Table Of Contents

What Is Tax Equivalent Yield?

Tax Equivalent Yield means how much yield (pre-tax returns) you would earn if you need to pay taxes on your tax-free investments. This will help you compare the yield between a tax-free investment and a taxed investment, and you would be able to find out whether the taxed investment is a good deal or not.

Thus, this metric helps in evaluating the after-tax return on various kinds on investment opportunities. But this calculation does not consider the risk involved in the investments, like the liquidity risk, the credit risk, etc. These risks are important considerations while making any investment decisions.

Key Takeaways

- Tax equivalent yield compares the yield of tax-free and taxed investments, helping you decide if a taxed investment is worth considering.

- One must first calculate tax equivalent yield by finding the tax-free yield from municipal bonds. These bonds are government-issued, so no tax is required on investment profit.

- The second component of the formula is (1 – Tax rate) to calculate the yield on a taxed investment. The denominator uses this factor to determine the benefit of investing in taxed assets

Tax Equivalent Yield Explained

Tax equivalent yield is the concept that explains that the yield from a taxable investment should be equal to the yield from a tax-free investment. By using this tool, the investors can compare the two types of investments and identiy which will give a better return.

The tax implications are an essential criterion to assess while investing. The advantages of putting one’s money into a tax-free fund are quite lucrative. But a comparison should be made whether such a fund will give a yield that will be more than the yield offered by a taxable fund.

The bonds exempted from tax are usually free of tax from both the federal and state income tax. In such cases, the investor should combine both the state and federal tax rates to calculate tax equivalent yield.

Sometimes the yield in the taxable security of the fund shows the yield figure, which is before the tax is charged. This is unfair and a misrepresentation of the calculation. Investors should be aware of such a process.

Formula

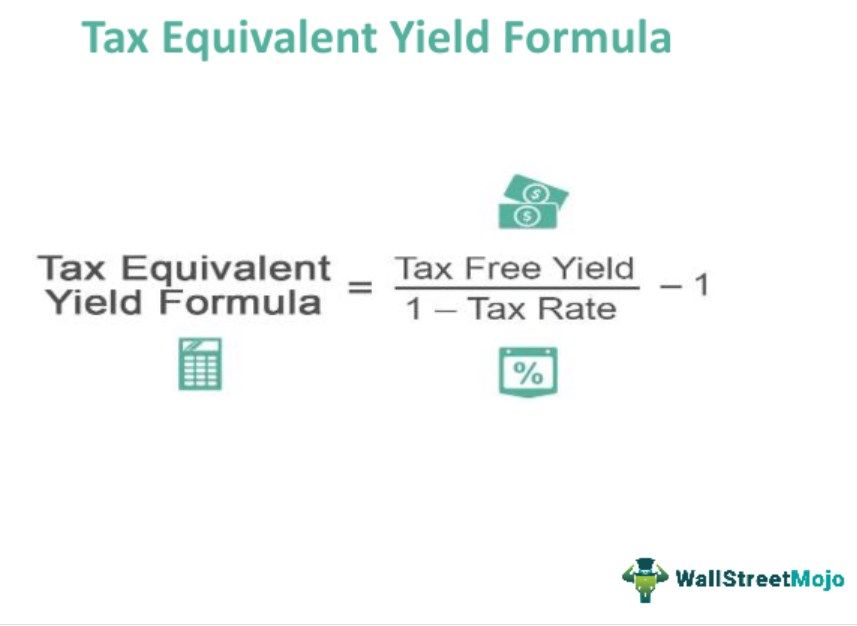

Here’s the formula to calculate tax equivalent yield –

How To Calculate?

As we can see, the formula for tax equivalent yield and the taxed yield. In the formula, there are thus two components.

- The first component is the tax-free yield. To find out the tax-free yield, all we need to do is look at the yield of municipal bonds. The government generally issues these bonds, and we don't need to pay any tax for the return earned from your investment.

- The second component of the formula is (1 – Tax rate). (1 – Tax rate) would help us find out the yield if it is being taxed. We use this in the denominator to find out how beneficial it is to invest in taxed investments.

Examples

Let us look at some examples to understand the concept.

Mrs. Olivia is new in the investment world. She wants to determine whether she should go for taxed or tax-free investments. She finds out that the taxed investments pay 12% on average. On the other hand, tax-free investments pay 8% on average. The prevailing tax rate is 35%. You need to guide Mrs. Olivia by choosing which investment would be more beneficial for her.

By using the formula, we get –

- Tax Equivalent Yield = Tax Free Yield / (1 – Tax Rate)

- Or, Tax Yield = 8% / (1 – 35%)

- Or, Tax Yield = 0.08 / (1 – 0.35)

- Or, Tax Yield = 0.08 / 0.65 = 0.1230 = 12.3%.

From the above calculation, we see that Mrs. Olivia certainly needs to invest in tax-free investments and not taxed investments.

Uses

Investors should use the formula for tax equivalent yield to determine whether it is prudent to pay higher taxes for investing in taxed investments.

Let’s understand this by using a simple example.

Let’s say that Mr. Ramesh has decided to look at both taxed investments and tax-free investments. The idea is to reduce the tax payment as much as he can.

He finds out that the taxed investment offers a 9% yield. And a tax-free investment offers him a 6% yield. And let’s say that the tax rate is 40%.

To find out, he uses the tax yield.

By using the tax equivalent yield equation, he gets –

- Tax Yield = Tax Free Yield / (1 – Tax Rate)

- Or, Tax Yield = 6% / (1 – 40%)

- Or, Tax Yield = 0.06 / (1 – 0.40)

- Or, Tax Yield = 0.06 / 0.60 = 0.1 = 10%.

So, Mr. Ramesh finds out that taxed investment isn’t a good deal, and he should go for tax-free investments.

Formula In Excel (with Excel template)

Let us now do the same example above in Excel.

It is very simple. You need to provide the two inputs of Tax Yield and Tax Rate.

You can easily find out the tax-equivalent in the template provided.