Table Of Contents

Capital Intensive Definition

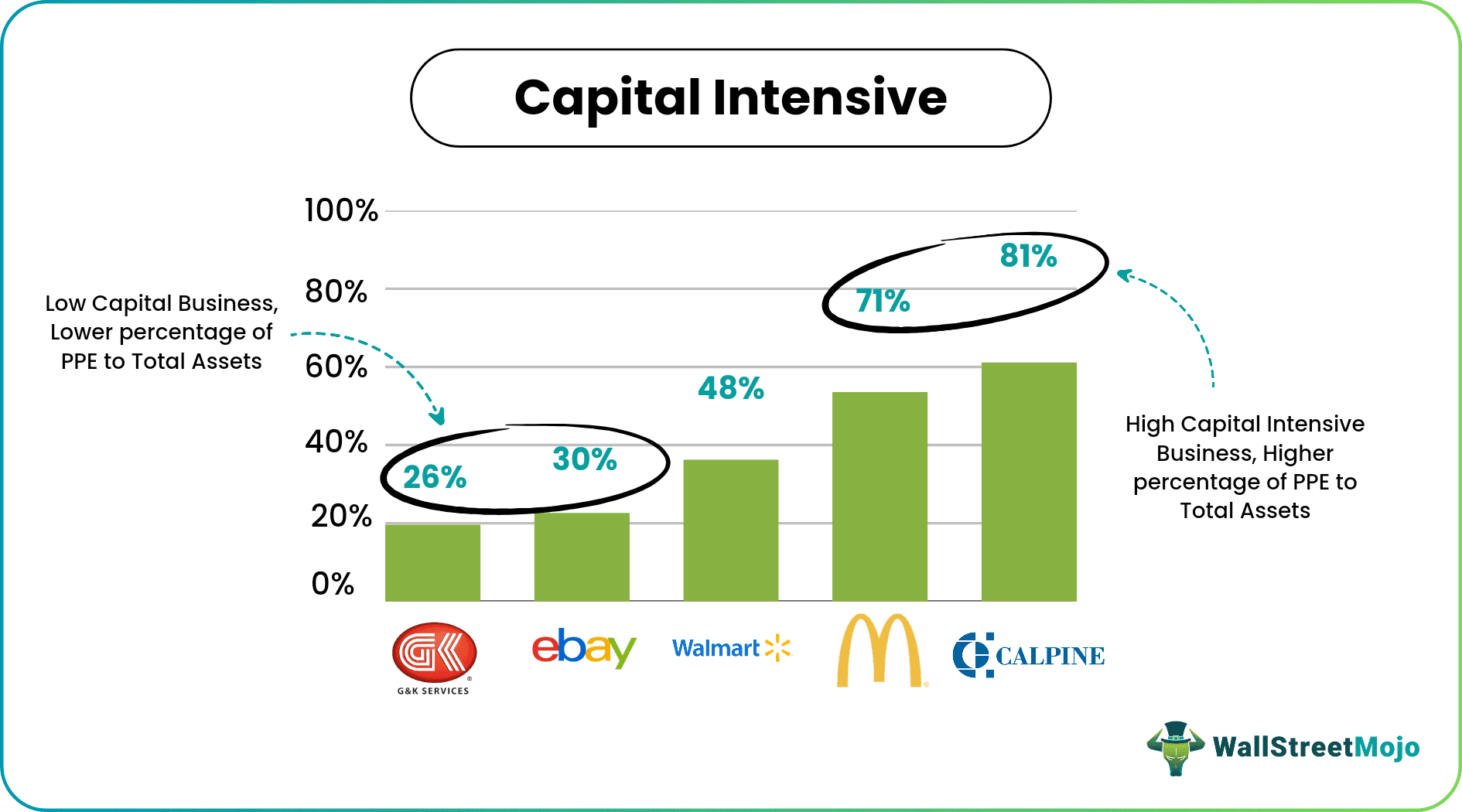

Capital intensive refers to those industries or companies that require large upfront capital investments in machinery, plant & equipment to produce goods or services in high volumes and maintain higher levels of profit margins and return on investments. Capital intensive companies have a higher proportion of fixed assets than the total assets. Capital intensive industries examples include oil & gas, automobiles, manufacturing firms, real estate, metals & mining.

Example of High Capital Intensive Industries

Imagine you are a utility provider and want to set up a plant that provides electricity to southern California. First, the company has to build coal, nuclear, or wind power stations. After which, they set up a transmission sector and then a billing and retail sector. For doing all these, the upfront costs will, in general, be billions of dollars – which are recorded as assets on the company’s balance sheet. For example, PG&E, the electric provider under strict scrutiny for recent California fires, has a total asset value of $89 billion. More than $65 billion is for different plant property and equipment types. It means PG&E has spent a lot to set up its plants and uses only a fraction of it as working capital. Now, let us look at a low capital-intensive company.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Example of Low Capital Intensive Industries

Imagine you are a software provider. You create software products and sell them off for a profit. In this case, there are no direct upfront costs. You hire several engineers, and the only upfront costs will be their salaries. At the same point, look at the asset size of Facebook. The total asset value of Facebook (the plant property and equipment) is just over $100 billion. However, Facebook is worth over $400 billion. The reason is that Facebook is not a capital intensive company. Its nature lies in the asset's delicate nature and the company's ability to grow.

Advantages of Capital-Intensive Industries

The following are some advantages of capital intensive companies.

- Ford, the car company, stayed as the leader of US automobiles for over 50 years. There are only a few automobile manufacturers in the USA. The same is the case with airplane manufacturing. Since airplane manufacturing is one of the most capital intensive, the ability of a normal person to go out and start a company on his own is almost zero. It ensures the incumbent players are safe and out of competition for everyone. The barriers to entry are high, and not everyone can get into the contest.

- The ability to have assets on the balance sheet; during the 1950s and 60s, the time was ripe for production-based companies. In addition, all these production companies require heavy capital investment. People who invested in these companies looked at the amount they invested in plant property and equipment and decided the company's value. It is essentially called value investing. Because people wanted to buy shares of only asset-heavy companies, the investment in such companies remained safe.

- All capital investments are tax-deductible and easily trackable. One can always price GE's plane engines or a factory that produces a million bolts per month. This tangible nature helps people analyze the companies better and, in turn, makes investing easy. Apart from these, investing in intangible assets is not a capital investment and will not be tax-deductible. This extra benefit nudged people towards funding more capital-intensive works.

Disadvantages of Capital Intensive Projects

The following are some disadvantages of capital intensive projects.

- Facebook had multiple iterations before it released its first version of the world. It is because all the incremental improvements were easy – because the project was not capital intensive. The risk of loss is low in capital-intensive projects, but the quantum of possible losses is extremely high.

- If the company goes on fire sale, the losses will be high. A fire sale is when the company requires money for working capital and sells off the assets. As the company sets itself up for a fire sale, its assets lose value so fast that only 30%-35% of it will be realized.

- The company cannot pivot easily. Most companies experiment with the nature of their products. Netflix shifted from a CD-based business to a streaming service in a year. Whereas GE, an extremely capital-intensive company, took over 15 years to change its direction. Spending money on projects anchors you over in that domain and makes movement difficult.

- The competition will be strong. We argued that heavy capital companies are safe from competition because of their high barriers. However, if there is a competition, the competition will be quite strong—the example of Boeing vs. Airbus is great. Until they were the only players, they had market dominance and controlled the prices. However, when the Brazilian government helped the barrier in becoming one of the major airplane manufacturers by subsidizing them, it took a huge chunk of market share because of cheaper planes. It explains how, even though capital intensive companies are safe and the probability of competition is low, the possible losses are high once competition comes in once competition comes in.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Conclusion

Multiple reasons and decisions go into whether the company should be capital intensive. There are businesses where initial high capital is not a choice (utilities, power, automobiles), and there are businesses where high capital intensive nature is a choice (streaming, software, etc.). Looking at the current companies, the power they hold, and their ability to keep the market share, one can decide how capital intensive his company or project should be.