Table Of Contents

What Is Form 10-K?

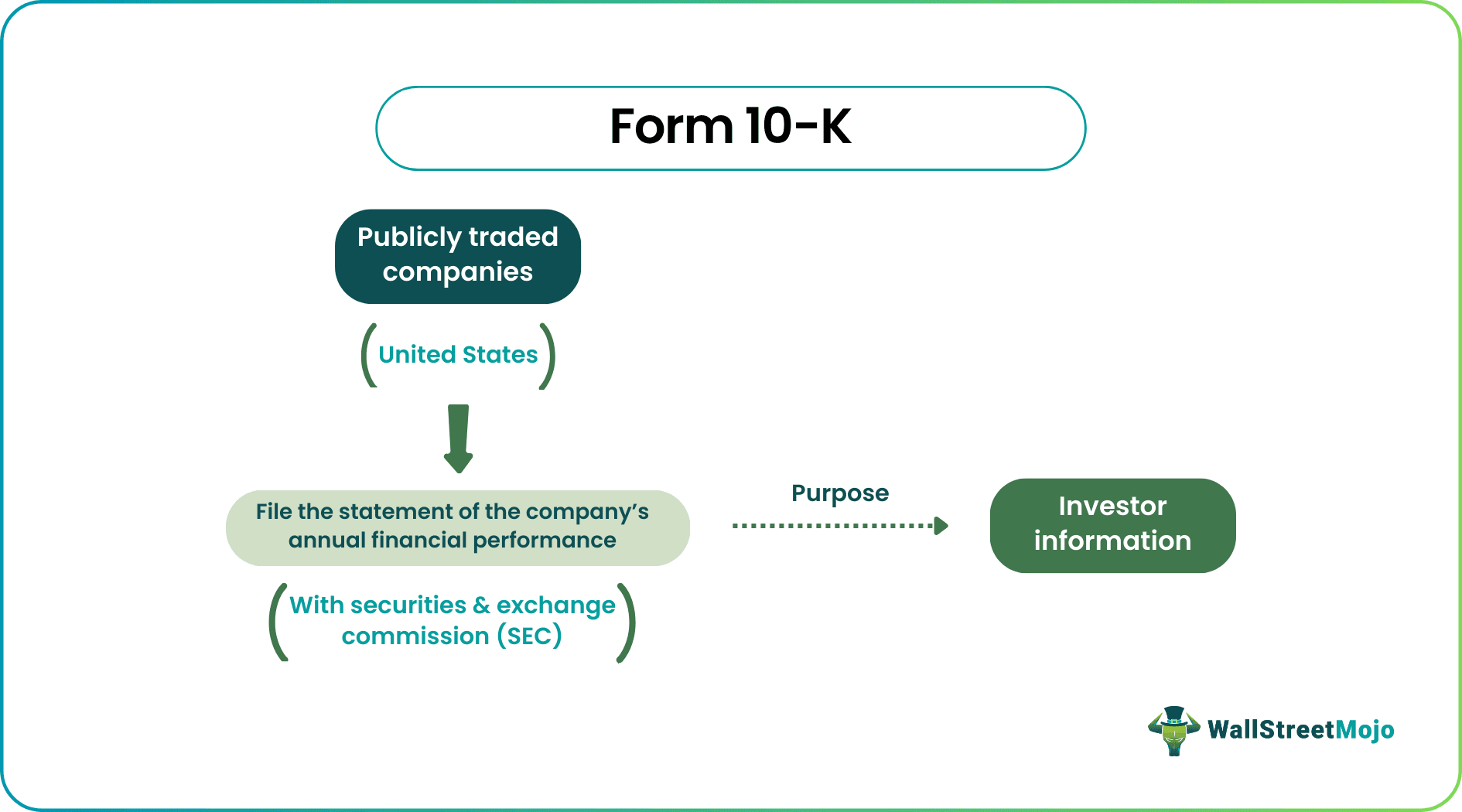

Form 10-K is filed in the United States by publicly traded companies with a detailed statement of the company’s annual financial performance. It is a necessary form to be filed with the Securities Exchange Commission (SEC) within 60 days of the fiscal year-end.

This form is prepared much more in detail than the company’s annual report, which is generally treated as a Bible for the investors and other third parties. It is only applicable to the companies listed on the various stock exchange indexes of the United States.

Key Takeaways

- Form 10-K is a comprehensive summary of a publicly traded company's yearly financial performance filed in the United States by those corporations.

- The five top things the company must mention in form 10-K are information about the business, overview, audit opinions, management decisions, and financial statements.

- 10-K is an important document for the company's brief description provided to the shareholders to make vital investment decisions.

- On the other hand, publicly providing a company's information is a disadvantage since it provokes a threat of its takeover.

Form 10-K SEC Explained

Typically, a company needs to file both annual reports and form 10-k sec filings in a single pager document with the annual report starting from the overview of the company financial statements. A good analyst should read and analyze both documents in-depth and make investment decisions accordingly. In addition, an analyst should carefully examine the risk factors both within and outside the business environment to understand the business correctly.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Filing Requirements

The objective of form 10-k instructions is to provide the shareholders with accurate and relevant information about the company to make successful investment decisions. Below are the top 5 most important sections in Form 10-K.

#1 - Business

This section of form 10-k sec filings discusses the core trade of the company, how it makes money, where it operates, and the overall vision and mission statements. This section is vital, especially for new analysts/investors who want to learn more about the company.

#2 - Risk Factors And Business Overview

Companies must also disclose the various systematic and unsystematic risk factors that affect the business. The company announces the potential threats it is opposed to and faces the competition. Also, the company provides an overview of the business and the new acquisitions it has made.

#3 - Financial Statements And Footnotes

This section includes the audited company's financial statements and its performance compared with the previous quarter or the same quarter of the last year. The audit financial statements include a balance sheet, income statements, statement of cash flow, and statement of other comprehensive income. The section also consists of footnotes to support the three primary accounts.

#4 - Management Discussion And Analysis

This MD&A section tells the story of the company’s current financial performances, plans, and vision. It also provides a comparison of the results against the past quarter. This section also contains words from the company’s board and its vision of how it will perform in the future.

#5 - Audit Opinion

In this section, the critical details of the auditor's opinion (qualified or Unqualified Opinion) regarding the financial statements. It also confirms if they were prepared as per the accounting policies and guidelines.

Advantages

Form 10-k instructions has the following advantages: –

- It is a source of information about the company for the shareholders and the investors, making it an essential document for investment decisions.

- It contains vital information about the company and tells the analyst the plans and the strategic initiatives the company will take in the future.

- It is also used for valuation purposes and the company’s financial projections. Thus, this document gives an insight to the investors and stakeholders about the mission, vision and future financial plans.

Disadvantages

Form 10-k annual report has the following disadvantages: –

- Because of the requirement and the filing criteria, form 10-k report tends to be very long and complicated. Still, investors need to understand that this is the most comprehensive public document available.

- Public information has a disadvantage too. There is a threat of takeover as the company discloses the public shareholding of every director and the compensation of the senior executive director.

- Form 10-k annual report needs to be filled quarterly, including compliance and cost. The form is usually unaudited, so it does not prove to be a good source to undertake an investment decision.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

Publicly traded companies fill out form 10-K under the SEC (securities and exchange commission). It helps investors and stakeholders with vital data about the company, its senior management, history, etc.

10-K is more thorough than a 10-Q because it is an annual report. Annual 10-K filings with the Securities and Exchange Commission are made. While 10-Q filing is done three times a year, or quarterly, 10-K filing is not done because it is filed in the last quarter. Therefore, the details in the 10-K are very in-depth.

According to sections 13 and 15(d) of the Securities Exchange Act of 1934, the designation "Form 10-K" as a Code of Federal Regulations (CFR) document is where the name "Form 10-K" originates. Companies must produce a 10-Q and an 8-K report in addition to a 10-K.