Table Of Contents

Taxation Without Representation Meaning

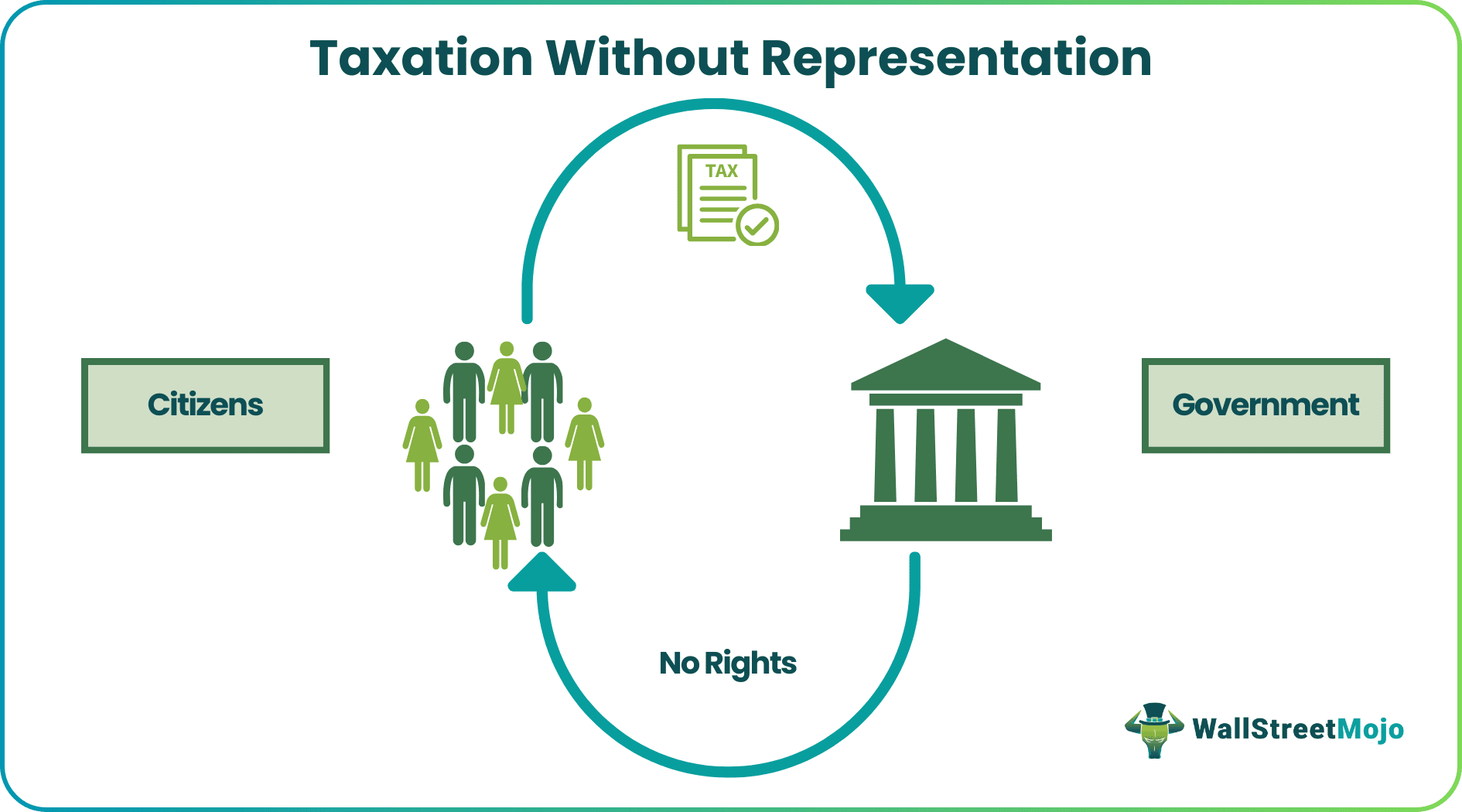

Taxation without representation is a popular phrase in the United States that gained prominence during the colonial rule of Britain in the country. The phrase describes a situation where the government collects taxes from its citizens without giving them any say in its policies or laws.

The phrase has historical significance and has contributed to the American Revolution's momentum. Now, taxation is essential to a concept of democracy or any other form of government as political and social representation is. However, a few examples of the same are that of the District of Columbia and Puerto Rico.

Key Takeaways

- Taxation without representation refers to a situation where the people of a country are taxed but do not get to enjoy any rights or say in political functions.

- The Stamp Act of 1765 was the historical event that triggered the American populace at the time and garnered momentum for the revolution and subsequent fight against colonial rule.

- District of Columbia taxation without representation is an example where the people of a region are taxed but denied any voting rights or representation.

Taxation Without Representation Explained

'Taxation without representation is tyranny' was one of the many famous slogans that echoed in eighteenth-century America and fueled nationalist sentiments. James Otis, a lawyer, popularized the slogan in 1761. After decades of oppression by the British, America reached the tipping point when the government imposed the Stamp Act of 1765.

The Stamp Act required the materials printed in colonies to use stamp paper produced in London, with an embossed revenue stamp. This act triggered the people and was one of the most critical events in the American independence struggle.

People were reluctant to pay taxes, that too, an unnecessary one, to the government, which would oppress them and not give them any political say. This was just one instance of taxing citizens without representation in America's colonial history.

The colonialists often imposed unfair taxes on their subjects and treated them like cash cows while simultaneously being unwilling to give them anything in return, not even fundamental rights.

Examples

The following examples can give a better idea of the topic:

Example #1

America, under colonial rule, was undergoing taxation without representation. Some examples are the Stamp Act of 1765, Townshend Acts, Sugar Act, etc. But this was pretty much the case for most colonies under British rule. The taxation of salt and opium in India by the British East India Company is one such example. The British imposed taxes on land, commodities, customs, etc., in almost all of its colonies.

Example #2

One of the best examples is the instance of District of Columbia taxation without representation. The United States capital, Washington, D.C., formerly known as the District of Columbia, is one of the only two regions that currently taxes its citizens without giving them any rights.

In recent years the capital city has come closer to becoming more democratic. But all those measures became unfruitful shortly after their implementation. For instance, Washington citizens have the right to elect a delegate. But twice, in 1993 and 2011, the politics in Congress had proved hopeless for the citizens.

Is Taxation Without Representation Illegal?

The answer to this question might be a little complicated. Historically, taxing colonies without providing them with political rights was considered illegal by the people under colonial oppression. That is one of the reasons why people were infuriated,d and the American revolution gained strength.

However, the current scenario in the District of Columbia, too, has a historical relation. In 1787, during the formation of the national capital, the framers of the constitution decided to establish a district that would not be under any state government's jurisdiction.

This was done to avoid regional disputes in a sensitive area, like the national capital, especially right after independence. But after almost two and a half centuries of independence, such a law might not be desirable. Nevertheless, since it is the law, such a restriction would not be illegal. But it is not fair on all grounds.