Table Of Contents

What Is Simple Moving Average (SMA)?

Simple moving average refers to a type of moving average, and it is derived by calculating the average of prices or values observed over a specific number of days or periods. It is used as a technical indicator in the financial market.

The average or the SMA values are plotted in a chart containing asset prices, forming the SMA line, and as new average values are plotted, the SMA line moves. Applying SMA to asset prices based on a selected range helps traders analyze price movements, identify trends, and determine entry or exit points.

Table of contents

- What is Simple Moving Average (SMA)?

- The simple moving average refers to a technical indicator that calculates the average value of a set of prices over a specified period.

- If the SMA is going upward, the market is in an uptrend; if SMA is heading downward, the market is in a downtrend.

- A buy signal is formed when the short-term SMA crosses and goes above the long-term SMA, and a sell signal is generated when the short-term SMA crosses and moves below the long-term SMA.

- Another type of moving average that is often compared to SMA is EMA (exponential moving average). It gives more weightage to recent prices than SMA.

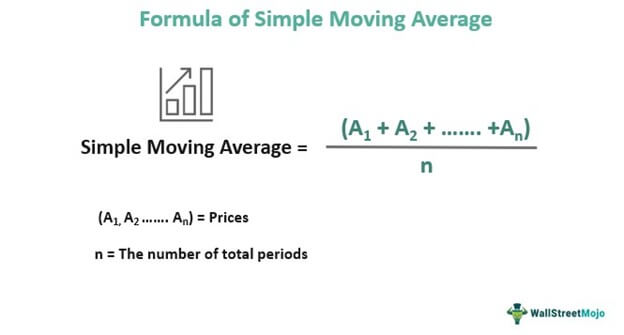

Formula Of Simple Moving Average

The SMA formula is similar to finding the arithmetic mean of sample data.

The traders calculate SMA for different time frames like 5-day, 10-day,50-day, 100-day, or 200-day SMAs. A shorter-period SMA signals a short-term trend, whereas a longer-period SMA hints about a long-term trend.

Chart

Let us look at this Novavax, Inc. price chart to understand the SMA concept better.

The yellow line in the above chart denotes the 20-period simple moving average. In simple terms, it is the mean of the stock’s 20-period closing prices. The chart aims to establish that the farther the security’s price is from the 20-period SMA, the more extended it is. Typically, whenever the stock price gets overextended, one may consider using a short-selling strategy to make financial gains in the market.

For more such charts about SMA and other technical indicators, one can visit the official TradingView website.

Example

Consider the following historical prices of Amazon.com, Inc. (AMZN):

| Period | Closing prices ($) |

|---|---|

| Mar 23, 2022 | 3,268.16 |

| Mar 24, 2022 | 3,272.99 |

| Mar 25, 2022 | 3,295.47 |

| Mar 28, 2022 | 3,379.81 |

| Mar 29, 2022 | 3,386.30 |

| Mar 30, 2022 | 3,326.02 |

| Mar 31, 2022 | 3,259.95 |

| Apr 01, 2022 | 3,271.20 |

| Apr 04, 2022 | 3,366.93 |

| Apr 05, 2022 | 3,281.10 |

Let's calculate 5-day SMA and 10-day SMA to understand the concept.

5-day SMA:

n= 5

Substitute the values into the SMA formula:

(3,268.16+3,272.99+3,295.47+3,379.81+3,386.30)/5 = $3,320.546

Day 5 price is greater than 5-day SMA (3,386.30>3,320.546): Buy signal

10-day SMA:

n=10

Substitute the values into the SMA formula:

(3,268.16+3,272.99+3,295.47+3,379.81+3,386.30+3,326.02+ 3,259.95+3,271.20+3,366.93+3,281.10)/10

= $3,310.793

Day 10 price is less than 10-day SMA (3,281.10<3,310.793): Sell signal

The simple moving average example above shows that the SMA trading rule compares the current market price to the corresponding moving average. When the stock price surpasses the moving average, a buy signal is generated, and a sell signal appears when it falls below the SMA.

Trading Strategies Using SMA

Constructing an SMA line from a collection of previous prices simplifies the volatility and minimizes the complexity of analysis. Importantly, it reflects the current trend in price movement. If the period used to calculate SMA is short, the output value will be similar to the observations; if the period is large, the SMA will be finer than the real data.

Crossover Strategy

Price crossover involves the comparison of asset price and the SMA. If the asset price crosses above the average, then a buy signal. A sell signal occurs if the asset price falls below average. Traders also use a combination of SMA lines covering the different periods. For example, 50-day SMA and 200-day SMA. An uptrend is forecasted if 50-day SMA crosses above the 200-day SMA (golden cross). On the other hand, if the 200-day SMA crosses above the 50-day SMA (a death cross), then a downtrend is anticipated.

Simple Moving Average vs. Exponential Moving Average

SMA and EMA are moving averages used as technical indicators. Which help analyze price trends, manage trades, decide on entry-exit points, etc. At the same time, let's look into some of their differences.

- The EMA, also known as EWMA (exponentially weighted moving average), prioritizes recent prices, but the SMA provides equal weight to all past values included in the calculation.

- EMA calculation is complicated; it involves more observation, smoothing, or discounting factors, whereas SMA involves simple calculation only.

- EMA is more sensitive to prices compared to SMA. For example, if the stock price picks a reverse direction, the EMA will reflect it sooner than SMA because it gives less priority to past prices and is more inclined to use the recent price variation.

The simple moving average indicator is widely used in technical analysis. However, it is not highly reliable and is quite sensitive to price swings. Hence, trading requires great care and simultaneous use of strategies like the application of limit loss techniques.

For professional-grade stock and crypto charts, we recommend TradingView – one of the most trusted platforms among traders.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

The SMA formula is:

SMA = (A1+A2+………An)/n

"A1+A2+………An" represents the sum of prices or values observed during a specific number of days or periods, and n is the total number of days or periods. The calculation follows the basics of arithmetic mean or an average of a specific set of values.

Consider shares of an entity closed at $10, $10.5, $11, $11 over a four-day period. The SMA will be ($10 + $10.5 + $11 + $11)/4 equaling $10.625.

SMA technique helps traders to predict the direction of price movement. For example, if the SMA is rising, it signals an uptrend, whereas if the SMA is moving down, then there is a downtrend. Furthermore, If the SMA of a short period rises above the SMA of a long period, an uptrend is anticipated, and if the longer-term SMA is above a shorter-term SMA, then a downtrend is possible.

Recommended Articles

This has been a Guide to Simple Moving Average (SMA). We explain its formula, SMA trading strategy, trend forecast, and vs. exponential moving average. You may also have a look at the following articles to learn more –