Table Of Contents

Capital Appreciation Meaning

Capital appreciation means the increase in the market value of assets compared to their purchase value within the stipulated period. The assets may include stocks, land, building, and fixed assets. The asset’s appreciation can be because of overall economic growth or due to the growth of the particular sector of the asset.

The concept of capital appreciation is beneficial in the case of some assets, such as real estate and investments. The same reflects the appreciation in the asset's value and gives the investor of assets a fair idea about its current profitability. On the other hand, the asset value can also deteriorate over a period and it is referred to as capital depreciation.

Key Takeaways

- Capital appreciation refers to the asset’s market value rise compared to its purchase value within the stipulated period. It involves stocks, land, building, and fixed assets.

- The calculated capital appreciation gain is purely imaginary since the actual sale does not happen.

- It is advantageous in the case of assets like real estate and investments.

- The capital appreciation concept helps a person understand the current profitability during asset selling. Based on such calculations and expected future prices, a person may know if they should hold or sell such an asset for maximum gains.

Capital Appreciation Explained

Capital appreciation is the increase in the market value of an asset owing to overall economic growth or the growth in the sector of the asset. It is the ultimate objective of any investor to find growth in the value of the asset they invest their hard-earned money into.

These assets could be shares, bonds, mutual funds, real estate, and so on. The use of a capital appreciation calculator gives the investor a clear idea of the positive run-up of the asset according to its current market value against the value during the time of purchase.

Depending on the asset class, the duration of the appreciation can vastly differ. For assets like stocks, the value could appreciate in a matter of days, whereas, for real estate, it usually takes a longer time for the property to increase significantly in value.

Therefore, it is important to consider the time frame and risk appetite of an investor before investing in any asset class.

Causes

Let us understand the causes and why any capital appreciation fund bets on the growth of a particular sector or the overall economy.

- Strong economic growth may also result in appreciation, especially for assets such as stocks.

- Lower interest rates lead to an infusion of money in the market and create a possibility of appreciation.

- It may occur for assets such as a company's stock because it outperforms other competitors.

- In the case of the real estate sector, capital appreciation may be a result of developments taking place in the nearby arena.

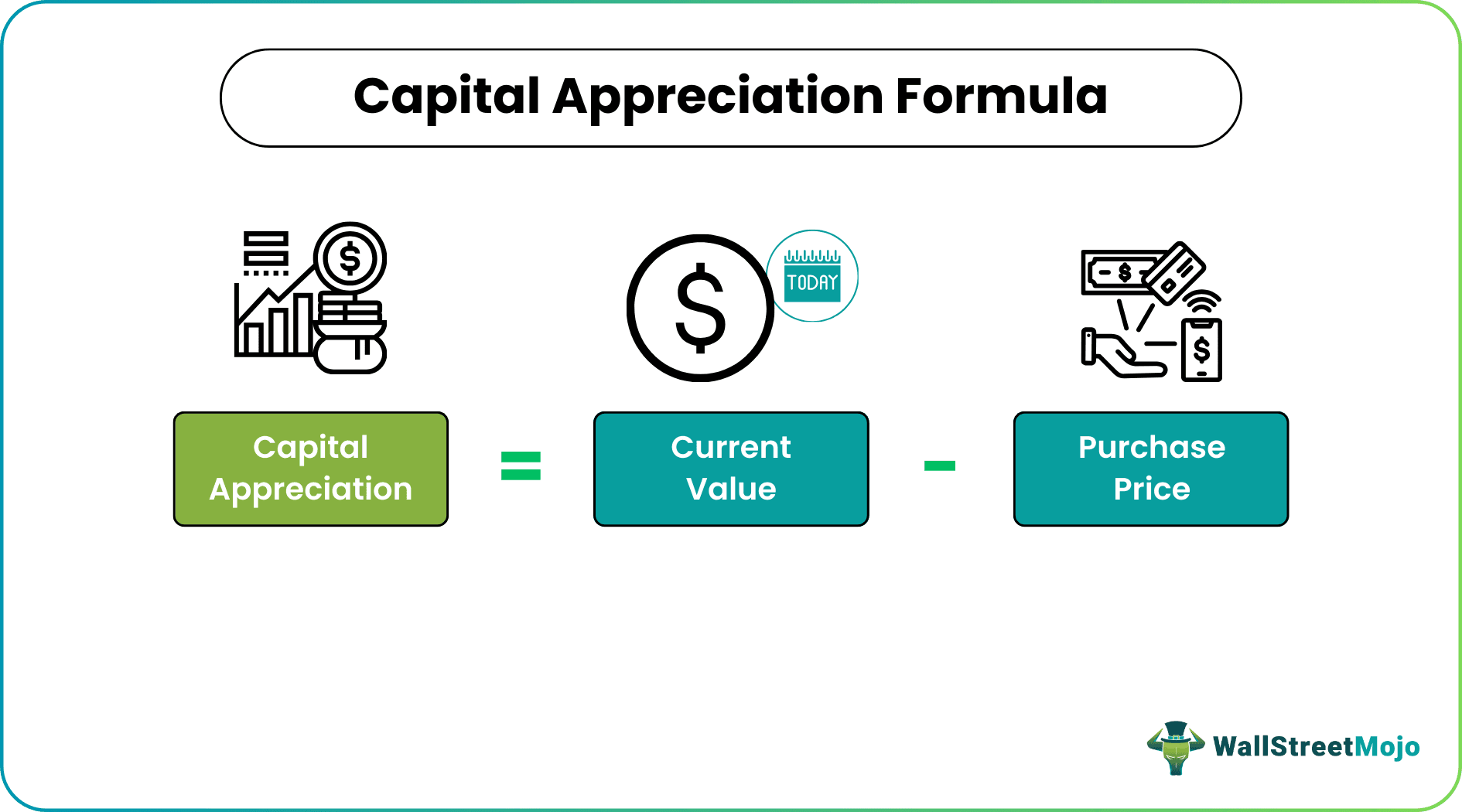

Formula

Capital Appreciation = Current Value – Purchase Price

Here, the current value means the current market value of the asset. The same will be the current market price at which one can sell the asset.

- The purchase price, also known as the acquisition price, is the cost incurred to purchase a particular asset.

- One may calculate it by reducing the asset’s purchase price from its current value.

Examples

Let us understand the concept better with the help of an asset appreciation calculator and a couple of examples as discussed below.

Examples #1

Mr. John purchased land in California. He bought the land in January 2016 for $2,00,000. Now, the price of the land has increased and will reach about $2,25,000 in 2020.

Solution

Calculation of Capital Appreciation: -

- = $2,25,000 - $2,00,000

- = $25,000

Example #2

Blackrock Capital Investment Corporation in 2023, declared that they are looking to increase their capital appreciation through equity and debt.

Their plan of investing in mid-market companies whose net worth was less than $250 million, where a set of both secured and unsecured loans could prove beneficial was made clear by their spokesperson.

As on December 2022, their net investment income accounted to $29.4 million.

Advantages & Disadvantages

Let us understand the advantages and disadvantages of investing in a capital appreciation fund or for an investor at an individual level through the discussion below.

Advantages

This concept helps a person know the current profitability that may arise if sold the asset. Based on such calculations and expected future prices, a person may decide whether to hold or sell such an asset for maximum profits.

Disadvantages

It only indicates the profits earned if they sold the asset. Only when disposing of the asset; will one know the real profits.

Capital Appreciation vs. Capital Returns

Capital appreciation and capital returns are often misunderstood for one another. Let us understand the difference through the comparison below.

Capital appreciation means an increase in the market value of the assets. It reflects the gain one could make by selling the asset at the current value at a particular period. The calculated gain is purely hypothetical since the actual sale does not occur.

On the other hand, capital return means the profits earned by a person on the sale of an asset. It can be calculated by reducing the asset's purchase price from its sale value. In the case of capital return, the gain calculates as an actual gain since the sale is carried out. Therefore, there is no scope for changes in the future.

Frequently Asked Questions (FAQs)

A capital appreciation bond, also known as CAB, is a municipal security on which the interest on principal occurs and compounds till maturity, during which the investor obtains a single payment showing the bond’s face value and all accrued interest.

Investments chosen for capital preservation or income production, such as government bonds, municipal bonds, or dividend-paying equities, may have less risk than those chosen for capital appreciation. As a result, capital appreciation funds are thought to be the most accurate for investors who can tolerate some risk.

A capital appreciation fund refers to a fund invested in assets like high-growth and value stocks, expected to appreciate aggressively. It involves higher risks but usually provides higher-than-average returns.

The capital appreciation gains occur either through investment sales or real estate property. The capital gains can either be short-term or long-term based on the duration. Capital appreciation profits are regarded as income and are taxable. The profits obtained are known as capital gains tax.