Table Of Contents

What Is A Unicorn Company?

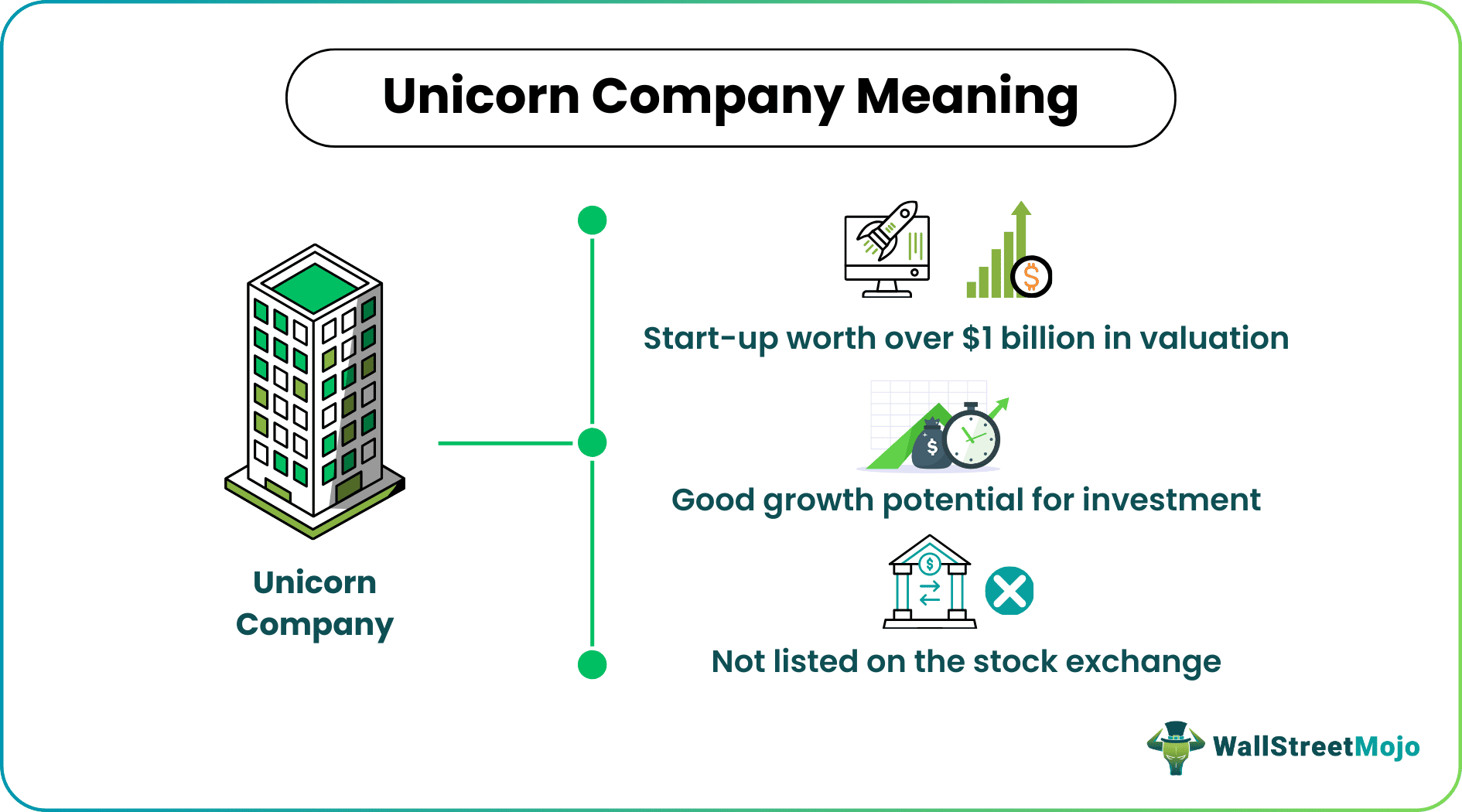

Unicorn companies are those companies that have a valuation of over one billion dollars in the early years. These are private companies that are not listed on the stock exchange. A unicorn company aims to achieve a valuation of $1 billion or more.

Most tech startups that are located in silicon valley are considered to be unicorns. These companies are rare and generally differ from other startup companies in their funding patterns, long-term growth, business models, and the uniqueness of products/services they offer to their end customers.

Key Takeaways

- Startup companies with a valuation of more than $1 billion are known as unicorns. These are unlisted private enterprises on the stock market.

- Early investors in these firms typically see good returns on their money.

- However, only a select group of investors can invest in unicorn companies. To invest in unicorn companies, a precise set of requirements must be satisfied.

- The primary factor that makes a startup an appealing investment alternative is the business idea's innovation or uniqueness.

- In addition, a company will likely acquire funding from investors if it can solve a customer's problem quickly and effectively.

Unicorn Company Explained

Unicorn companies are startup companies that have higher valuations. The founder of Cowboy Ventures, a venture capitalist popularly known as Aileen Lee, coined the term unicorn in 2013. Lee wanted to find a term for the technology startups with a valuation of over $1 billion and was specifically founded in the US after 2003.

Some people start their businesses with a small round of funding, and eventually, as they see progress in growth, they start investing more. But unicorn startups tend to witness early growth in terms of revenue and attract investment majorly through outside investors, i.e., both domestic and foreign investors from the venture capitalists. High Net Worth individuals, private investors, or company employees are generally the major investors in unicorn startups. Companies generally ask for a specific amount of investment at a specific valuation. At each level of funding, the company's valuation also increases; hence the price per share increases simultaneously.

Usually, the people who invest early in these startups make good returns on investments. However, investing in a unicorn company is limited to certain investors. Certain criteria need to be fulfilled to invest in unicorn companies, including a person with a net worth of $1 million or an income of at least $200,000. Some well-known unicorn companies are SpaceX, Chime, Canva, Flipkart, Snapchat, Stripe, etc.

Unicorn Company Video Explanation

Unicorn Valuations

Since unicorn companies are innovative and disruptive, they are expected to grow rapidly. But there has been an instance of fastest growth mainly in the tech sector, especially the SaaS industry, fintech, insured techs, and health techs.

Now the funding in such startups is evaluated as per how the investors or the venture capitalists will forecast the future growth of the business. The valuations of unicorn startups are based on their expected outcome in the future rather than the financial performance or the fundamental analysis of the company.

Characteristics

The main characteristics that set apart a unicorn company and make them ideal for investment are:

- Innovations: The innovation or the uniqueness of the business idea is the main criterion that makes the startup an attractive option for investment. In addition, if the business addresses the problem of the consumers related to anything in seconds with high outputs, it is more likely to receive funds from the investors.

- Growth Strategy: The investors also help the startups in rapid growth as they get the increased benefit of an increase in the price of share with an increase in the valuations of the unicorns when they start making a certain amount of profits.

- Market competition: If the business activity is related to something with huge demand in the market or no competitors, the monopoly in the market can survive in the cutthroat competition. Investors invest in such businesses since they have a huge potential for future growth.

- Buyouts: In the current scenario, the unicorn startups do not meet the Initial Public offer (IPO). So big companies capture the small market by buying them and selling the products and services under their name. The increased funding by giant organizations gives the leverage to the unicorns to leap forward and boost the targets of these big tech giant companies. Examples include Google, Facebook, etc.

Pros And Cons

Here are the main advantages and disadvantages associated with a unicorn company:

Pros

- The uniqueness of the product or service makes it a suitable form of investment due to its future growth potential.

- Most tech companies have taken over the space among unicorn startups. Hence innovation is the key criterion where venture capitalists want to spend their funding.

Cons

- Generally, special criteria need to be followed before investing in unicorn companies. Therefore, private venture capitalists or high-net-worth individuals are the main investors who can invest in these startups.

- The price of shares is highly illiquid after it goes for an IPO subscription and succumbs to the high fluctuations, so this could be a risky investment for the general public in the long run.

Examples

Let us look at a few of unicorn companies examples to understand the concept better:

Example #1

Tuhabi, a Colombian property technology startup, intends to increase in size next year, focusing on Mexico's growth. In addition, a unicorn startup with a valuation of more than $1 billion announced plans to spend more than $250 million on buying a house in Colombia and Mexico over the next few months.

Tuhabi enables sellers to sell their homes online and receive a payment within ten days, accelerating the real estate framework in two Latin American countries where sales take up to a year.

Example #2

Brewdog, a well-known Scottish craft beer firm, has a unicorn valuation in the UK. After raising more than $264 million in investment, the company's valuation reached over $1 billion in April 2017. Brewdog, the first unicorn ever crowdfunded, attained unicorn status 11 years after its formation.