How The Digital World Removes Traditional Financial Limitations

Table of Contents

Introduction

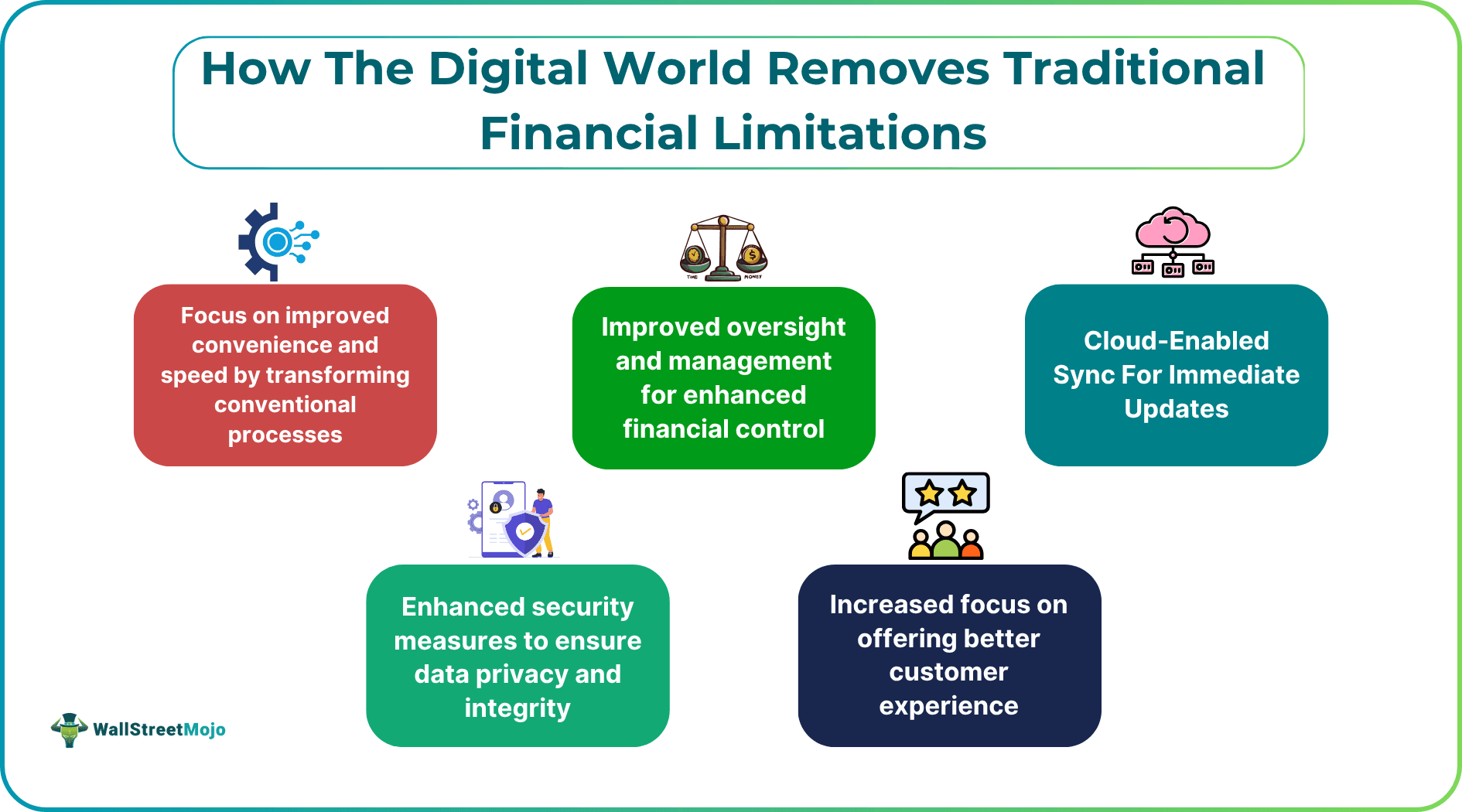

Over the years, a lot of changes have taken place within the financial services industry. This is a result of the increased adoption of digital innovations. Traditional financial institutions have been plagued by several seemingly insurmountable challenges since their inception. Indeed, outdated technology, high operational costs, inefficient processes, security and privacy concerns, limited scalability, and limited accessibility and convenience have been recurring challenges for these establishments.

That said, digitalization has proven to be successful in addressing some of these challenges. But just how much has the digital financial transformation enhanced traditional finance, mitigated its limitations, and ultimately evolved the financial services industry to its present state? If you wish to know the details of its impact, the following sections of the article will surely help.

Demand For Convenience And Speed

Changing consumer behavior has created a stronger demand for convenience and speed than ever before. Now that digital finance is standard, the days of waiting for hours or days for payments to clear are largely gone. Consider how online shopping is driving digital economy benefits. For instance, whether it is for food, groceries, or clothing, people can tap on the pay button and receive instant confirmation that the payment is done and their order is being processed.

Entertainment works the same way. If you buy a PlayStation subscription, you expect immediate access and seamless usability without delays or interruptions. This expectation for real-time service is also one of the many reasons for choosing casinos not on BetStop, as players often find that locally regulated sites are still tied to slower traditional financial systems. These casino platforms are licensed and operate outside the national self-exclusion program and tend to offer greater flexibility, smoother interfaces, and faster payouts when compared to local sites. This is the perfect example of not being limited to imposed restrictions that can significantly impact the user experience.

Oversight And Management

Traditional financial systems operate on the principle of centralized control. In this case, the major powers often rest with a central authority that supervises all financial activities. This directly leads to longer processing times and thicker bureaucratic red tape when it comes to accessing finance.

However, the advent of decentralized finance or DeFi is playing a key role in the digital financial transformation. It provides a direct counter to the limitations of the traditional financial system. As the name implies, decentralized finance emphasizes transparency and operational flexibility and allows for greater control over funds compared to traditional financial institutions.

DeFi uses blockchain technology, ensuring transactions are completed promptly and updated in real time. Customers also have greater access and control over their assets, with several DeFi initiatives offering users robust asset management tools to facilitate the transfer, sale, and purchase of digital assets. Additionally, DeFi platforms offer users enhanced privacy, which is especially attractive for those who prefer anonymity.

Cloud-Enabled Sync For Immediate Updates

Operational or operating expenses (OpEx) have always been a significant concern for traditional financial organizations. Indeed, it has been a severe limiting factor in overall customer service delivery efficiency. Fintech companies, on the other hand, are not faced with such hassles because they fully leverage online financial systems and advanced technology in their daily operations.

For instance, several fintechs do not operate from a physical location yet still serve millions of customers worldwide without unnecessary delays or disruptions. One reason they can do so is that the majority of the data used for transaction processing is securely stored in the cloud. This makes it extremely easy for teams to work seamlessly across borders to deliver exceptional service to customers, as transactions are processed in real time and updates are uploaded to the cloud, even when team members are scattered across different geographic locations.

Enhanced Security

Arguably, one of the advantages of digital financial transformation, enabled by blockchain technology, is increased transaction security. Cybersecurity is one of the most important concerns for financial institutions, especially in the era of digitization that the world is currently experiencing. After all, financial institutions handle extensive personal and financial data, which makes them a prime target for cyberattacks.

However, the rise of modern financial technologies such as smart contracts, blockchain, and more has enabled fintech companies to offer customers a level of security, efficiency, and convenience that traditional financial systems cannot match yet.

These fintech platforms deploy multifactor authentication or MFA, encryption, and secure cloud storage to protect the vast amounts of data and financial information held in their data vaults. Blockchain technology, in particular, offers advanced security measures by ensuring that financial records are tamper-proof and not easily altered.

Bolstered Customer Experience

The speed, efficiency, and accessibility of financial services that fintech companies provide have ushered in a level of customer experience that most traditional financial institutions struggle to match.

Many of the mundane tasks handled manually in traditional financial institutions are automated on fintech platforms powered by artificial intelligence (AI) and machine learning (ML). This leads to reduced loan processing times for customers seeking credit facilities, comprehensive compliance checks, and faster responses to customer service enquiries.

These automated processes also offer the added benefit of cost reduction, which is a significant factor in whether a financial institution breaks even or remains profitable at the end of the day. Mobile banking, digital wallets, and peer-to-peer lending are examples of fintech solutions that have led to a more user-friendly and efficient banking experience for customers.

Challenges Of Going Digital

As much as digital innovation has led to a positive shift in the financial services sector, there are still a few challenges that hamper the holistic adoption of digitization in this space. Cultural resistance, integration complexities, high implementation costs, legacy infrastructure, government policies and regulatory requirements, and compliance and ethical considerations are among the challenges financial institutions face when implementing digital financial transformation initiatives for removing financial limitations.

These difficulties or hurdles can slow down progress, especially for organizations that have limited resources or fragmented systems, and they often require long-term strategic planning to overcome the challenges.

Such hurdles need to be addressed for the benefits of digital innovation to be readily available to all and sundry, but there is no denying that the financial services landscape has evolved through digitalization and innovation, creating new opportunities with regard to accessibility, efficiency, and customer empowerment across various sectors and global markets.