Table Of Contents

Financial Market Meaning

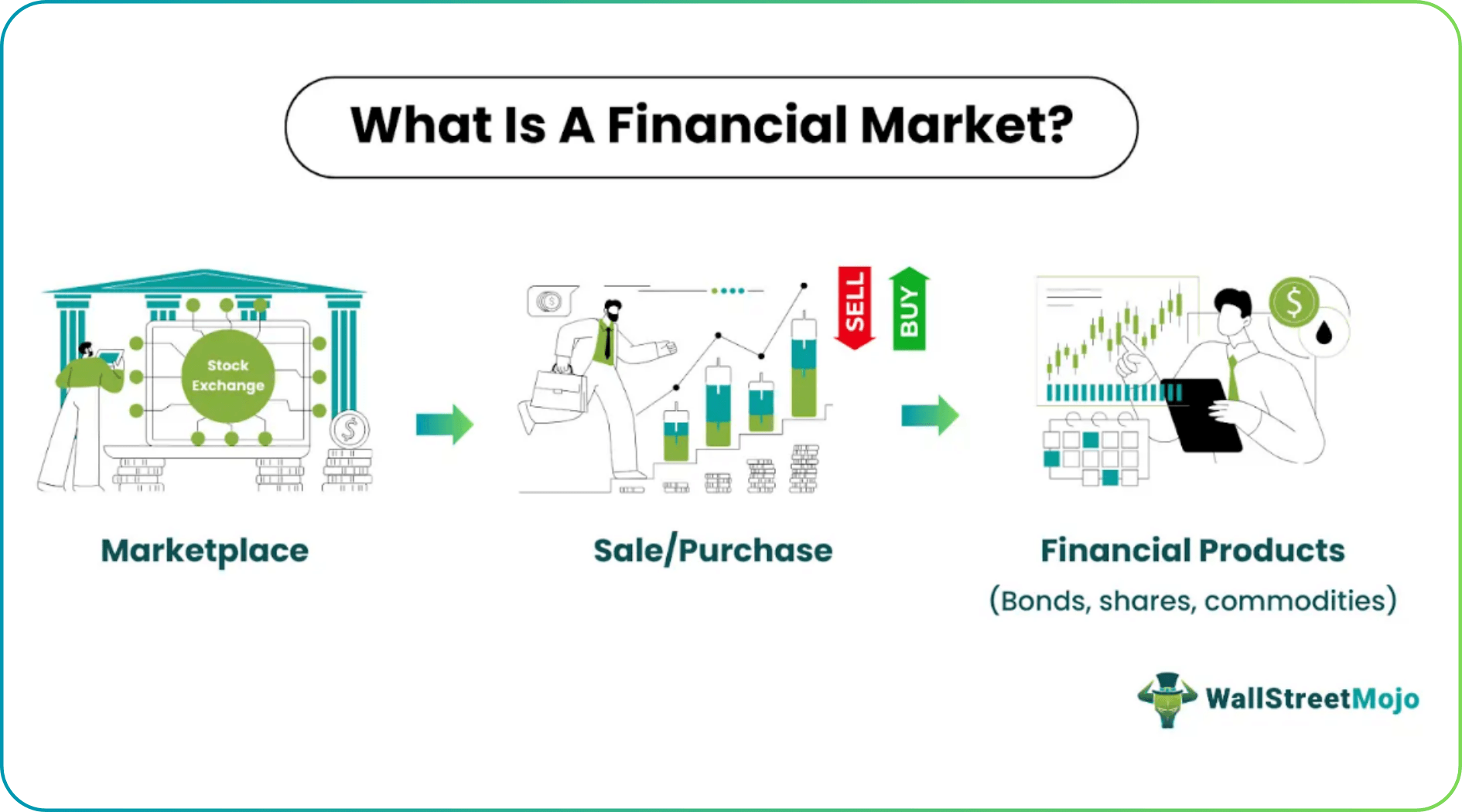

The financial market refers to the market where the sale and purchase of financial products occurs. Such products include stocks, bonds, currencies, derivatives, commodities, cryptocurrencies, etc. It acts as a platform for sellers and buyers to connect and deal in their desired financial assets at a price determined by market forces.

A financial market becomes a medium between people or institutions requiring capital and those having the capital to invest. It means those with extra funds offer them to those who need additional finances to grow their businesses and earn more. These markets can be classified based on the nature and maturity of claims, delivery timing, and organizational structure.

- The financial market is the marketplace where different financial assets such as bonds, shares, commodities, currencies, derivatives, etc., are traded.

- It brings together the sellers and buyers to deal in their desired financial assets at a determined price.

- Millions of dollars are traded daily in the capital market depending upon the economy, either through stock exchanges or OTC.

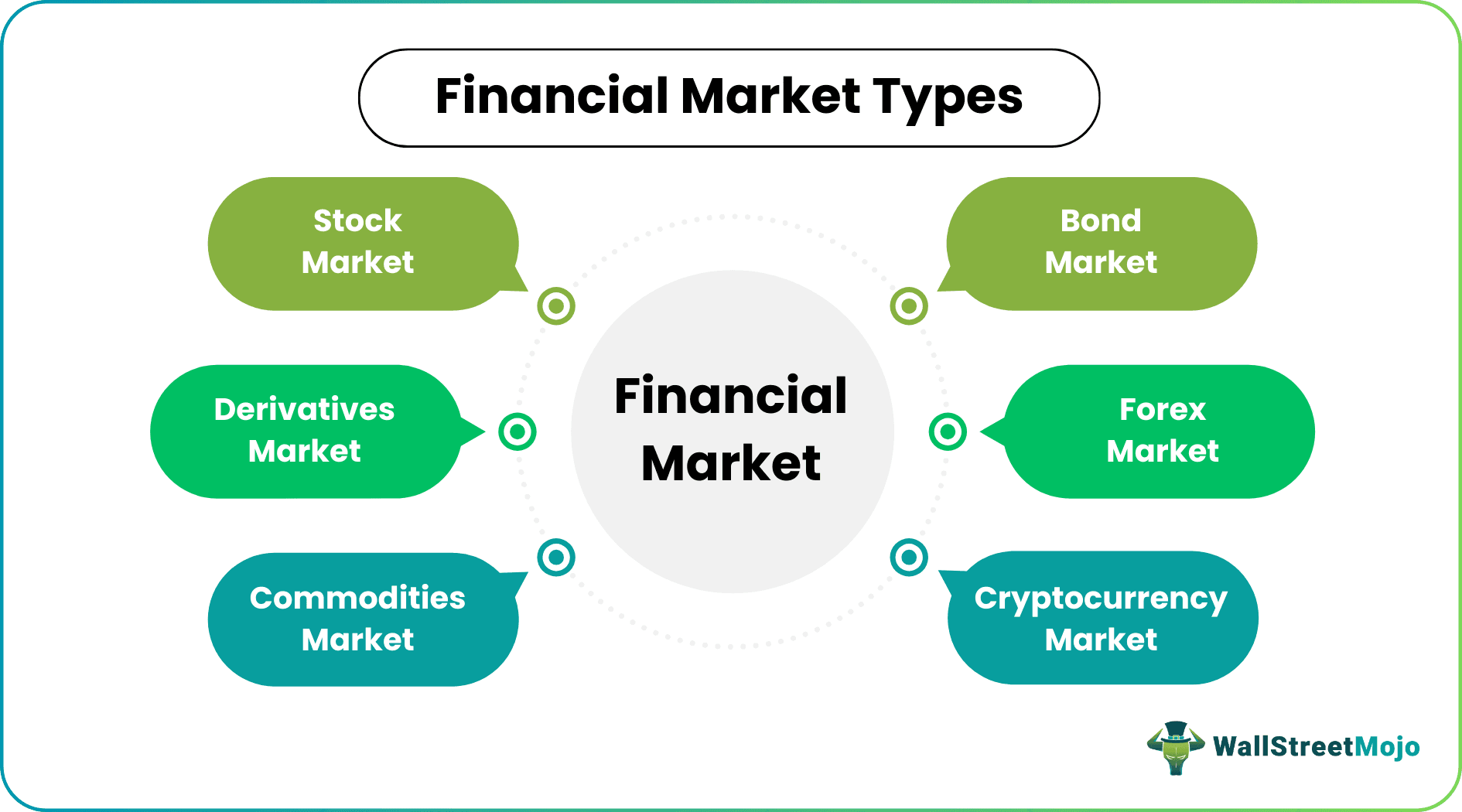

- Stocks, bonds, derivatives, forex, commodities, and cryptocurrency markets are some of the types of the financial market.

How Do Financial Markets Work?

A financial market is a platform where businesses and investors look forward to raising funds to grow their ventures and reap good returns on investments. In this marketplace, the buyers get appropriate sellers, and the sellers crack a good deal by having the best buyers for their financial products.

These markets are classified into different kinds based on varied parameters. However, the major classifications are based on the nature of the claim, claim maturity, delivery time, and organizational structure. For example, based on the nature and type of claim, a financial market is classified as a debt or equity market. While the former is where the exchange of bonds and debentures occurs between investors, the latter is where investors deal with equities.

Depending on the maturity term, there is a money market that deals with money-backed securities and short-term funds, like treasury bills, commercial paper, and certificate of deposit (CDs). These investments mature within 12 months. Another one is the capital market, which builds a platform for investors interested in medium and long-term securities.

Based on the delivery timing, there is a cash market where trade occurs in real-time and a futures market where traders accomplish a trade on a future date.

The next classification is with respect to the structure of the organizations involved. These include an exchange-traded market with a centralized system with a specific operational pattern and an over the counter (OTC) market that is decentralized and has customized procedures for the investors to follow

Such a market is also referred to as Wall Street, which proves to be healthy for the proper working of the capitalist economies across the globe.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Types of Financial Markets

The above classifications are relevant for different types of it. The types of Financial markets of these capital markets are mentioned below:

#1 - Stock Market

This is the hub for companies looking forward to raising their capital. First, they register their shares and issue them to interested traders via an initial public offering (IPO) in the secondary market. They list the shares or stocks on stock exchanges, including NASDAQ, New York Stock Exchange (NYSE), or OTC, a non-physical trade counter.

#2 - Bond Market

It is the marketplace, allowing investors to buy bonds from companies to finance their projects. The bonds are a promise of repayment to the companies or the government purchasing them within a specified period. The companies have to pay the principal amount and interest for a complete settlement.

#3 - Derivatives Market

The derivatives market deals with derivatives, which derive their value from an underlying asset. Individuals and firms can trade in futures, options, forward contracts, and swaps here. Such trades can be entered either via over-the-counter or in exchange-traded derivatives to manage the financial risk.

#4 - Forex Market

The foreign exchange (Forex) market helps conduct currency trade. These markets are operated through financial institutions and are used to determine foreign exchange prices for every money.

#5 - Commodities Market

A commodity market deals with commodity market, including assets like gold, oil, wheat, rice, etc. There are around 50 major commodity markets all over the world.

#6 - Cryptocurrency Market

Digital assets are trending, given the opportunities offered to investors and traders. The transactions occur and are recorded using blockchain technology. The cryptos, including Bitcoin, Ethereum, etc., are available on online crypto exchanges, letting traders participate in the trade on a global platform.

The exchanges have digital wallets through which users exchange one digital currency with another, including traditional currencies. As centralized markets, these platforms are likely to face cyber issues, like hacks and frauds.

Functions

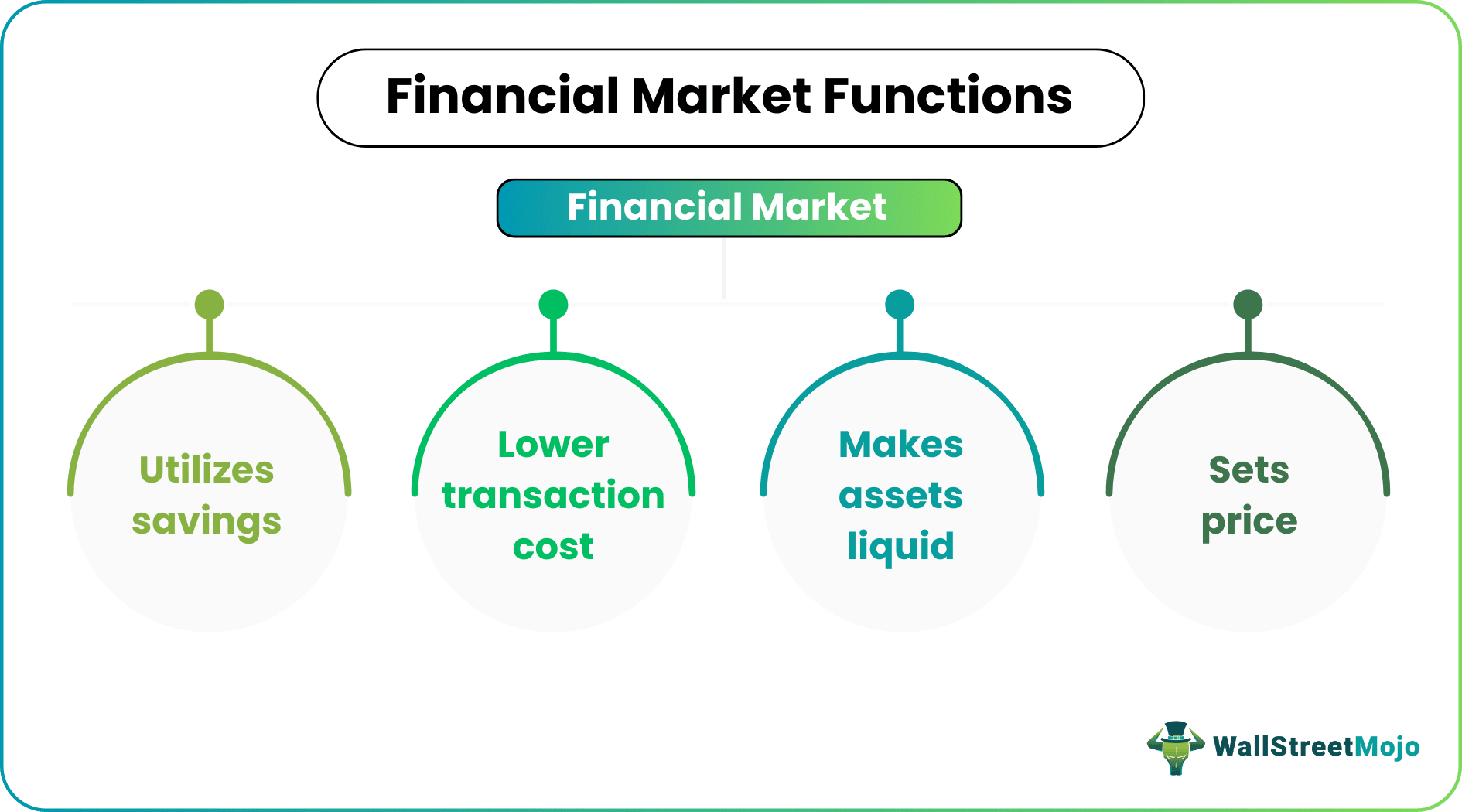

The financial markets help individuals and institutions use their savings more productively. Banks, one of the major elements of a capital market, help their customers utilize the money saved to open multiple savings schemes for interested investors for better returns. In addition, they enable firms and individuals to obtain loans from banking institutions to fulfill their personal and business loan requirements.

One of the major financial market functions is determining the prices of the securities available in the market. However, there is no law to set the securities prices. Instead, the capital market determines the costs depending on how an asset performs or financial market news or information surrounding it.

The traders and investors can easily acquire all the required information about the desired securities without spending anything extra. In short, the cost of transactions is pretty low. Plus, these markets make assets liquid. As a result, traders can trade in securities anytime at their convenience.

Examples

Let us consider the following financial market examples to understand how it works:

Example #1

James decides to begin a startup. Since his father already had a well-established business venture, he seems to know how to begin raising capital. The startup owner registered the company and bid for some major projects he successfully acquired.

To meet the financial requirements for the project, he issued bonds in the financial market under the name of his company. The investors knew James, given how he performed at his dad’s office. Thus, they bought the bonds that assured the repayment, including the interest within the decided period. As soon as James accomplished the project, he repaid all the bondholders immediately.

Example #2

Multiple factors affect the financial market, which directly or indirectly influences the prices of the securities available in the market. Recently, the S&P 500 was down by 11%, while the NASDAQ witnessed a downfall of 19% in 2020. The reason behind such turmoil in some of the most valuable stocks was the rampant inflation, increasing interest rates, the new COVID-19 wave that led to the latest lockdowns in China, and the Russia-Ukraine issue.

Advantages & Disadvantages

Financial markets let traders raise funds to grow businesses using long-term and short-term schemes. They do not restrict investors so far as the choice of the type of securities or assets is concerned. Instead, they offer various assets for traders to buy/sell or invest in. Hence, one can choose stocks, bonds, derivatives, currencies, cryptocurrencies, etc., to trade in.

The authorities, however, have set some rules and regulations to follow to ensure investors crack the deals. Though the protocols to obey are too many for interested traders to follow, they simultaneously make the process reliable for individuals and entities participating in the trading process.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

A financial market is a platform that connects buyers and sellers of securities and ensures that trading activities are efficiently accomplished. It offers both short-term and long-term schemes to investors to invest in or raise capital for the businesses to grow.

These markets are efficient given the strict rules and regulations framed by authorities for the traders and investors to follow. However, if an individual or company is found violating the laws, they are likely to face heavy penalties. In addition, the violation might lead to the cancellation of the license.

These markets exist as they help set up the prices for securities made available to traders and investors. Plus, these act as a platform to let individuals and institutions use their savings in the best possible way to build finances for future use. In short, it keeps the assets liquid and keeps the capitalist economies active.

Recommended Articles

This article is a guide to what is a Financial Market, its meaning, and its types. Here we explain the functions of a financial market along with examples. You can learn more about financing from the following articles: -