Table Of Contents

Bonds Meaning

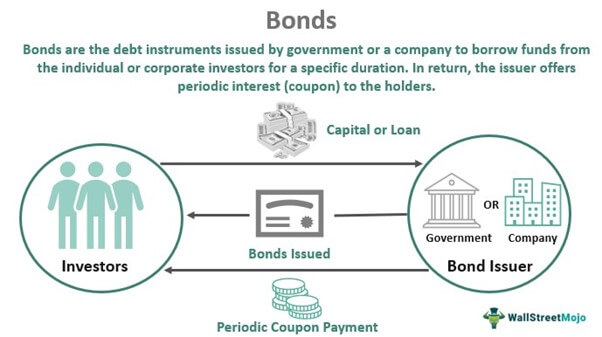

Bonds refer to the debt instruments issued by governments or corporations to acquire investors' funds for a certain period. These are fixed-income securities that allow the bondholders to earn periodic interest as coupon payments. Thus, the bond issuers are the borrowers, while the bondholders are the lenders or investors.

Bonds are tradable units that can be exchanged in the secondary market like stocks. Though they have a par value, they can be traded at a discounted or premium price. Further, bondholders have a stake in a business as they are entitled to the interest and repayment of principal on maturity. This privilege makes them more secure than stocks as an investment. However, unlike equity holders, they are not owners and have no claim in the company's profits.

Key Takeaways

- Bonds are the debt instruments issued by a government or a company to borrow funds from individual or corporate investors for a specific duration. In return, the issuer offers periodic interest to the holders.

- These securities have a face value which is their redeemable price. Also, the issuer provides coupon payments to the holders throughout the holding period.

- There are a variety of bonds like corporate, government, municipal, fixed-rate, floating-rate, convertible, zero-coupon, high-yield, etc.

How do Bonds Work?

A bond is simply a medium of loan for the companies and the government. The funds so accumulated by the issuer can be used to pay off debts, initiate new projects, or meet other financial requirements. However, lenders are individuals or institutions looking forward to making long-term investments to earn stable returns.

Such funds are treated similarly to loans and have a principal sum (issuance value), interest (coupon), and loan term (maturity period). Most of them offer a fixed interest rate at regular intervals, i.e., monthly, quarterly, semi-annually, or annually. But some have floating rates as well, though they involve higher risk.

Individuals and institutions can buy the new issuance via bidding in the auctions, visiting the Treasury Direct website, and from the brokers or issuing investment banks. However, prevailing bonds can be purchased by the investors in the secondary markets from the bondholders.

Moreover, the investors can look for other options like index funds and exchange-traded funds for more diversified investment. A buyer should always give due consideration to a bond's credit rating and its expense ratio before investing in it. In addition, the previous years' yield and coupon rate are equally important.

These instruments are prone to various types of risks, such as credit, liquidity, foreign exchange, inflation, corporate restructuring, volatility, and yield curve risks. The changes in their prices immediately impact the portfolio of securities as it offers relatively stable returns. Additionally, the price of a government bond is susceptible as it will depict the economic stability of the respective country. The credit rating agencies’ upgrade or downgrade can also impact its prices.

Characteristics

For the investors, bonds are long-term debt securities, while for the issuers, they serve as a source of generating funds or borrowing from investors. So let us now understand the various features that distinguish them from other investment vehicles:

- Issuer: The company or government (city, state, or national authority) issuing debt instruments to borrow money from individuals and corporate investors is termed as an issuer.

- Par Value: Every bond has a face value written on it, which is the amount a bondholder is liable to receive on the maturity date.

- Market Value: It is the price at which the bonds trade in the secondary market.

- Coupon: The rate of interest offered by the issuer on these debt securities is termed the coupon rate. Also, the annual interest paid to the investors is the coupon value.

- Coupon Date: The date on which the investors receive periodic interest payment is the coupon date.

- Maturity Date: The date the bond can be redeemed is its maturity date. The maturity period of such debt instruments can be for short, medium, or long term.

- Yield: The percentage return an investor makes by holding a bond to maturity is termed its yield.

- Credit Rating: The top rating agencies such as Moody's, Standard and Poor's, and Fitch rate different bonds based on their risk level. The ones with high risk are scaled low and known as junk bonds.

Types of Bonds

A bond can be of multiple kinds based on its issuing party, coupon payment, flexibility, yield, etc. However, some of the common ones are discussed below:

- Fixed-Rate: These instruments have coupon rates that remain constant throughout their life.

- Floating Rate: The coupon rates of these securities are linked to a reference interest rate, such as the LIBOR (London Interbank Offered Rate) or U.S. Treasury Bill rate. Since these are volatile, they are classified as floating. For example, the interest rate may be defined as U.S. Treasury Bill rate + 0.25%. It gets recomputed on a periodical basis.

- Corporate: These are debt securities issued by the companies and sold to various investors. They can be secured or unsecured. The backing for them depends on the payment ability of the company, which in turn is linked to possible future earnings of the company from its operations. These are the aspects looked in by the credit rating agencies before giving in their confirmation.

- Government: These are issued by the national government promising to make regular payments and repay the face value on maturity. The terms on which the government can sell such securities depend on its creditworthiness in the market.

- Municipal: These debt instruments are released by the nation, state, or cities to raise finances for their upcoming or running projects. The income from such securities is exempted from the state and federal tax liabilities.

- Zero-Coupon: They do not pay any periodical interest during their life. Instead, they are usually issued at a discount to the par value, making it an attractive investment. This difference is then rolled up, and the entire principal amount (par value) is paid on maturity. Financial institutions can also issue them by stripping off the coupons from the principal amount.

- High Yield: Such debt securities, also known as junk bonds, are rated below investment grade by the credit rating authorities. So, to attract investors, the issuers offer a higher rate of return. Since these are lower-grade instruments, they are expected to offer a larger yield. Investors willing to take a risk for higher yield opt for them.

- Convertible: It allows the holders to exchange them for specific equity shares. These are considered hybrid securities since they possess combined features of equity as well as debt.

- Inflation-indexed: These debt instruments link the principal and the interest amount to the inflation indexes like the consumer price index. Thus, they protect investors from inflation prevailing in the economy, thereby securing their investments.

- Subordinated: These are a class of unsecured corporate debt securities that have a lower priority than other instruments at the time of liquidation. The risk is higher than senior bonds. Once the creditors and senior bondholders are paid, the subordinated bondholders are compensated. Comparatively, they have a lower credit rating. Some examples of them are the debt instruments issued by banks, asset-backed securities, etc.

- Foreign: These debt securities are issued by a foreign company in the domestic market to raise funds in the domestic currency. As most investors would be from the domestic market, it can benefit from a diversified portfolio. Moreover, the investors can also get foreign exposure in their respective portfolios—for instance, Bulldog and Samurai bonds.

Bond Pricing

The market value of a bond is the present value of the principal sum and the interest payments discounted at the yield to maturity (rate of return).

Market price = Present value of interest payments + Present value of principal amount

- CV = Coupon value

- P = Principal value

- y = Yield to maturity rate

- n = Number of coupon payments

Please note that the yield and price of the bond are inversely related so that when the market rate rises, the price will fall and vice-versa.

Thus, the success of these securities is directly proportional to the yield they offer. Yield is the yearly return in percentage that the bondholders earn on such security.

Y = Yield

Case #1

For instance, if a bond was issued for $2000 with an annual coupon of $90, then its yield is:

Yield = (90/2000) *100 = 4.5%

Case #2

Now, assume that due to spontaneous increase in demand, the price rose to $2300, so:

Yield = (90/2300) *100 = 3.91%

Case #3

Similarly, if the price drops down to $1900, then:

Yield = (90/1900) *100 = 4.74%

Thus, from the above example, we can interpret that when the prices go up, the percentage yield falls, and when the prices decrease, the yield percentage goes up.

Bond Examples

One of the blooming high-yield European bond funds is the Schroder ISF EURO High Yield fund. Even amidst the Covid-19 conditions, this debt security fund performed well. Though the growth was slow, with various monetary policy reforms and rising inflation, it lived up to the investors' expectations. Each unit is trading at 168.0569 Euros as of November 2, 2021. Also, the fund marked a 4.59% yield to maturity and generated a 4.52% return in five years. To gain more insight on this fund, check the Bloomberg website.

Another top-rated bond index fund is the Fidelity U.S. Bond Index that primarily includes the intermediate-term debt securities. These debt securities offer an SEC yield of 1.1% while its expense ratio is just 0.025%. The best part of this fund is its diversified portfolio with around 2300 different bonds (37% of which are U.S. treasuries), which provide fixed income opportunities to the holders. Read more about it in the article published in Kiplinger.

Bond Indices

The bond index refers to a parameter for judging the performance of the bond market. The index is calculated by tracing a bundle of top-performing debt securities. Several such indices exist for the management of portfolios and measuring returns, such as:

- Bloomberg Barclays U.S. Aggregate

- Citigroup BIG

- Merrill Lynch Domestic Master

- JP Morgan Global Index

They also act as a benchmark to measure the performance of different bond funds. This comparison enables fund managers to devise strategies to manage the funds effectively. The market price and interest payments of selected debt instruments form the basis of calculating the index.