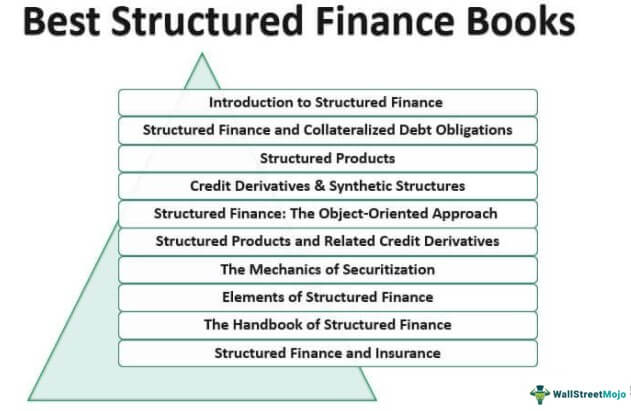

List of Top 10 Best Structured Finance Books [2025]

Structured finance has acquired a newfound significance in the post-subprime era. It has also undergone fundamental changes with wider implications in the emerging global economic scenario. Below is the list of the top 10 structured finance books:

- Introduction to Structured Finance ( Get this book )

- Structured Finance and Collateralized Debt Obligations ( Get this book )

- Structured Products ( Get this book )

- Credit Derivatives & Synthetic Structures ( Get this book )

- Structured Finance: The Object-Oriented Approach (The Wiley Finance Series) ( Get this book )

- Structured Products and Related Credit Derivatives ( Get this book )

- The Mechanics of Securitization: A Practical Guide to Structuring and Closing Asset-Backed Security Transactions ( Get this book )

- Elements of Structured Finance ( Get this book )

- The Handbook of Structured Finance ( Get this book )

- Structured Finance and Insurance ( Get this book )

Let us discuss each structured finance book in detail, along with its key takeaways and reviews.

#1 - Introduction to Structured Finance

by Frank J. Fabozzi (Author), Henry A. Davis (Author), Moorad Choudhry (Author)

Structured Finance Books Review

An excellent top structured finance book that can help understand what kind of financial transactions constitute structured finance and what lies outside its ambit. Usually, securitization, derivatives, special purpose vehicles (SPV), and project finance are when we speak of structured finance. However, this structured finance book deepens the understanding of structured finance, defined as non-traditional financing, which can cover a much wider range of complex financing techniques. It also helps discover the growing significance of structured finance in modern financial markets by helping carry out transactions to meet the specific needs of a financial entity or corporation. Those new to the subject would find it a highly informative exposition that details several aspects of the field.

Key Takeaway from this Best Structured Finance Book

An easy-to-understand introduction to structured finance, which goes beyond the usual approaches to present a much more evolved definition of the field as a whole. Apart from helping understand securitization, credit derivatives, and other specially structured financial transactions, this best-structured finance book also highlights the increasingly significant role of tailor-made financing in future financial markets.

#2 - Structured Finance and Collateralized Debt Obligations:

by Janet M. Tavakoli (Author)

Structured Finance Books Review

This best-structured finance book of practical value on structured finance primarily focuses on Collateralized Debt Obligations (CDO) and outlines an effective approach for the valuation of structured credit products. Some of the important securitization-related concepts discussed in this work include cash versus synthetic arbitrage CDOs, changes brought about by CDSs on Asset-Backed-Securities (ABS), subprime, Alt-A securitizations, synthetic indexes, and the emerging role of hedge funds, among other things. The author also highlights the issue of possible fraud with today’s structured credit products due to their uniquely complex composition and discusses the issues related to the valuation and estimation of risk returns for investments made in CDOs and synthetic CDOs. Professionals in the field have a great deal to learn from this best-structured finance book, including how one might address issues with current structured credit products and develop more nuanced structured products in the future.

Key Takeaway from this Top Structured Finance Book

A highly useful best-structured finance book focuses on the valuation of structured credit products, including CDOs and synthetic CDOs, along with other related issues. The author also addresses the issue of possible fraud with the kind of structured products in vogue these days and covers several other important topics, including CDSs on ABS, subprime, and Alt-A securitization. A recommended work for structured finance professionals to better understand the issues related to valuation and risk returns associated with structured credit products.

#3 - Structured Products

A Complete Toolkit to Face Changing Financial Markets (The Wiley Finance Series)

by Roberto Knop (Author)

Structured Finance Books Review

An exposition of several derivative products which have changed the face of financial markets in the last decade. The author discusses the valuation, risk assessment, and key elements of the main structured products covered in this top structured finance book and explains their underlying concepts. Apart from dealing with instrument assessment and risk measurement for structured products, the author goes ahead to explain equity-indexed and fixed-income structures to help enhance an overall understanding of the subject. Finally, to help institutional investors make the most of these products in modern markets, the author also offers ten golden rules of structured products to help them achieve desired results.

Key Takeaway from this Best Structured Finance Book

This top-structured finance book aims at helping acquire a broad-based understanding of how top-structured products work and addresses the issues of valuation, risk assessment, and special features associated with some of them. The fundamental idea is to help institutional investors gain a practical understanding of some structured products, which would help them make more informed decisions. A highly recommended read for institutional investors as well as finance professionals.

#4 - Credit Derivatives & Synthetic Structures

A Guide to Instruments and Applications

by Janet M. Tavakoli (Author)

Structured Finance Books Review

A highly acclaimed book on credit derivatives that seeks to create an understanding of these complex financial instruments and their real-world applications. The author clarifies several misconceptions about credit derivatives and explains how one can use them strategically to manage risk. This structured finance book lucidly explains the structure and application of credit derivative products Using charts, graphs, and investment basics. An ideal read for banking professionals and anyone dealing in credit derivatives.

Key Takeaway from this Top Structured Finance Book

A practical and easy-to-understand guide on credit derivatives dispels several myths about these financial instruments. The author does an excellent job of making this complex topic highly accessible to the average reader and helps understand how credit derivatives serve as an excellent tool to manage risk. This a recommended read for anyone interested in understanding practical concepts and applications related to credit derivatives.

#5 - Structured Finance: The Object-Oriented Approach (The Wiley Finance Series)

by Umberto Cherubini (Author), Giovanni Della Lunga (Author)

Structured Finance Books Review

This top-structured finance book represents an unusual attempt to bridge the communication gap between IT and financial professionals by utilizing a unique object-oriented approach. The authors describe the derivatives as a collection of objects as part of the replicating portfolios theory and link it with the IT concept of object-oriented programming (OOP) to help IT professionals garner a better understanding of relevant financial concepts to understand structured products better. This book aims at helping facilitate the development of streamlined financial and risk management software for structured financial products. The authors have provided a consistent object-oriented programming framework for IT professionals developing software tools for structured products. This a highly recommended read for IT and finance professionals dealing with this difficult class of derivatives.

Key Takeaway from this Best Structured Finance Book

A work of its kind intended to provide a common language and framework for finance and IT people to help develop better software tools for structured financial products. The authors have made a rather original attempt to link these two disparate fields by providing a broader common framework for defining objects in both domains, which one can then use for developing consistent data structures for these complex derivative products. A must-read for IT professionals aspiring to work with any software tool for structured products.

#7 - The Mechanics of Securitization: A Practical Guide to Structuring and Closing Asset-Backed Security Transactions

by Moorad Choudhry (Author), Suleman Baig (Author)

Structured Finance Books Review

A complete step-by-step guide for professionals on structuring and closing asset-backed security transactions details how the 2008 credit crisis has impacted and shaped the securitization of assets on the whole. This work describes how banks structure a deal methodically and implement it, along with a discussion of rating agency reviews, legal requirements, liaising with third parties, and securing investors. In short, this work offers a detailed insider’s view of how banks and financial institutions go about securitization, including all the essential aspects of this complex process. A recommended read for financial professionals who might have to deal with securitization.

Key Takeaway from this Best Structured Finance Book

A highly useful guide on asset-backed securitization in the post-subprime era. This best-structured finance book intends to create a complete understanding of this process, along with a discussion of rating agency reviews, due diligence, and other aspects. It also helps understand how the securitization market has changed in the post-subprime era. A must-read for professionals dealing in structured finance.

#8 - Elements of Structured Finance

by Ann Rutledge (Author), Sylvain Raynes (Author)

Structured Finance Books Review

This top structured finance book on the fundamentals of structured finance by expert authors in the field. Often investors find structured products rather confusing and need to learn more about how to make the best use of them. In this volume, authors have made a concerted effort to present the basics of structured finance and securitization for an average investor to enable them to understand how structured products work. It explains in easy-to-understand language how structured finance is all about tailoring certain products to specific financing needs for large pools of assets, taking into account several relevant factors like investor risk, asset class, and specific needs of issuers and investors. A recommended read for structured financial analysts, asset management companies, and a wide variety of institutional investors.

Key Takeaway from this Top Structured Finance Book

This is an excellent introduction that can help any investor acquire an understanding of structured products and securitization and what purpose they serve. The beauty of this top structured finance book lies in the fact that its treatment of the subject cannot only help those new to the field but can also work as an excellent source of reference for professionals dealing in structured finance due to its rare level of clarity for such a complex topic. A prized possession for institutional investors and finance professionals.

#9 - The Handbook of Structured Finance

by Arnaud de Servigny (Author), Norbert Jobst (Author)

Structured Finance Books Review

A complete introductory guide to structured finance helps understand most of the issues facing the modern investor and addresses them with the help of powerful models. The author makes this complex subject highly accessible to the reader and explains several useful techniques for investors to identify, measure, price, and monitor deals efficiently. This top structured finance book offers the building bricks of structured finance for investors and explains the fundamentals of the field, opening up a new world of possibilities for investors.

Key Takeaway from this Best Structured Finance Book

A commendable guide on structured finance for investors offers several useful approaches, tools, and techniques to address major issues faced by them. In addition, the author also discusses some useful debt and equity modeling concepts, which can help immensely while dealing with structured products. A must-have for anyone new to structured finance and willing to make the most of available tools and techniques.

#10 - Structured Finance and Insurance:

The ART of Managing Capital and Risk

by Christopher L. Culp (Author)

Structured Finance Books Review

It is an excellent treatise on the increasingly significant role of structured finance in devising customized insurance products for modern corporations. The author beautifully explains the concept of Alternative Risk Transfer (ART), which is integral to creating structured insurance solutions that can serve the specific needs of corporations. The readers can understand how it can help manage capital and risk simultaneously, thus helping create greater value. However, due to the complexity of this concept, there is always an inherent risk of inefficient structuring, which can create a novel set of problems to deal with. This classic structured finance book provides the much-needed clarity of concepts and their practical applications for finance professionals to help avoid such a situation.

Key Takeaway from this Top Structured Finance Book

A complete guide on structured insurance products with a detailed explanation of alternative risk transfer (ART) for finance professionals. Modern corporations face a much higher level of competition and risks that must be managed efficiently. Alternative risk transfer helps in this process, which lets the corporation know which risks to manage and which ones to keep to create greater value. However, the author also warns of the inherent dangers of devising these products, which can lead to further confusion and loopholes if due care is not taken.