Alternative Data in Equity Research: Unlocking Alpha Beyond the 10-K

Table of Contents

Introduction

Equity research is a crucial function in finance as it offers key information that helps investors make informed decisions related to industries or companies. Traditionally, it involves analyzing key financial data in 10-K reports, which include financial statements like the cash flow statement and balance sheet, the assessment of earnings, and the evaluation of risks.

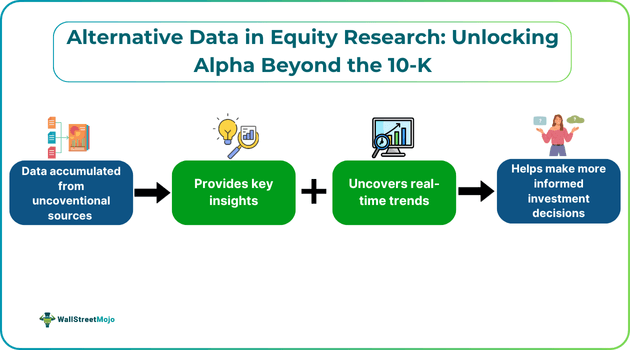

While such evaluation and analysis of financial information can help gain key insights, finance professionals may fail to obtain real-time trends and understand market sentiment. Also, by relying only on 10K reports, individuals cannot get forward-looking indicators that can prove to be crucial when it comes to decision-making. To combat this issue, individuals should consider going beyond 10-K analysis and leveraging alternative data in equity research.

Alternative data includes non-conventional financial or non-financial information that one cannot find in company filings or earnings reports. The use of such data has increased significantly among private equity firms and hedge funds. For them, it is now a critical investment research tool that offers competitive insights and allows for the uncovering of hidden trends.

One of the common ways to accumulate such data is by using web scraping tools, which involve gathering substantial and relevant data from different websites. That said, a lot of websites take anti-scraping measures so that one cannot collect the data. Moreover, websites have geo-restricted content, preventing users from collecting alternative data. In such cases, one can get access to non-traditional financial data by utilizing a proxy server. Let’s understand more about it in the following section.

Using Proxy Servers to Collect Alternative Web Data Securely

The process of manually collecting alternative data in equity research can be a slow process. Moreover, there are chances of making errors during accumulation. Hence, it is best to depend on automation via web scraping. That said, the majority of modern websites have specific systems that prevent automatic data extraction.

These systems identify repetitive access patterns that block Internet Protocol or IP addresses and serve a CAPTCHA whenever something seems suspicious. To bypass such systems, using a proxy server is ideal. This is because proxy servers rotate IP addresses between requests, which prevents you from getting blocked because of anti-bot rules or rate limits.

Additionally, proxy servers help you get access to non-traditional financial data from various geographical locations. If any site limits content to any user in the United States or displays different pricing, a proxy server based in that geographical location can provide the user with direct access.

Having the level of access provided by proxy servers is essential to get a complete picture of the market.

As scraping requirements increase over time, the importance of proxies increases. Large-scale data accumulation requires individuals to send a significant number of requests every hour, which is something that the majority of online platforms do not allow from only one IP address. Proxies help in this case by distributing the load across a number of addresses, which makes scraping faster.

Note that proxy servers also minimize developers’ maintenance overhead. Rather than spending a lot of time developing CAPTCHA solvers or handling IP address bans manually, individuals can depend on a proxy server to address any issue automatically.

One must also remember that irrespective of how smoothly a data extraction project runs if there is any compliance or ethical issue, the chances are it will get shut down. Hence, it is crucial to ensure the use of proxy servers that are ethical and compliant.

What Counts as Alternative Data in Equity Research?

Alternative data in equity research refers to information or data accumulated from non-conventional sources. It can comprise any data not included in press releases, broker research, company filings, and earnings reports. Therefore, equity research based on alternative data goes beyond 10-K analysis. Ensuring the use of reliable web scraping can minimize data inconsistencies and improve the accuracy of alternative data analysis.

Serving as a vital investment research tool, this type of data can offer investors a granular view of any industry, trend, or market. Often, alternative data provides key insights that unlock equity research alpha and help investors make well-informed and accurate investment decisions.

Alternative Data can be of the following types:

- Data Generated Via Individuals: This type of data is unstructured and predominantly comes from app usage, web traffic, and social media. It provides insights into consumer behavior and sentiment. Such insights can help companies improve the performance of their brand and boost customer loyalty.

- Data Generated Via Sensors: Such data includes information accumulated from geolocation, weather forecasts, and satellite images. It offers insights into sociological patterns and consumer behavior. Examples of such data include property details, foot traffic, etc. Investors find such data helpful as they provide insight into the profitability associated with an opportunity.

- Data Generated Through Business Processes: Such data consist of commercial transactions, bank records, information from government agencies, transaction records related to credit cards, and commercial transactions. Usually, such data is structured and can provide an indication of the company’s performance.

Investor Use Cases: Unlocking Alpha with Alternative Data

Let us look at some popular use cases of investor use cases of alternative data that help unlock equity research alpha.

- Portfolio Management: Alternative data can help in offering timely and frequent updates, which enable analysts to identify and evaluate any changes that may impact the portfolio. Moreover, the data allows investors to take necessary actions quickly so that they can avoid significant losses.

- Competitive Landscaping: Alternative data can play a key role in filling the gaps related to competitive research, irrespective of whether it is any sell-side investor looking to get a clear picture of the market or a company looking to formulate a winning investment strategy. Since the data gets updated frequently when compared to traditional data, it improves decision-making and provides a competitive edge.

- Due Diligence: Alternative data in equity research can help validate potential investments and get access to the complete picture of all possible risks and benefits.

- Stock Trading: With the availability of alternative data, retail investors can leverage non-traditional financial data to gain key insights that can help make informed buy and sell decisions in the stock market.

- Deal Sourcing: Another important application of alternative data is that it assists in finding investment opportunities by providing investors with unique insights.

With competition increasing in the financial sector, analysts and investors need to make use of alternative data in equity research effectively to make informed decisions and achieve their objectives. For gathering such data, proxy servers are undoubtedly an invaluable tool. With these proxies, organizations and individuals can optimize their strategies based on key data-based insights and gain an edge a competitive edge.