Can Generative AI Really Replace Analysts? Here’s the Truth

Table of Contents

Introduction

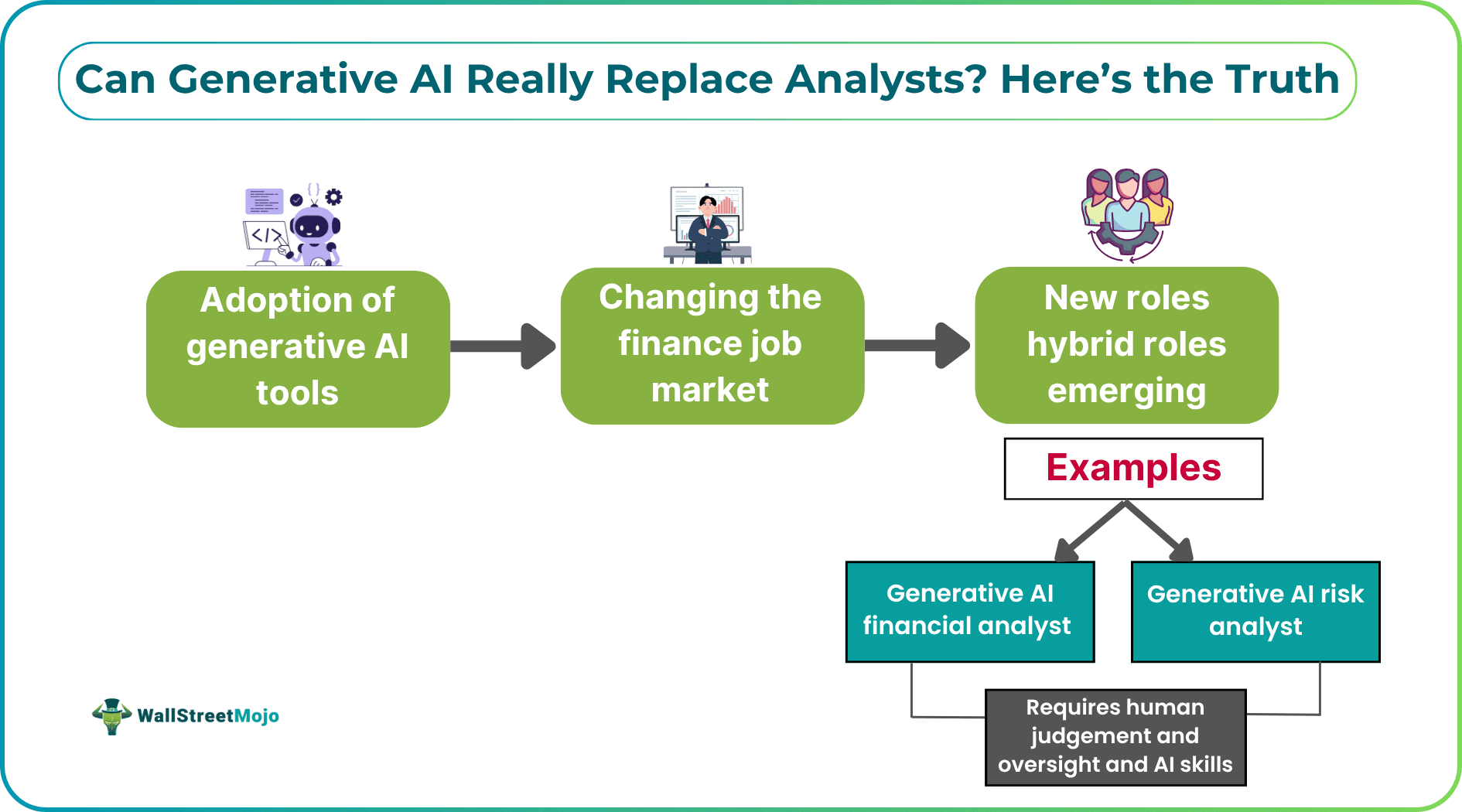

Artificial intelligence has been changing the shape of the job market across different industries, including finance. Analysts employed by different organizations, like private equity firms, investment banks, and hedge funds, are using generative AI or GenAI tools to perform various tasks, including research, analysis, financial reporting, and financial modeling & valuation using AI. The growing adoption of such solutions is increasing their efficiency and productivity, which in turn is impacting the organization’s revenue positively.

Nevertheless, the use of AI-powered tools has students, freshers, and even experienced financial analysts worried. They have the fear that the generative AI tools will soon replace them. But, is that true? As explained clearly in the Generative AI for Beginners Course. AI will not replace you. Instead, it will be leveraged by humans to boost efficiency and the overall performance. This increasing adoption will lead to the introduction of new roles like generative AI financial analysts.

If you are looking to develop a clear understanding of the transformation driven by generative AI in finance, you are in the right place. This article will provide you with an example to help you comprehend what the future of financial analysis will look like.

Before we take a look at the example, let us compare the myths and the reality concerning GenAI in finance.

Myth vs. Reality

The table will help clear the common misconceptions people have about the use of GenAI for financial analysis.

| Myth | Reality |

|---|---|

| GenAI tools will replace humans entirely for all tasks. | The tools cannot replace humans. People who can work with AI tools, like generative AI financial analysts, will replace individuals who don’t. |

| There is no need to validate AI-generated information, statistics, and analysis. | Humans must verify information, analysis, and statistics generated by GenAI tools. Remember, AI has the capability to accelerate research, but the technology cannot replace it. |

| People must have coding knowledge to be able to leverage the generative AI tools. | Even aspiring analysts with zero coding knowledge can learn how to use GenAI tools for certain tasks through programs like the Generative AI for Beginners Course. |

| Generative artificial intelligence tools do not require any human input. | The GenAI system requires human intelligence for rectification and data or information verification. Moreover, human oversight is necessary to ensure ethical use of the tools. |

| Creating a financial model & valuation using chatGPT does not require any human involvement. | Human judgment is vital for carrying out the entire process with accuracy. |

From the above table, we hope it is clear that there is no debate of AI vs human analysts in reality. Humans who can use AI effectively for financial analysis will be the ones to replace people who choose not to upskill in AI through programs like the Generative AI for Beginners Course.

Human + AI Workflow Example

In this section, let us take a look at an example to understand how financial analysts can integrate AI into generative AI financial analysis tasks.

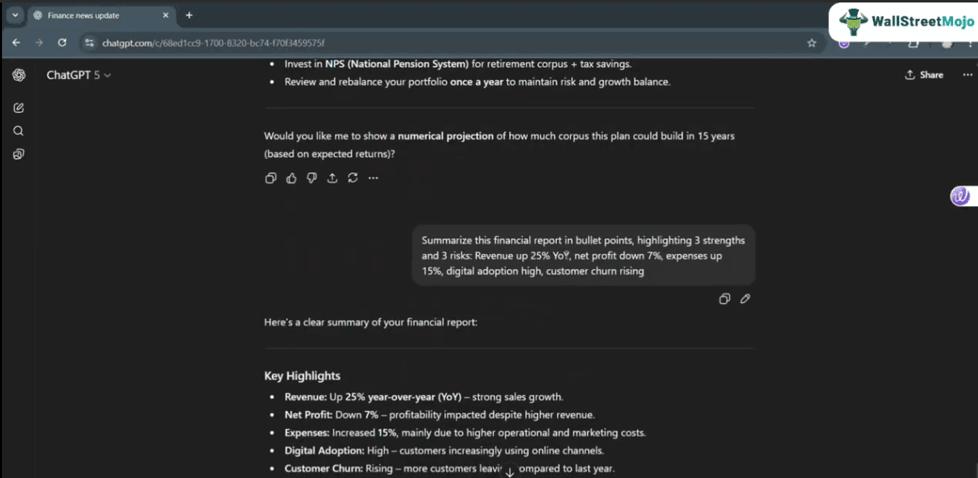

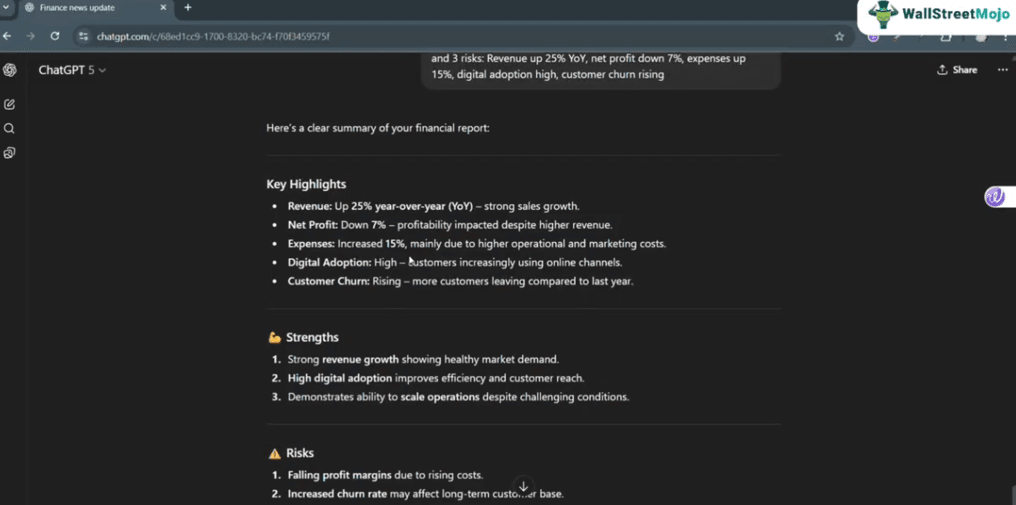

Image Source: Generative AI for Beginners Course

Image Source: Generative AI for Beginners Course

The above images show how it is possible for analysts to summarize key details concerning financial performance within seconds by crafting an effective prompt. One can give instructions to the tool as to how they want the information presented. For example, in this case, the trainer instructed the tool to present the summary in bullet points.

We hope that now you have a basic idea of how a generative AI financial analyst can integrate AI into their workflow and improve productivity. In this way, professionals can create prompts and perform different tasks, like research and analysis, faster.

Real Limits of GenAI in Finance

Let us look at some key limitations of generative AI in finance that financial analysts must keep in mind.

- GenAI tools can hallucinate. This can result in the generation of incorrect information. In such cases, analysts cannot rely on the output for making decisions. So, experts recommend verifying the output before using it.

- If individuals end up uploading any confidential data into unsecured AI-powered tools, there are concerns regarding data security and privacy. Indeed, if sensitive data falls into the wrong hands, it can result in serious losses. Moreover, the company may experience reputational damage.

- Generative AI financial analysts must keep in mind that these tools often utilize outdated data to generate output. Since such tools may not have access to real-time data, analysts may have to provide the information themselves to get the desired output.

- AI models lack real-world understanding, which is why one cannot rely on them fully for analysis. This is a key area where human oversight or judgment is necessary.

- Lastly, one must keep in mind that regulatory frameworks with regard to generative AI in finance will evolve in the future, as government-imposed changes are expected to take place. Hence, there’s still a lot of uncertainty concerning GenAI in finance that future analysts need to consider.

The Future Analyst Profile

Artificial intelligence is driving the evolution of analysts’ workflows. Considering that, the most sought-after analysts in the future will be those who can combine traditional financial skills with GenAI skills and engage in responsible AI practices. Indeed, aspiring and experienced analysts will need to upskill in AI so that they know how to leverage the technology to improve their productivity and efficiency if they wish to compete in the changing job market.

Indeed, future analysts will no longer have the role of just crunching numbers. They will require the AI-related knowledge and skills that allow them to make strategic decisions that benefit the company.

Given below are examples of the skills and knowledge they need to become a successful generative AI financial analyst:

- Prompt engineering

- Conducting responsible AI practices

- Using AI to summarize financial information and create presentations

- Accelerating research and fundamental analysis using chatGPT

- Carrying out effective risk management with generative AI tools, etc.

Conclusion

Now that you have reached the end of the article, we hope that you now have a clear idea regarding the AI impact on finance careers. So, AI cannot serve as a replacement for financial analysts. Instead, the integration of the technology into operations will result in the emergence of hybrid roles, as noted above. Examples of such roles may include generative AI financial analysts and generative AI risk analysts.

So, considering the current landscape concerning the job market within the finance space, it makes perfect sense to develop relevant AI skills through the Generative AI for Beginners Course. Upon completing the program, you will obtain a certificate that demonstrates your proficiency in using GenAI tools. This certificate can play a key role in helping you get shortlisted. Moreover, the knowledge and expertise you gain through the course can provide you with the confidence needed to crack interviews.