Table of Contents

Bookkeeper Meaning

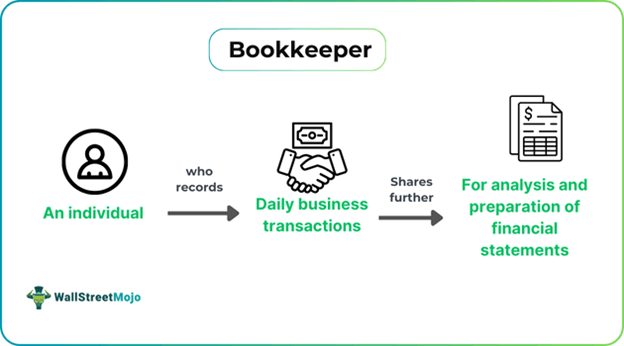

A Bookkeeper is a person who keeps track of a company's financial transactions. Their job mainly involves adopting techniques and practices for recording transactions, making them significant in providing accurate and current financial records for further interpretation. They differ from accountants, who classify, summarize, and interpret business transactions.

Financial records are necessary for creating financial statements, ensuring compliance with tax laws, and making informed business decisions. Using this data, the financial statements are prepared, which helps analyze the transaction and offer a fair view of the businesses. Investors make investment decisions only after looking into these statements.

Key Takeaways

- Bookkeepers are professionals responsible for recording and organizing financial transactions, reconciling accounts, and generating financial reports.

- Bookkeeper jobs require numerical and organizational skills, practical experience, and, optionally, a professional certification.

- Their salaries vary based on experience and location, with a median annual wage of around $47,440 annually.

- Bookkeepers differ from CPAs and controllers in terms of their scope of responsibilities.

- CPAs are licensed accountants who provide a broad range of accounting services, while controllers oversee financial operations and provide strategic guidance within an organization.

Bookkeeper Explained

A bookkeeper is a qualified individual who tracks and arranges a company's financial transactions. Primary responsibilities include recording accounts receivable and payables, bank deposits, payroll, and reconciliations. The job also includes preparing quarterly tax filings and other mandatory reporting and performing a range of other clerical tasks.

Businesses need bookkeepers to ensure their financial transactions are instantly and accurately recorded for further processing and interpretation. These records help produce financial reports, ensure compliance with laws and taxes, assist in strategic planning and decision-making, and help perform financial analysis. Bookkeepers maintain the integrity of a company's financial information by accurately recording and categorizing financial transactions, making the available data reliable. It further helps analyze profitability, track cash flow, and evaluate the company's overall financial health, allowing business owners, managers, and stakeholders to use these figures for informed decision-making.

These reports give a quick overview of the firm's financial position and performance, enabling stakeholders to comprehend the organization's financial health and make wise decisions. Bookkeepers ensure compliance with legal and tax duties by keeping accurate and current financial records. This simplifies creating and submitting tax returns and offers the evidence needed for audits. Additionally, accountants use the data recorded to prepare financial statements that show the true and fair view of the business, enabling investors to decide whether to invest in a business.

Duties

A wide range of duties form part of the bookkeeper job description. Let us quickly check them below:

- Recording transactions - Bookkeepers record sales, purchases, receipts, and payments from daily business operations. They ensure that every transaction is properly identified and recorded in the correct accounts of the general ledger.

- Reconciling accounts - Bookkeepers compare bank accounts with the company's records to find discrepancies and guarantee the correctness of financial data. This process includes comparing transactions, locating and fixing errors, and ensuring that all accounts are correctly balanced.

- Payroll and tax compliance - Bookkeepers may be responsible for payroll processing, figuring out wages, subtracting taxes, and ensuring payroll tax responsibilities are met. They also help prepare and submit tax returns and preserve records for audits.

- Accounts receivable and payable monitoring - They track the payable and receivable account balances and often handle and monitor a company's accounts receivable and payments.

- Bookkeeper jobs - require planning and using various software and tools to organize and streamline accounting activities.

How To Become?

Most employers choose applicants with at least a high school diploma or equivalent while looking for a bookkeeper. However, basic postsecondary education is often required for entry into bookkeeping, accounting, and auditing. Based on the qualifications sought, skills required, and experience expected for the post of a bookkeeper, here are the steps that one can follow to become a bookkeeper:

- Check Educational Background - A degree or diploma in the relevant field can help individuals grab a bookkeeping job. Normally, employers look for a high school degree for one to join as a bookkeeping professional. In addition, continuing with bookkeeper courses and attending relevant workshops to stay updated on the latest accounting software and market trends are essential.

- Acquire Required Skills - Good organizational abilities, quantitative aptitude, and attention to detail are important traits that one must have if one aspires to bookkeeping jobs. Learning about computerized accounting applications and fundamentals helps find such a job. In addition, undergoing relevant practical training to learn the skills is always recommended.

- Have Relevant Experience - To get started, working in entry-level jobs or internships to gain real-world experience in bookkeeping can help you apply for more advanced bookkeeping jobs. Individuals can develop their skills and gain an understanding of their daily duties while working in an entry-level position.

- Earn Certifications - A professional certification can boost an individual's credentials, identifying them as a certified bookkeeper. The two main organizations that grant credentials to individuals interested in bookkeeping are the National Association of Public Bookkeepers (NACPB) and the American Institute of Professional Bookkeepers (AIPB). A Certified Bookkeeper (CB) certification is awarded to those with credentials from AIPB. The Certified Public Bookkeeper (CPB) title is awarded to those who become licensed via NACPB. These certifications help prove a candidate’s competency to employers in the bookkeeping job market.

Salary

Various factors affect a bookkeeper's salary, including experience, geography, and company size. The Bureau of Labor Statistics (BLS) reported that the median annual salary for bookkeeping, accounting, and auditing clerks in May 2023 was $47,440.

Bookkeeper vs CPA vs Controller

The differences between the concepts are given as follows:

| Key Points | Bookkeeper | CPA | Controller |

|---|---|---|---|

| Concept | A bookkeeper is someone responsible for organizing and recording daily financial activities. | A CPA is a qualified professional accountant who clears the CPA exam, complies with state licensing regulations, and acquires particular educational and experience requirements. | Financial controllers are high-level financial managers who often oversee their firms' budget, audit, and accounting departments. |

| Functions | They are responsible for keeping correct records, balancing the books, and help in further preparation of financial reports. | Audits of financial statements, tax planning and preparation, and financial counseling are just a few of the many accounting services offered by CPAs. | A controller holds a more senior position in the accounting division of a business. They oversee accounting and financial operations, including budgeting, internal controls, compliance, and financial reporting. |

| Significance | Normally, bookkeepers don't offer financial analysis or strategic advice and stick to recording transactions for further analysis unless they are also functioning as accounting bookkeepers. | They are qualified to offer attest services and have a better understanding of the accounting principles. | Controllers analyze financial data, make strategic recommendations, and participate in decision-making. They collaborate closely with senior management and are crucial to planning and managing finances. |