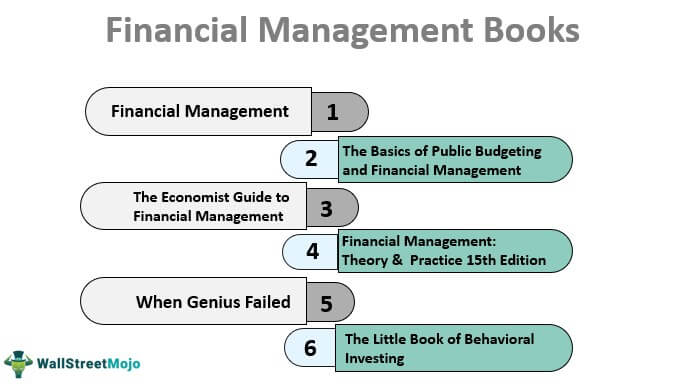

6 Best Financial Management Books [2025]

Get on the next level of financial management by mastering the same with the help of experts. Below is the list of such best books on financial management to read in 2025 –

- Financial Management ( Get this book )

- The Basics of Public Budgeting and Financial Management ( Get this book )

- The Economist Guide to Financial Management (2nd Ed) ( Get this book )

- Financial Management: Theory & Practice 15th Edition ( Get this book )

- When Genius Failed ( Get this book )

- The Little Book of Behavioral Investing ( Get this book )

Let us discuss each financial management book in detail and its key takeaways and reviews.

#1 - Financial Management

Theory & Practice (with Thomson ONE – Business School Edition 1-Year Printed Access Card) (Finance Titles in the Brigham Family) 14th Edition.

The author is a graduate research professor and has taught the subject since 1971. This book was published in 2013. It has defiantly written by an expert and with great content. This book is a complete explanation for graduate and undergraduate students as the author does not assume that the readers know the base of finance and hence has given a fantastic description making the subject easy for the readers. In addition, this book includes good live examples, calculations, and answers for students to take a self-test.

Book Name & Author

Financial Management: Theory & Practice (with Thomson ONE – Business School Edition 1-Year Printed Access Card) (Finance Titles in the Brigham Family) 14th Edition —by— by Eugene F. Brigham and Michael C. Ehrhardt.

Book Review

This best book on financial management is a perfect example as it strikes a balance between theory and practical knowledge of finance. The author makes sure that he gives a clear understanding of essential concepts that need to be developed and implemented in the finance field. It starts with the presentation of the fundamentals of corporate finance before moving on to the discussions of specific techniques. It also explores and explains the latest economic and financial crises, along with the part-finance plays in every industry and the world of business.

Best Takeaway from this best financial management book

This financial management book contains presentations that are very relevant and engaging, with several examples and the importance of using Excel at a job and in finance. In addition, the author has made sure he gives you a book that is a complete reference tool to help you in your career and academics.

#2 - The Basics of Public Budgeting and Financial Management:

A Handbook for Academics and Practitioners

The government has used this top financial management book for government budgeting, which explains the aspects of the budgeting process and procedure of the state government, country, and city. The author has also very well explained the process of creating a budget in a step-by-step format. If you are a beginner in budgeting, this is just the perfect book for you. It gives you a great understanding of understanding budgeting from both the perspective that is theoretical as well as practical.

Book Name & Author

The Basics of Public Budgeting and Financial Management: A Handbook for Academics and Practitioners —by— Charles E. Menifield (Author)

Book Review

The author gives the readers applications along with exercises to explain budgetary theory along with providing the reader with practical experience. The reader is given a chance to learn different technical concepts and skills, which are essential to understand the subject, along with practical exercises provided in each chapter that need to be applied to learn these concepts. This book covers financial ideas, public revenue, financial concepts, risk assessment, financial management, cost-benefit analyses, and more. The reader, as a student, will defiantly gain an excellent foundation to start working in a government or an organization budget office.

Best Takeaway from this top financial management book

The author’s experience is the best takeaway of this top financial management book as he has been a senior visiting scholar at the Congressional budget office, which gives him immense experience in financial management and budget creation. In addition, he gives the students a rich understanding of the subjects and their concepts.

#3 - The Economist Guide to Financial Management (2nd Ed)

Principles and practice (Economist Books)

To make logical decisions, you must thoroughly understand the subject irrespective of a particular industry or firm. This book helps you with a complete understanding of financial management, which will help you make the right required decisions. The information provided in this book is full-fledged, and it does not hide or cover the concepts. Therefore, you can use this book if you are familiar with finance and this industry and only need a revision. Again, the author of this book is an expert as he has been involved in training and giving consultancy to firms for the last 20 years and is the author of 4 other financial books.

Book Name & Author

The Economist Guide to Financial Management (2nd Ed): Principles and practice (Economist Books) —by— The Economist and John Tennent.

Book Review

Suppose you face difficulty and embracement in financial understanding, like dealing with management reports, capital proposals, budgets, etc., due to lack of training even, besides having the ability to manage. In that case, the author is making it easy for you here in this book. Every chapter of the book covers every task a manager has to accomplish, for example, assembling a budget, reading variances on a report, constructing a proposal to invest in new equipment types, and exploring the ethical principles one can use in each task. This book is just the appropriate guidance to implement these principles.

Best Takeaway from this best book on financial management

This book on financial management is excellent for readers to help them understand financial jargon, statements of finance, performance measures, management accounting, costing, budgeting, pricing, investment appraisals, assisting in decision-making, etc.

#4 - Financial Management: Theory & Practice 15th Edition

The author has served as a financial president for The Financial Management Association and has written several articles and journals on the cost of capital, capital structure and other parts of finance. He has also authored and co-authored textbooks on managerial finance and economics, which have been used by more than 1,000 finance universities across the globe. In addition, he has been tested as an expert on several cases at both the federal and state level. Finally, he has also served as a consultant to many corporations and government bodies across the globe. In short, this book is again written by a financial expert.

Book Name & Author

Financial Management: Theory & Practice 15th Edition —by— Eugene F. Brigham and Michael C. Ehrhardt.

Book Review

This book on financial management gives you a proper understanding of the economic concept used across the industry, which can be used or put to use in different stages of financial effectiveness—beginning with the presentation of corporate finance rather than discussing the specific techniques to start with. The author then moves on to explore crises in finance and the financial world. Finally, he elaborated the content with several valuable examples, encouraging the students to use excellent Microsoft Excel to understand the concepts better. The entire book is a beautiful reference for your academic and professional growth.

Best Takeaway from this top book on financial management

What can be better than learning from the experience and knowledge of an expert in the subject? The author has displayed his knowledge and experience in the best way to make understanding financial concepts easy for you.

#5 - When Genius Failed

The Rise and Fall of Long-Term Capital Management

Amazingly written book as the author has brilliantly explained the very famous Wall Street trader John Meriwether who was also a partner at Salmon Brothers and was one of the most brilliant brains in the industry. The author has also written some fantastic books on world-class greed, hubris, etc. He has explained the fund that one kept in secrecy, not described the story of its success, and finally, its destruction, which is much more interesting to read. It is a must-read book about a successful tycoon who ended up failing. This book includes the people involved in the rise and fall of hedge funds, which is a must-read for every management student.

Book Name & Author

When Genius Failed: The Rise and Fall of Long-Term Capital Management —by — Roger Lowenstein.

Book Review

The author happened to narrate the most impressive history of hedge funds. The story is so devastating that not just the $100 billion money-making company failed and suffered a terrible disaster. Still, the biggest banks and the stability of Wall Street suffered a huge hit. This book is an epic and a must-read for students from a financial background as it provides a good set that gave rise to the scenario. This book offers a good case study to the students and is also excellent for people interested in the industry and the case of hedge funds. Or, in case you are a dealer in hedge funds, you must read the same for your reference.

Best Takeaway from this best financial management book

The case of LTCM and its creator John Meriwether is the best example for people dealing in hedge funds and the stock exchange. The entire scenario and its happenings are described well in the book for students to understand better.

#6 - The Little Book of Behavioral Investing:

How not to be your own worst enemy

The author is a co-Head of Global Strategy at Society General and has been one of the top-rated strategists for over a decade, which makes him quite experienced in the subject. The author is created a great deal in the financial market and has gained immense experience. He has very smartly explained the blockages amid your rational decision-making and has given mechanisms to help you unblock your path. In addition, the author has given you strategies to help you make long term investment decisions. With the help of many studies and support, he has guided the audience to take the best route and gain success. His style is straightforward and accessible. This top book on financial management is simple for readers interested in understanding human behavior and its interrelatedness to the financial market.

Book Name & Author

The Little Book of Behavioral Investing: How not to be your own worst enemy —by— James Montier

Book Review

This best financial management book covers time-tested ways of knowing and avoiding the shortfalls of investor unfairness by one of the world’s best behavioral analysts. The author teaches us how to learn from our investment mistakes making sure we do not repeat them. He also teaches you to hunt for behavioral principles that allow the investors to maintain a successful investment portfolio to a specific minimum risk. Unfair emotions of the investors and their overconfidence are three significant factors that can lead to a financial loss for the investor on his investments. Behavioral finance science recognizes that the investor makes his decision psychologically, and studying this finance can help him overcome his huddles in investments and losses. This financial management book will take you on a tour of market investors' behavioral changes and how psychological barriers display emotions, overconfidence, and other behavioral issues that affect their investment decision-making power.

Best Takeaway from this top financial management book

The mechanism to unblock our paths is the best-described method for success. The entire market revolves around the behavioral pattern of the investor, and how to overcome the same to have a successful investment is the author's motive.

Amazon Associate Disclosure

WallStreetMojo is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to amazon.com