening Income Reliability And Planning For Economic Uncertainty

Creating a smarter retirement plan that can withstand decades of economic uncertainty requires more than simply choosing the right investments. It involves establishing income sources that remain dependable even when markets falter. Many retirees rely heavily on portfolio withdrawals, but many experiences show that a single income stream is rarely sufficient to manage both expected and unexpected expenses over the long term.

Social Security, pensions, part-time work, annuities, rental income, and dividends play different roles in shaping financial consistency. For individuals, the challenge lies in balancing these sources in a way that reduces reliance on any one of them, especially those sources that are vulnerable to market downturns or inflationary pressures. For example, Social Security provides a stable, inflation-adjusted income, but it may not keep pace with lifestyle expectations. Dividends can be valuable, but companies are free to reduce or suspend payouts in challenging economic periods.

Rental income can offer resilience, yet it comes with maintenance costs and vacancy risks. A combination of income types offers a buffer against these uncertainties. Retirees who construct their financial plan around multiple income legs, similar to diversifying a portfolio, are better positioned to maintain purchasing power, manage unexpected medical expenses, and maintain lifestyle continuity even during prolonged market stress.

Additionally, building a reserve of highly liquid assets can help cover short-term requirements without forcing untimely sales of long-term investments. This cushion provides emotional comfort and financial protection, enabling retirees to endure temporary volatility while preserving their core portfolio for growth.

Ultimately, a retirement income strategy grounded in both diversification and liquidity provides retirees the best chance of sustaining financial independence, regardless of the economic challenges that unfold throughout their retirement journey.

Adapting Your Plan Across Different Retirement Stages

Retirement is not static. It unfolds in phases, each with distinct financial characteristics. Early retirement often features higher discretionary spending on travel, hobbies, or home projects. The middle phase tends to be more stable as daily routines settle and major expenses become predictable.

In the next phase, retirement typically shifts toward increased healthcare costs, reduced mobility, and a greater emphasis on stability rather than growth. Aligning investment strategy and spending expectations with these natural transitions allows retirees to maintain confidence and ensure financial control. This may involve adjusting portfolio risk levels, revising income strategies, or reallocating savings toward medical or caregiving requirements. The most successful retirement plans acknowledge these different stages from the beginning and incorporate mechanisms for ongoing recalibration.

Maintaining Flexibility For Long-Term Security

Retirement planning works best when it is flexible, not rigid. No financial plan, regardless of how well-designed, survives untouched for 30 years. Markets fluctuate, expenses shift, and personal circumstances evolve. A plan that incorporates regular reviews, adaptation, and strategic adjustments is far more likely to support long-term financial security than one that remains fixed. Indeed, a flexible approach ensures that retirees can respond confidently to economic changes without jeopardizing the sustainability of their savings.

Final Word

Building a smarter retirement plan today requires a deeper level of awareness and preparation than in past generations. Saving consistently matters, but the structure and behavior of investments matter even more once withdrawals start and volatility becomes a greater risk. Understanding how long-term returns behave, how sequence-of-returns risk can shape outcomes, and how to balance growth and income is key to ensuring financial security.

Instilling emotional discipline and adopting flexible withdrawal approaches help retirees navigate market uncertainty without undermining their long-term goals. Protection against longevity, healthcare inflation, and unforeseen expenses ensures savings remain durable throughout a long retirement. Ultimately, retirement success depends on adaptability, realistic expectations, and a thoughtful balance between personal requirements and financial strategy.