Table Of Contents

What Is Cost Of Capital Formula?

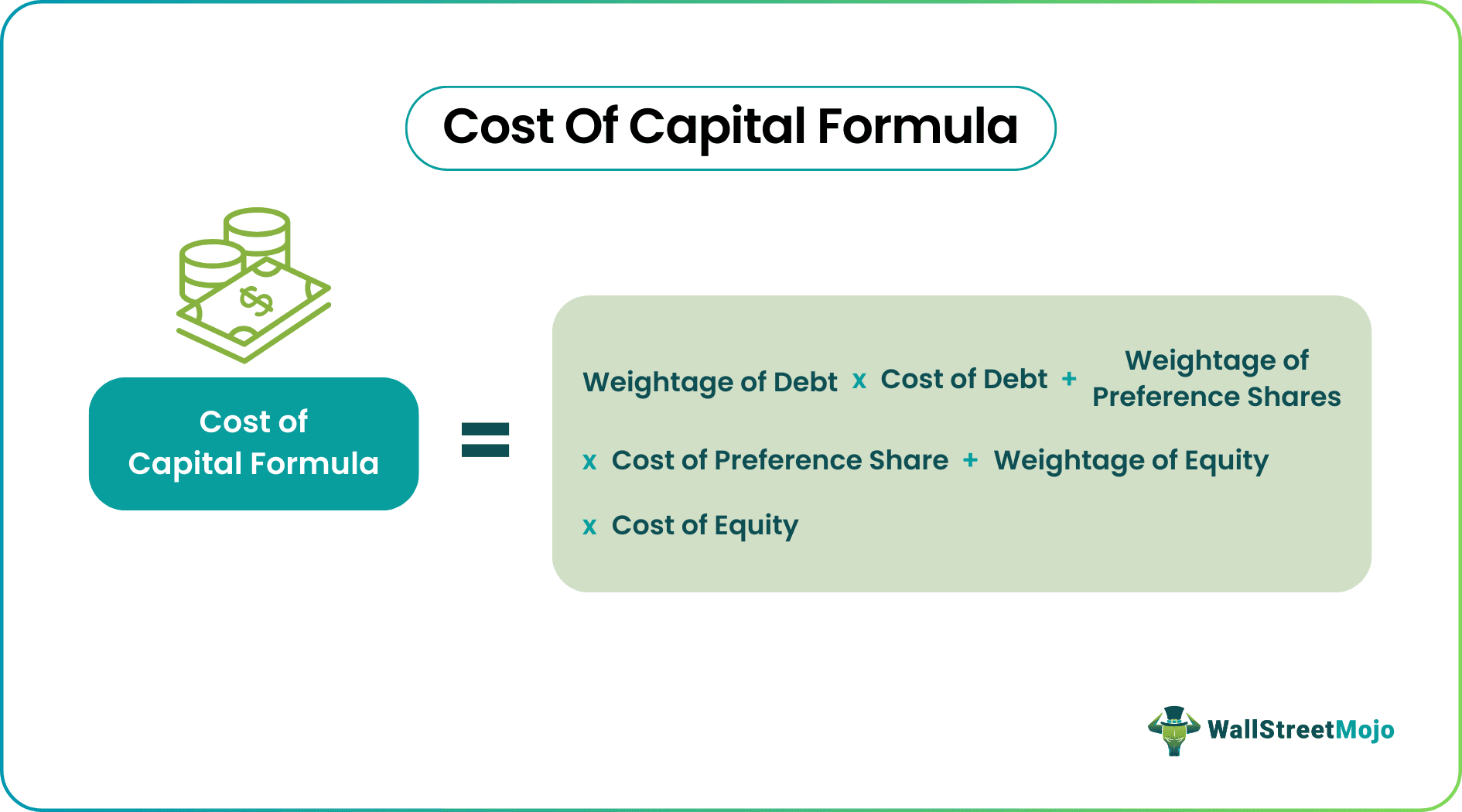

The cost of Capital formula calculates the weighted average cost of raising funds from the debt and equity holders and is the total of three separate calculations – weightage of debt multiplied by the cost of debt, weightage of preference shares multiplied by the cost of preference shares, and weightage of equity multiplied by the cost of equity.

The formula explains the level of return that an investor will aim to get if they decide to invest in a project or investment opportunity. This return should be more than the cost of investing money in it, otherwise, the portfolio is not feasible. The financial data is used to determine it, which is a tool for analysts and investors in order to evaluate the potential risk or return of any financial decision.

Key Takeaways

- The cost of capital formula computes the weighted average cost of securing funds from debt and equity holders. This calculation involves three steps: multiplying the debt weight by its price,

- the preference shares weight by its cost, and the equity weight by its cost.

- Knowing the cost of capital is vital for financial decision-making. It helps evaluate a company's capital structure components (debt, preference shares, equity) based on their proportions.

- Calculating the weighted average cost of capital is crucial for making critical financial decisions such as leverage, dividends, and capital structure.

Cost Of Capital Formula Explained

The cost of capital formula refers to the method of calculating the expected return from an investment opportunity based of which the investors decide to put their money on it. An investor, who might be a corporate of an individual, will grow only when the investments generate revenues that can be used to provide long term benefits, which is over and above the cost of the same. The evaluation of the value produced from such sources in the form of expected future cash inflows after deducting the cost of putting money in such sources of capital is calculated using the formula.

The equity and debt cost of capital formula is represented as,

Cost of Capital = Weightage of Debt * Cost of Debt + Weightage of Preference Shares * Cost of Preference Share + Weightage of Equity * Cost of Equity

Any return in excess of the cost of investment results in value creation that instigates a favorable decision in favor of the opportunity. Therefore, in the financial market, the use of this formula has gained vast importance, especially when the market condition is very competitive. Arriving at the value of cost of capital is not only complex but also quite challenging. A lot of analysis, assumptions, and observation is done to assess the value using overall cost of capital formula that will provide the right direction towards investment decision.

It can be observed overall that more the risk of investment, the higher the cost of capital. This is because since the lenders or owners are taking a higher risk, they should be compensated for the loss that they may have to face in case the prospect does not work. It is also the opportunity cost of putting money into that particular project instead of putting it in another comparable opportunity.

Calculation

Let us learn about the steps followed in the process of equity and debt cost of capital formula calculation, as given below:

Find the Weightage of Debt

The outstanding debt and preference share are available on the balance sheet. The weight of the debt component is computed by dividing the outstanding debt by the total capital invested in the business, i.e., the sum of outstanding debt, preferred stock, and common equity. At the same time, the value of common equity is calculated based on the stock's market price and outstanding shares.

Weightage of debt = Amount of outstanding debt Total capital

Total capital = Amount of outstanding debt + Amount of Preference share + Market value of common equityFind the Cost of debt

The cost of debt is calculated by multiplying the interest expense charged on the debt with the inverse of the tax rate percentage and dividing the result by the amount of outstanding debt and expressed in terms of percentage. The formula for the cost of debt is as follows:

Cost of debt = Interest Expense * (Tax Rate) Amount of outstanding debtFind the Weight of the Preference Share

The weight of the preference share component is computed by dividing the amount of preference share by the total capital invested in the business.

Weightage of Preference Share = Amount of preference share Total capitalFind the Cost of Preferred Stock

The cost of preferred stock is simple, and it is calculated by dividing dividends on preference shares by the amount of preference share and expressed in percentage. The formula for the cost of preference share is as follows:

Cost of Preference Share = Dividend on preference share Amount of Preferred StockDetermine the Weightage of Equity

In the equity cost of capital formula, the weight of the common equity component is computed by dividing the product of a market value of stock and the great number of shares (market cap) by the total capital invested in the business.

Weightage of Equity = Market value of common equity Total capitalFind the Cost of Equity

In the next step of equity cost of capital formula, we see that the cost of equity is composed of three variables- risk-free return, an average rate of return from a group of a stock representative of the market, and beta, which is a differential return that is based on the risk of the specific stock in comparison to the larger group of stocks. The cost of equity is expressed in terms of percentage, and the formula is as follows:

Cost of Equity = Risk-Free Return + Beta * (Average Stock Return Risk-Free Return)

Example(with Excel Template)

Let us take an example of a company ABC Limited to see if it can generate returns, using the overall cost of capital formula.

The company has reported a return for its last fiscal year Let us take an example of a company ABC Limited to see if it can generate returns.

First we have to calculate the following -

Total Capital:

So, Total capital = $50,000,000 + $15,000,000 + $70,000,000

- Total capital = $135,000,000

Weightage of Debt:

So, Weightage of debt = $50,000,000 ÷ $135,000,000

- Weightage of debt = 0.370

Cost of Debt:

Therefore, Cost of debt = $4,000,000 * (1 – 34%) ÷ $50,000,000

- Cost of debt = 5.28%

Weightage of Preference Share:

Hence, Weightage of preference share = $15,000,000 ÷ $135,000,000

- Weightage of preference share = 0.111

Cost of Preference Share:

So, Cost of preference share = $1,500,000 ÷ $15,000,000

- Cost of preference share = 10.00%

Weightage of Equity:

So, Weightage of equity = $70,000,000 ÷ $135,000,000

- Weightage of equity = 0.519

Cost of Equity:

So, Cost of equity = 4% + 1.3 * (11% - 4%)

- Cost of equity = 13.10%

So from the above, we have gathered the following information.

Therefore, Calculation of the Cost of Capital Formula will be -

The formula in excel will be -

Based on the above calculations, ABC Limited’s return of 10.85% is adequately higher than its cost of capital of 9.86%.

Relevance And Use

Given below are some of the important uses of the concept of cost of capital formula in financial management and in financial market.

- Understanding the cost of capital is very important as it plays a pivotal role in the decision-making process of financial management. The objective of the cost of capital is to determine the contribution of the cost of each component of a company's capital structure based on the proportion of debt, preference shares, and equity.

- A fixed-rate interest is paid on the debt, and the preference shares are given a fixed dividend yield. Although a company is not required to pay a fixed rate of return on equity, there is a certain rate of return expected of the equity portion.

- Based on the weighted average of all the cost components, the company analyses if the actual rate of return can exceed the cost of capital, which is a positive sign for any business. Based on this, various management decisions are taken about dividend policy, financial leverage, capital structure, working capital management, and other financial decisions, etc.

- The corporates can take decision regarding designing of capital structure of the business by using the cost of capital formula in financial management, which calculate the cost of raising capital in different forms. The decision regarding the proportion of debt and equity in financing a business is important because its profitability and liquidity positions is dependent on this to a great extent.

- Since investors use it to understand the feasibility of investment in a business, an attractive investment will add to the valuation of the company and lead to an increase in its share prices. This creates a positive image of the business in the competitive financial market.

Thus, the above are some important uses of the concept. Due to the everchanging corporate and financial landscape, the use of this formula will always be of utmost importance for both company management and the stakeholders’ point of view. This will ultimately help in channelizing funds in the right direction that will add value and multiply it at the highest level possible.