Table of Contents

What Is Inflation Adjustment?

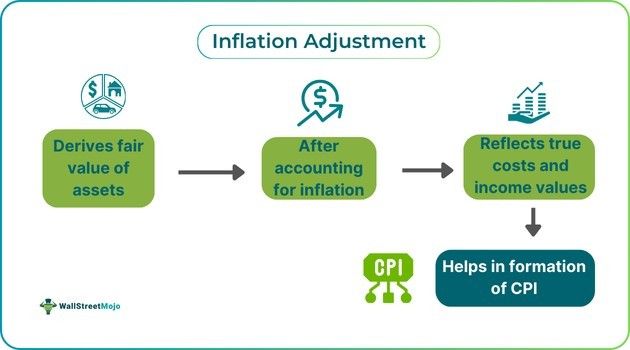

The inflation adjustment is the concept of accounting for inflation to determine the price rise and derive the real value of wages, commodities, goods and services. The process mostly occurs when there is a price increase. The effect of inflation is accounted for concerning the consumer price index (CPI).

A CPI is a price index, and any changes in the CPI track reflect the price shift over time. The index showcases the price of a weighted average market value of consumer goods and services. A higher CPI means high inflation; likewise, a low CPI value signifies low inflation or even deflation. Inflation adjustment is performed parallel to global companies and their financial reporting.

Key Takeaways

- Inflation adjustment accounts for the effect of inflation on the price and real value of goods and services.

- The two key methods of inflation adjustment are the current purchasing power (CPP) and the current cost accounting (CCA) method commonly employed at times of excessive inflation and deflation.

- Although it helps in accurate financial reporting, many market analysts criticize it for actually complicating financial statements, making them difficult to understand.

- The concept is permitted by both IFRS and US GAAP but has different guidelines and requirements.

Inflation Adjustment Explained

Inflation adjustment is the concept of deriving the fair value of company assets, investments, costs and income after accounting for the effects of inflation. Global companies often operate in multiple countries, each with different inflation rates and levels. In such a scenario, financial statements and historical information become complicated and sometimes irrelevant. To fix this, businesses use inflation adjustment to record, report and represent current and true economic values. This method is specifically used in times of excessive inflation or deflation.

Under both IFRS(International Financial Reporting Standards) and US GAAP(Generally Accepted Accounting Principles), companies are required to rework their financial statements from time to time to report relevant and accurate current economic and financial conditions. On the contrary, inflation adjustment has garnered criticism for complicating the financial statements and making it complex for investors and other market users to comprehend the financial figures. In addition, it is identified as a moral hazard issue as this features as a loophole for many companies to mislead the public with their financial statements. Although it helps in accurate financial reporting, many market analysts criticize it for actually complicating financial statements, making them difficult to understand.

Apart from this, individuals and family households can use inflation adjustment to determine the rise in inflation, the general price increase and the value of their goods, services and assets. Inflation adjustment has its benefits and drawbacks, but eventually, it helps to derive the true value of items and is a crucial part of corporate finance and general accounting.

How To Adjust Inflation?

There are two key methods of inflation adjustment -

- Current purchasing power (CCP) - The current purchasing power is employed to adjust the financial statements and figures to the current price. As for the non-monetary items, a specific conversion rate is employed for historical figures based on a price index. The conversion rate is deduced by dividing a period’s end index price by the period’s beginning index price. In contrast, when it comes to monetary items, they are taken into account for a loss or net gain adjustment.

- Current cost accounting (CCA) - Compared to CCP, current cost accounting negates the historical cost and instead considers the fair market value. This method applies to both monetary and non-monetary items to adjust their current values.

Examples

Below are two examples of inflation adjustment -

Example #1

Suppose John runs a company and is using inflation adjustment to account for his machinery value in 2016. The whole machinery was bought by John for $9000 in 2007. The CPI was 324 then, but in 2016, the consumer price index reached 729.

To determine the new value, John employs the CPP method and multiplies the historical cost by the conversion factor. But first, John has to derive the conversion factor.

Conversion factor = Current CPI/Historical CPI

729/324 = 2.25

Now to reevaluate the price of machinery = 9000 x 2.25 = 20250

Hence, the new value of John’s machinery in 2016 would be $20250. At the end of the period, John will record the new value in the balance sheet as the closing equipment balance

Example #2

The Ensuring Access to Risk Management Act of 2024 was introduced in the US House of Representatives to acknowledge the compensation concerns for crop insurance agents by reintroducing the inflation adjustment that was stalled back in 2016. The bipartisan bill is getting support from the National Association of Professional Insurance Agents (PIA).

By using this bill, the cap under the standard reinsurance agreement (SRA) of 2011 will be able to calculate the maximum amount that can be used to compensate crop agents. The cap has not been adjusted since 2016 and has been a major reason for reducing agents’ commissions yearly. PIA expressed their operations to actively pursue the bill to support crop insurance agents.

Importance

The importance of inflation adjustment can be summarized as follows -

- Matching current revenue with costs offers a fair breakdown of profitability.

- Inflation adjustment assists in the formation of the consumer price index, which people use to derive different market values.

- Market analysts derive the true and fair price of goods and services concerning CPI.

- Using inflation adjustment, investors can study the financial reporting of companies and compare the historical data more effectively.

- It particularly helps in situations of high inflation or deflation by factoring the current revenues when it comes to historical costs.