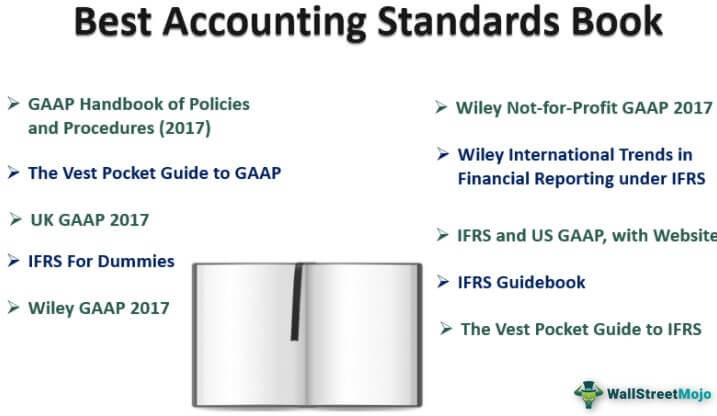

Top 10 Accounting Standards Books [2025]

If you need to use accounting regularly in any profession, it's important to know accounting standards. The best way to learn the detailed specifications of accounting standards is to pick up a few latest books and dive in. Below is the list of such books on accounting standards-

- Wiley GAAP 2021 – Interpretation and Application of Generally Accepted Accounting Principles ( Get this book )

- UK GAAP 2019: Generally Accepted Accounting Practice under UK and Irish GAAP ( Get this book )

- GAAP Handbook of Policies and Procedures (2021) ( Get this book )

- The Vest Pocket Guide to GAAP ( Get this book )

- Wiley Not-for-Profit GAAP 2020: Interpretation and Application of Generally Accepted Accounting Principles ( Get this book )

- IFRS Guidebook: 2021 Edition ( Get this book )

- IFRS For Dummies ( Get this book )

- The Vest Pocket Guide to IFRS ( Get this book )

- IFRS and US GAAP, with Website: A Comprehensive Comparison ( Get this book )

- Wiley International Trends in Financial Reporting under IFRS: Including Comparisons with US GAAP, China GAAP, and India Accounting Standards ( Get this book )

Let us discuss each accounting standards book in detail, along with its key takeaways and reviews.

#1 - Wiley GAAP 2025 – Interpretation and Application of Generally Accepted Accounting Principles

by Joanne M. Flood

Grab this updated version of GAAP if you want to master the accounting standards.

Book Review:

As accounting professionals, you must have this book. It is a mammoth accounting standards book that you won’t be able to put down. The readers who have purchased and read this book have remarked that it's the only book on GAAP you should read. Moreover, it’s the updated version. And you will not only learn about accounting standards offered by FASB (Financial Accounting Standards Board); you will also know how to apply them in real professional settings. Whenever you are unclear about any business combinations, leases, financial instruments,and more than 17 new FASB Accounting Standards Updates.

- You will also receive a detailed index for easy reference.

Grasping GAAP is essential for anyone looking to excel in accounting. For those who want to take their learning to the next level, this Basic Accounting Certification Course is designed to build on this foundation and enhance their expertise. It shows financial statements created in adherence to GAAP, thus helping learners to develop a practical understanding.

#2 - UK GAAP 2019: Generally Accepted Accounting Practice under UK and Irish GAAP

by Earnst & Young LLP

This accounting standards book is widely applicable if you work/would like to work in the UK.

Book Review:

The GAAP in the UK is completely different from the US GAAP. In the US, GAAP stands for Generally Accepted Accounting Principles; but it is Generally Accepted Accounting Practices in the UK. And UK GAAP doesn’t only define accounting standards in the UK, but it also includes UK Company Law. This book is particularly useful if you want to work in accounting/finance in the UK or are already working in the UK. UK GAAP has been in effect for the last two years, and this book contains all that you need to know about UK GAAP. Since this is a new concept altogether, it will take some time to gain popularity. But if you read this huge book or keep it as a reference, it will help you solve any issue you might have during any deal or need an update on correcting the information. This book is fully updated and will serve all accounting professionals worldwide.

Key Takeaway

- The length of this best accounting standards book is 1952 pages. You can understand how comprehensive this book can be. It includes the scope of UK GAAP, concepts, presentations of financial statements, accounting policies, estimates, and errors.

- You will also learn about agriculture, retirement benefit plans, public benefit entities, heritage assets, foreign currency transactions, share-based payments, leases, investments in joint venture, intangible assets, and so on and so forth.

#3 - GAAP Handbook of Policies and Procedures (2021)

by Joel G. Siegel, Marc H. Levine, Anique A. Qureshi, and Jae K. Shim

This book is much different in scope, and the book is useful to all accounting professionals.

Book Review:

Reading a book that is 1800+ pages long is a gigantic task. But what if you can read it, refer to it, go back to it again and again, and then read some more whenever you have some spare time? Then the book becomes your ally. This guide book is similar in nature. Accounting professionals in the world should pick this book up and read, refer, and go back to it again and again. This accounting standard book can also be used as a training manual for CPAs. It’s duly updated and includes all the rules and policies you need to know as accounting professionals. This book should be kept at the desk of the accounting department, and whenever someone feels the need to clear their doubts about GAAP can check the book out.

Key Takeaway

- The first thing about this best accounting standards book is comprehensiveness. It includes every thumb of rules, every accounting standard (updated ones as well), plus solutions for problems accountants face every day. It's not easy to pull through one or two takeaways when the full book consists of many takeaways.

- It also includes accounting principles, required and recommended disclosures, specialized accounting topics, tables, examples, practice tools, and financial reporting presentation requirements.

#4 - The Vest Pocket Guide to GAAP

by Steven M. Bragg

This book is a great book to keep as an accounting student.

Book Review:

If you read one comprehensive guide on GAAP, read this book. Yes, it’s not updated, and it doesn’t include the latest changes in GAAP. But keep this book as fundamentals of accounting standards and read the updates from any of the above books we mentioned. Now, why is this book very useful? First of all, this book is very well structured. And secondly, it's very easy to read and refer to. As an accountant, it’s not easy to remember all GAAP rules. The solution is to keep this book with you always and refer to it whenever you doubt anything. As accounting students and professionals, this book will always remain handy for all your accounting needs and tax purposes.

Key Takeaway

- This best accounting standards book is helpful for people who are beginners and also for people who are professionals. This book shows all the transactions (even the simpler ones).

- This book is very well structured, and as a result, you can refer to it easily. Plus, you would be able to go through many real-life examples as well.

- You will learn about journal entries, calculations, flowcharts, footnotes, disclosures, and examples.

#5 - Wiley Not-for-Profit GAAP 2020: Interpretation and Application of Generally Accepted Accounting Principles

by Richard F. Larkin, Marie DiTommaso and Warren Ruppel

This guide is yet to be released, but if you run a non-profit, this is a great book for reference.

Book Review:

As you can see, this book is yet to be released, but the pre-order has already started. And this book stands in 12th position in the best seller rank in accounting standards as we're writing this. This top accounting standards book is short compared to its other counterparts. It is only 576 pages long as it is only focused on not-for-profit. If you work in a non-profit as an accountant, this book would be your ultimate guide to making any crucial decision. If you are running a not-for-profit, there can be a thousand things that can bother you about what rules and regulations to follow. This book will aid you and assist you in making the right decisions.

Key Takeaway

- First, you will get these four things –

- You will learn about any latest changes in GAAP, specifically relevant for non-profit organizations.

- You would find checklists using which you can check the disclosures of GAAP requirements.

- You will get a reference book to guide in measurement, disclosure, and presentation.

- You will also be able to take help through charts, tables, and flowcharts and make quick decisions.

- This guide also includes accounting research bulletins, FASB’s accounting standards codification, AICPA statements of positions, and FASB's emerging issues task force statements relevant to non-profit organizations.

#6 - IFRS Guidebook: 2021 Edition

by Steven M. Bragg

This will ease up your time in understand IFRS in detail.

Accounting Standards Book Review:

IFRS (International Financial Reporting Standards) is a set of accounting standards set by an independent, non-profit body called the IASB (International Accounting Standards Board). Normally, IFRS documents are thousands and thousands of pages, making things difficult for accounting professionals. That’s why this nifty little book will help solve the problem. It has all the accounting standards you require under IFRS, and it is just 450 pages. As accounting professionals, you can refer to it whenever you need to. Moreover, if you plan to become an accounting professional, this volume will become an invaluable resource for you.

Key Takeaway from this Top Accounting Standards Book

- Convenience is the major takeaway. You will get all the required information in under 450 pages (over 1000+ pages).

- This top accounting standards book includes each accounting topic, how you should disclose accounting information, and if you ever need to look for additional information, where to look in the IFRS document source.

- This volume also includes practical examples that will help you understand real-world situations and how to use journal entries.

#7 - IFRS For Dummies

by Steven Collings

If you want to build your concept regarding IFRS, this is the perfect book for you.

Accounting Standards Book Review:

This book is not updated, but this book will give you clarity and an understanding of what IFRS means. You will learn more than you think – you will get to know the breakdown of IFRS, how IFRS affects financial statements, and a method for finding solutions to difficult problems. Of course, this book wouldn’t suffice in terms of the latest updates, but if you just read this book on IFRS, you will get a good grip on the IFRS. Moreover, if you are trying to understand IFRS for the first time, you should start with this dummies guide. This book is arranged so that if you read it section by section, you will be able to gain maximum benefit from it.

Key Takeaway from this Best Accounting Standards Book

- No matter what you are, a professional accountant, a student, or a trainee, this is the perfect start for you in IFRS.

- You will learn why IFRS was created, the application of IFRS, how to prepare IFRS financial statements, what mistakes to avoid while reporting, and how to disclose them.

- This best accounting standards book is pretty easy to go through. Written in lucid language, this book would be a perfect learning tool for every accounting enthusiast.

#8 - The Vest Pocket Guide to IFRS

by Steven M. Bragg

It is a quick guide to getting a grip on IFRS.

Accounting Standards Book Review:

This book is an essential guide for learning IFRS. It’s not updated, but you can check the latest book to know the updates. This best accounting standards book is for those who want a comprehensive understanding of IFRS. As accounting professionals, you may need to go through many transactions, and you find difficulty entering the complex ones. But this book will help you. This book is written in a "question and answer" format and is perfect for quick reference. You can look at the book, open up the section, and then look for the right treatment in the book. In a nutshell, this book is an essential guide for all accounting professionals.

Key Takeaway from this Top Accounting Standards Book

- You will be able to learn all International Financial Reporting Standards (IFRS) (except the recent changes) with brief explanations and hundreds of respective examples.

- You will also be able to use this as a reference guide for thresholds for segment reporting, recognizing intangible assets, restating financial results in hyperinflation examples, and so on and so forth.

- It is a must-have for busy accounting professionals who would be able to quickly go through this book to find out the required solution.

#9 - IFRS and US GAAP, with Website: A Comprehensive Comparison

by Steven E. Shamrock

This book will show you how to look at IFRS and GAAP from the right perspectives.

Book Review:

You work in an organization that follows IFRS in reporting the financials. And now, you’re tasked with doing two (GAAP and IFRS) simultaneously. How would you do it? Just grab this book, and everything will become easy for you. Even if it’s a little expensive, this book will help you understand how to implement both GAAP and IFRS in real-world situations and how to understand the difference between them. In a nifty little 213 pages, this book will show you how to report fixed assets, revenue recognition, capital leases, etc. If you’re a student preparing for a bachelor's/master's degree in accounting, this book will help you rationally understand both IFRS and GAAP. The only pitfall of this book is that it misses out on tables that readers mentioned could have been a great addition to this book, but this book has a great companion website through which you can access many resources.

Also, check out the difference between IFRS vs US GAAP

Key Takeaway

- This top accounting standards book points out the differences between IFRS and GAAP in areas such as – inventory, provisions & contingencies, intangible assets, financial instruments, leases, revenue, and so on.

- This book has emphasized examples to explain both IFRS and GAAP. This book also has a companion website through which you can download a lot of spreadsheets and templates.

#10 - Wiley International Trends in Financial Reporting under IFRS

Including Comparisons with US GAAP, China GAAP, and India Accounting Standards

by Abbas A. Mirza and Nandakumar Ankarath

This book is a gem and the first of its kind. Grab this book if you’re an accounting professional.

Book Review:

Every year, many books are written on IFRS and GAAP. But very few books consider the difference between various accounting standards and establish a relationship with each of them. This book is written by experts from the UAE and India who have years of experience in accounting. It is a global reference book that helps students and professionals worldwide learn the practical application of international accounting standards to financial statements. If you read this book, you will be able to learn about examples of footnote disclosures and financial statement formats. You will also be able to go through real-life case studies, which will give you clarity and an understanding of the similarities and differences of various accounting standards.

Key Takeaway

- This book is useful for a global audience, and the guide is written to establish a relationship among various accounting standards applicable in the world.

- This best accounting standards book is quite comprehensive. It offers examples of footnote disclosures and financial statement formats from the world's best 500 companies, which are already compliant with IFRS and report under IASB (International Accounting Standards Board).

- It will also provide comparisons of IFRS with US GAAP, Indian GAAP, and Chinese GAAP.