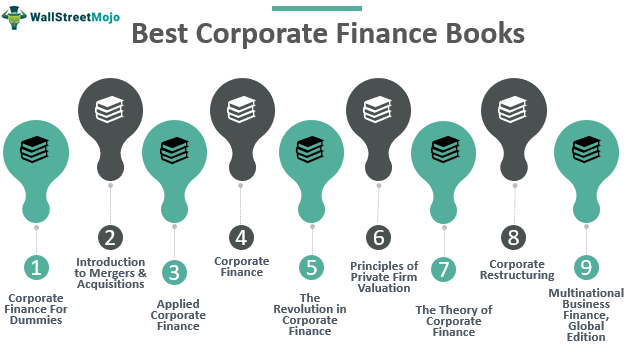

9 Best Corporate Finance Books [2025]

Corporate finance essentially deals with the capital investment and financing decisions of a corporation that have a bearing on the performance growth of the entity. Here we discuss the top 9 Best Books on Corporate Finance to read in 2025.

- Corporate Finance For Dummies (Get this book)

- Introduction to Mergers & Acquisitions (Get this book)

- Applied Corporate Finance (Get this book)

- Corporate Finance (Irwin Series in Finance) (Get this book)

- The Revolution in Corporate Finance (Get this book)

- Principles of Private Firm Valuation (Get this book)

- The Theory of Corporate Finance (Get this book)

- Corporate Restructuring (Get this book)

- Multinational Business Finance, Global Edition (Get this book)

#1 - Corporate Finance For Dummies

Author - Michael Taillard

Book Summary

An excellent introductory Corporate Finance Book that lays the fundamentals of corporate finance for students and beginners. This work systematically elaborates on various aspects of corporate finance, thus helping readers acquire a good grasp of theoretical concepts, followed by useful information on the practical application of these principles. Some of the key topics covered in this work include accounting statements, cash flow, capital management, identifying and mitigating risks, along with a focus on critical areas like mergers and acquisitions (M&As) and valuation. A highly recommended work on corporate finance for those new to the field with a balanced treatment of its various aspects provides a complete overview of the field.

Key Takeaways

It is a commendable introductory textbook on corporate finance that stands apart for its readability, depth of clarity, and highly organized approach to this complex field. It offers useful information, tools, and resources to help understand corporate finance principles and strategies and their practical application—an ideal knowledge resource on corporate finance for lay people and students of the subject.

#2 - Introduction to Mergers & Acquisitions

Author - Kate Creighton, William J. Gole MBA, CPA

Book Summary

A highly useful Book on Corporate Finance M&As which details a complete strategic approach necessary for a corporate acquisition, aimed at minimizing any risks involved in the process and handling unexpected issues arising out of the same. The author focuses specifically on integrating corporate strategy with M&A planning. Keeping in view the significance of mergers and acquisitions, the author offers useful guidance on pre-transaction planning, including insights on key documentation and complex aspects of deal structuring, among other things. Complete work on M&As and their relevance to an overall corporate strategy which can help streamline the entire process to enhance functional efficiency and achieve a higher level of risk management.

Key Takeaways

A highly recommended work on M&A planning and identifying and managing risks effectively associated with corporate acquisitions. The author has dealt at length with the question of developing corporate strategy in such a way as would allow for more efficient handling of mergers and acquisitions, which can play a significant role from the point of view of corporate strategy.

#3 - Applied Corporate Finance

Author - Aswath Damodaran

Book Summary

This corporate finance book is on applying underlying principles in the context of six real-world companies. For the sake of clarity, three types of decision-making are recognized, investment, financing, and dividend decisions depending on the nature and purpose of any specific decision. This structured approach makes it possible for students to grasp the intricacies of practical corporate finance. Still, the text also encourages further study with the help of live cases and concept questions—excellent work for students and professionals willing to develop a detailed practical understanding of corporate decision-making.

Key Takeaways

A highly recommended book for students and professionals to get acquainted with the study of corporate finance through live case studies and real-world examples. Demystifying a complex subject like corporate finance, the author utilizes six real-world companies to explain the decision-making process clearly. The sole focus is to help students apply the fundamentals of corporate finance to study real-time data of corporations and gain an in-depth understanding of how corporate decisions are made.

#4 - Corporate Finance (Irwin Series in Finance)

Author - Stephen A. Ross, Randolph W. Westerfield, Jeffrey F. Jaffe

Book Summary

This best corporate finance book addresses some of the most challenging aspects of the study of corporate finance, including integrating all the complex aspects into a coherent whole. To offer a wider perspective on the subject, this work also includes valuable articles and opinions of leading experts in the field, which helps elucidate certain complex aspects—a commendable book on corporate finance and its application for students and practitioners. The current updated edition offers updated information on critical issues and illustrations of real-world examples and case studies. It comes with supplementary material, including a student CD-ROM, S&P's Card, and Ethics in Finance Powerweb to add value to the readers.

Key Takeaways

Bringing to board the expertise at their command, the authors present an overview of corporate finance, bringing together disparate aspects of the subject to help create a better understanding. Realizing the significance of practical application and the issues involved, this work heavily relies on practical illustrations of real-world examples. It offers some useful supplementary material for students and beginners.

#5 - The Revolution in Corporate Finance

Author - Liza H. Jacobs

Book Summary

This corporate finance textbook deals at length with the ongoing transformation in corporate finance, discussing the latest theoretical advances in the field and how they impact real-world corporate decisions. This updated edition offers a good deal of additional information, enhancing the overall value of the work as a highly accessible academic text for the average reader. It also features two new chapters on International Finance and International Corporate Governance, along with discussing the contribution of Nobel Laureate Merton Miller to finance. A must-have possession for anyone looking to get acquainted with the latest in terms of theory and practice in the field of corporate finance.

Key Takeaways

An advanced text on the latest advances in corporate finance utilizes several scholarly articles from the Bank of America Journal of Applied Corporate Finance for the purpose. What makes this work unique is that despite using visibly academic work, it comes across as a highly accessible work for the readers. In addition, this work also offers useful information on the contribution of Nobel Laureate Merton Miller to the world of finance. A gem of work for students, beginners as well as professionals.

#6 - Principles of Private Firm Valuation

Author - Stanley J. Feldman

Book Summary

The author presents a highly practical exposition on the valuation of private firms, which combines a purely academic approach with a practical one. This work deals with several complex aspects of firm valuation, including how firms create value and ways to measure it with a great deal of transparency. Some of the issues discussed include valuing control, determining transaction value and valuation implications of FASB 141 (purchase price accounting) and FASB 142 (goodwill impairment). Dealing with wide-ranging legal and technical issues related to valuation and deal structure makes this immensely useful work for professionals who have more or less of an advisory role to play in the valuation of private firms.

Key Takeaways

An excellent corporate finance book on firm valuation and deal structuring deals with the intricacies of valuation, including what constitutes value and how it is measured. Several topical issues are discussed in work, focusing on technical and legal issues to bring in greater transparency in the process—a must-read for financial practitioners who need to deal with the issue of valuation in any form whatsoever.

#7 - The Theory of Corporate Finance

Author - Jean Tirole

Book Summary

It is nothing less than an excellent book on modern corporate finance theory, which combines aspects of this complex field with his highly organized approach and accessible language. Building his work around the incentive or contract theory approach, he addresses corporate governance and auditing reforms, the role of private equity, financial markets, and corporate mergers and acquisitions, among other things. He offers a comprehensive view of corporate finance in a way that makes it possible to judge its impact in both micro and macroeconomic contexts, applying advanced concepts without losing sight of the fundamentals. A highly recommended read for students as well as practitioners of corporate finance.

Key Takeaways

An advanced book on corporate finance theory dwells deeper into the complexities of this field than most other works while retaining its accessibility for the average reader. One of the rare works that make it possible to study broader policy issues related to corporate finance and have more of an immediate impact. A perfect read for those who would want to pick up the finer threads of corporate finance theory without losing track of the reality.

#8 - Corporate Restructuring

Author - Bryan de Caires

Book Summary

This best corporate finance book deals with the complex question of corporate restructuring, which involves a wide range of factors and impacts corporations in a big way. Intense market competition and the need for corporations to readjust their position more often has made restructuring a much more common phenomenon today. The author deals with various forms of corporate readjustments, including leveraged buy-outs, buy-ins, mergers, and acquisitions, along with refinancing, which is usually adopted for the purpose. In this highly dynamic marketplace, it has become increasingly difficult for corporations to make the right choices for restructuring despite the availability of varied options. This work is intended to fill this gap and make for an ideal companion for students and financial professionals.

Key Takeaways

An evolved corporate finance book focused on corporate restructuring and how corporations can make the right kind of decisions to achieve desired results in this direction. The author deals with the corporate deals of buy-outs, buy-ins along with M&As and other forms of restructuring activity which forms the bulk of these activities. A classic work on restructuring meant for students and professionals in the field who need to deal with the issue of restructuring in one form or another.

#9 - Multinational Business Finance, Global Edition

Author - David K. Eiteman, Arthur I. Stonehill, Michael H. Moffett

Book Summary

A comprehensive overview of international finance offers useful insights into enterprise decision-making for managers and business leaders in general. The entire focus of expert authors is towards helping managers prepare to face the challenges of operating big corporations in a highly dynamic and constantly evolving marketplace. To help readers gain a practical understanding of the issues faced in decision-making, real-world cases are presented throughout the work. A brilliant read for students, professionals, and business leaders to understand the intricacies of multinational corporate finance.

Key Takeaways

Authored by experts in the field, this work offers a unique understanding of decision-making and problem-solving in international corporate finance. Several real-world cases are presented for readers to apply the principles enumerated. An ideal read for students, professionals, and business managers to acquire a detailed understanding of international corporate finance.

Amazon Associate Disclosure

WallStreetMojo is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to amazon.com.