Following are the points that explain the differences between treasury specialists and treasury analysts. Let us look at them in brief:

Table of Contents

What Is A Treasury Specialist?

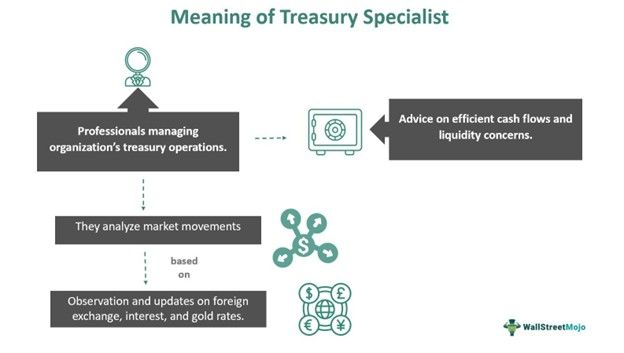

Treasury Specialist refers to the financial professional overseeing the daily cash flow activities and other financial activities of the organization. They are a part of the treasury department, and their primary function is to provide advice related to liquidity matters and ensure compliance in financial dealings that take place.

There are different hierarchies in this position, including junior and senior treasury specialists. They provide their expert advice in managing financial instruments well and investing in the same while keeping a close watch on the company's performance and evolving market trends. As a result, they play a vital role in keeping the firm's financial health in place.

Key Takeaways

- A treasury specialist is a finance professional who provides expertise in treasury operations and managing the organization's daily cash flows.

- They aim to maintain liquidity, financial stability, and firm health. It provides guidance on financial matters and cash management issues.

- The salary of a specialist ranges between $47,426 and $470,875 per year. However, the average median is $104,669 per annum.

- To obtain this job role, they must have a minimum of eight years of experience in the treasury department. Also, knowing financial and IT system modeling is a must.

What Does A Treasury Specialist Do?

A treasury specialist is a finance person working in the treasury department to provide expert advice in financial matters. They are mostly concerned with cash management and liquidity. In short, they ensure that the cash flows happen smoothly and there is no contingent risk arising all of a sudden. Also, if it occurs, they shoulder the responsibility to guide it to solutions. In addition, treasury specialists look after the organization's funding programs.

To be more precise, these specialists keep on analyzing and assessing the foreign exchange rates along with the interest rates and prices of gold so that their advice is reliable and fruitful for the clients.

In the Treasury department, the senior treasury specialist acts as an apex of the team. They provide extensive knowledge and expertise in treasury management and financial analysis. Moreover, they also lead the treasury team in their daily tasks and duties. They make significant decisions involving investment and finance. In contrast, the junior treasury specialist has limited power over the decision-making process. They assist the senior team members with routine tasks and conduct fundamental financial analysis with strategy implementation.

Some of the skills required in treasury specialist jobs include problem-solving, financial and accounting knowledge, communication, collaboration, handling treasury management systems, and ethical awareness of compliances and regulations. Also, they must develop procedures for preventing money laundering cases within the organization.

Job Description

Let us look at the essentials based on which the criteria in a treasury specialist resume are matched:

#1 - Education

One of the foremost things that one looks for in a treasury specialist resume is a bachelor's degree in finance or accounting. However, anyone aspiring to join this team should also hold an equivalent degree in computer science, finance, accounting, economics, or a similar field. In addition, it is vital to complete post-graduation (master's degree) in the areas mentioned above. Furthermore, aspirants can take additional courses in treasury and risk management, corporate finance, and financial analysis.

Moreover, earning certifications like Certified Cash Manager (CCM), Certified Treasury Professional (CTP), and Association of Corporate Treasurers (ACT) is also crucial.

#2 - Roles And Responsibilities

Following are the roles and duties involved in this job. Let us look at them:

- Involving in daily cash management to ensure adequate funds for meeting the operational needs of the organization.

- Cooperating and coordinating with banks for credit facilities. It also includes negotiating with them over bank statements and compliance with loan covenants.

- Reviewing short-term borrowings and investments, thereby creating an optimal portfolio for maximum returns.

- Implementing treasury policies and developing cost-reduction strategies regarding bank fees and associated costs.

- Managing the organization's foreign exchange reserves to minimize financial risk. Likewise, they must also lead the treasury projects and give meaningful insights as input.

#3 - Experience

In most cases, firms and agencies prefer a minimum experience of five to eight years in the treasury field. Also, they must have equal knowledge of creating financial models and software applications. In addition, such candidates should know IT system modeling skills in C++, Python, and similar programming languages. They must also have strong interpersonal and relationship management skills.

Salary

The salary of such specialists varies across locations and organizations. Some reports suggest that the average salary in the United States is $104,669 per year. However, the actual range is between $47,426 and $470,875 on a yearly basis. A similar report by Comparably states that the highest salary is offered in San Jose, CA (California). And this range is higher than almost 97% of the specialists working in the US. It is around $206,657 compared to other states.

In addition to the salary offered, they also receive complementary benefits like health insurance, retirement plans, professional development opportunities, and much more.

Treasury Specialist vs. Treasury Analyst

| Basis | Treasury Specialist | Treasury Analyst |

|---|---|---|

| 1. Meaning | It refers to a professional overseeing and managing the cash operations of the organization. | A treasury analyst is responsible for managing the employer's (organization's) financial activity. |

| 2. Responsibilities And Duties | They manage the treasury operations and cash flows and ensure liquidity stays. | They prepare treasury reports, presentations and support teams in treasury operations. |

| 3. Qualifications | Aspirants must have a degree in finance, computer science, accounting, financial engineering, or similar fields. | Bachelor’s degree in accounting, finance, or economics field. |

| 4. Salary | Their median salary is $104,669 yearly. | According to the reports, their average median salary is $66,139 per year. |