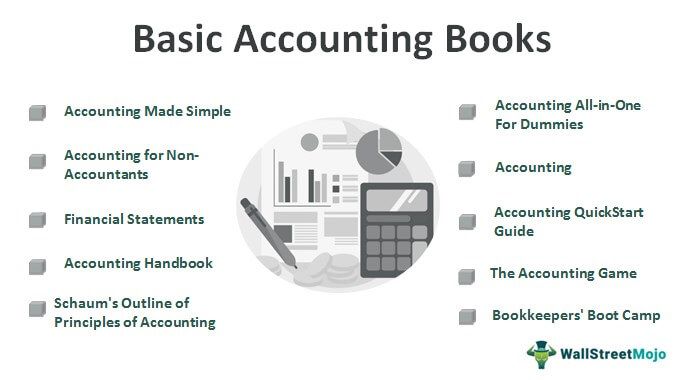

Top 10 Basic Accounting Books for Beginners [2025]

The objective of accounting is to systematically record financial transactions in the books of accounts to determine the financial position of any organization. Below is the list of books on basic accounting that you must read in 2025 –

- Accounting Made Simple ( Get this book )

- Accounting for Non-Accountants ( Get this book )

- Financial Statements ( Get this book )

- Accounting Handbook ( Get this book )

- Schaum's Outline of Principles of Accounting ( Get this book )

- Accounting All-in-One For Dummies ( Get this book )

- Accounting: The Ultimate Guide to Accounting for Beginners ( Get this book )

- Accounting QuickStart Guide ( Get this book )

- The Accounting Game ( Get this book )

- Bookkeepers' Boot Camp ( Get this book )

Let us discuss each of the beginner accounting books that cover the fundamentals and its key takeaways and reviews.

#1 - Accounting Made Simple

Accounting Explained in 100 Pages or Less

Author of this Accounting Book: Mike Piper

Book Review:

This short book offers a basic introduction to accounting principles and terminologies. The author’s brief explanations and numerous concise examples make it the perfect reference book for people from a non-accounting background.

Key Takeaways

A few of the major takeaways from this book are listed below:

- Accounting Equation and its significance

- Concepts and assumptions behind Generally Accepted Accounting Principles (GAAP)

- Calculating and interpreting several different financial ratios

- Preparing journal entries with debits and credits

- Calculating depreciation and amortization expenses

#2 - Accounting for Non-Accountants

Author: Wayne Label

Book Review:

This well-written book is focused on people who are new to account principles, as it lays out, for instance, different sequential snapshots of the balance sheet to demonstrate how individual adjustments should be treated.

Key Takeaways

Apart from providing the basics of the books of accounts, the author focuses on a few major topics like:

- Dealing with audits and auditors interpret financial statements

- Managing budgets

- Controlling cash flows

- Using accounting ratios

#3 - Financial Statements

Author: Thomas Ittelson

Book Review:

Every term is defined in simple, understandable language. Concepts are explained with basic, straightforward transaction examples. The author aims to provide a solid foundation for its readers to understand the concepts.

Key Takeaways

Few takeaways from this book:

- How do the balance sheet, income statement and cash flow statement work together to present any company’s financial health

- The visual approach to see exactly how each transaction affects the three key financial statements of the enterprise.

#4 - Accounting Handbook

Author: Jae K. Shim

Book Review:

A very informative and relevant book that takes an interesting approach to account. The author aims to focus on the accountants, bookkeepers, and business students as it provides perfect examples and material for referring.

Key Takeaways

Few of the topics that the book addresses are as follows:

- Short-entry definitions of everything

- A detailed explanation of accounting terms

- Cost management, taxation forms, and their preparation

- Financial reporting requirements and compliance, and U.S. GAAP (Generally Accepted Accounting Principles) and IFRS (International Financial Reporting Standards)

#5 - Schaum's Outline of Principles of Accounting

Author: Joel J. Lerner

Book Review:

The book comprises a collection of solved problems in accounting principles so that readers can easily connect the dots.

Key Takeaways

A few of the major topics covered in this book are as follows:

- Debits, credits, the chart of accounts, the ledger, inventory measurement, net realizable value, recovery of bad debts, and methods for computing interest

- Fixed assets, depreciation and scrap value, methods of depreciation

- Payroll and payroll taxes

#6 - Accounting All-in-One For Dummies

Author: Kenneth W. Boyd

Book Review:

As the book promises on its cover with its title, it offers to impart learning in simple and layman's terms. The author consistently uses examples and analogies to make the topics interesting and relatable.

Key Takeaways

Some of the aspects of accounting that the book covers are as follows:

- Setting up accounting system; recording accounting transactions

- Adjusting and closing entries

- Auditing and detecting financial fraud

- Planning and budgeting for businesses

#7 - Accounting

The Ultimate Guide to Accounting for Beginners

Author: Greg Shields

Book Review:

Providing a general overview of financial statement, analysis, and principles followed by the accounting practice, this book offers simple explanations that are easy to follow to relate the accounting terms and concepts in business usage.

Key Takeaways

Few major topics that the book covers are as below:

- The Cash Flow Statement

- The CPA and Public Accounting

- Tax Accounting

- Accounting Reports: The Income Statement

#8 - Accounting QuickStart Guide

The Simplified Beginner's Guide to Financial & Managerial Accounting for Students, Business Owners and Finance Professionals

Author: Josh Bauerle CPA

Book Review:

It is a very thorough book that covers almost all major topics and terms in accounting; The book is very helpful for small business owners as it outlines the procedures to handle accounting for a small business.

Key Takeaways

A few of the major topics covered in the book are as follows:

- The Principles of Financial Accounting, Managerial Accounting, and Tax Accounting

- Business Entity Types; Their Pros, Cons and Their Financial Statements

- GAAP Standards and their relevance to Accountants

- The Logic and Methods of Classic Double-Entry Accounting

#9 - The Accounting Game

Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand

Author: Darrell Mullis

Book Review:

Using the world of a child’s lemonade stand to teach the basics of managing finances, this book makes the subject enjoyable and understandable. The author makes readers use their senses, emotions, and critical thinking skills to learn. The book mainly focuses on business owners/managers and budding entrepreneurs.

Key Takeaways

A few of the key learnings that the book imparts are as follows:

- Business accounting procedures and creating financial reports

- Financial Accounting

- Step-by-step processes for managing to account in business.

#10 - Bookkeepers' Boot Camp

Author: Angie Mohr

Book Review:

This book shows small business owners the essentials of record-keeping, and why it's crucial to a business's success to track financial data. The author shows the business owners how to sort through the information and paperwork, record what is important, and use that information to grow a business for success.

Key Takeaways

Some of the main learnings that the book imparts are as follows:

- Purpose of record/bookkeeping

- Analyzing and tracking financial information

- Starting a business, growing a business, and exiting a business

AMAZON ASSOCIATE DISCLOSURE

WallStreetMojo is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to amazon.com