Table Of Contents

Who Is A Valuation Analyst?

In simple terms, a valuation analyst analyses an asset, a business, equity, real estate, commodity, fixed income security, etc., and then estimates an approximate value. They will use multiple methods to estimate the valuation since one approach wouldn’t work for every type of asset.

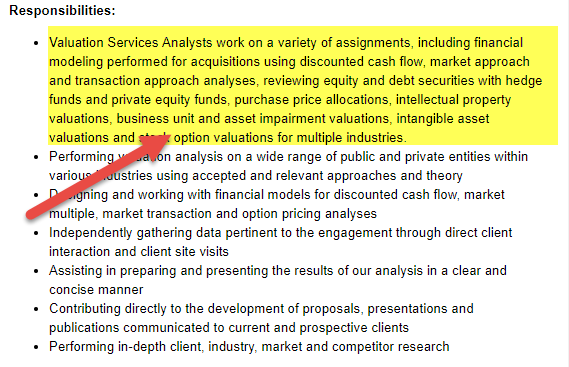

Let us look at one of the job profiles for a Valuation Analyst. Key responsibilities are listed in the below snapshot.

As we note, valuation analysts work on various assignments, including financial analysis of companies, Discounted Cash Flow Analysis, Financial Modeling of companies, reviewing debt and equity securities, valuation of Intellectual property, business valuations, intangible asset valuations, option valuations across multiple industries.

However, while performing the valuation analysis, she would chunk down the inherent aspects of each asset and look at all the factors.

For example, if an analyst looks at the valuation of a business, she may use the discounted cash flow method. Under that method, she will look at all the future cash flows the business can generate and then turn them into present values to see the actual value of the business.

They look at various factors before they ever value a company or an asset. These factors are –

- Profit Margins

- Sales/Revenues

- Capital Expenditures

- Options for financing

- Tax Rates

- The rate of Discount that would be used to find out the present value, etc.;

Let's now look at the qualifications.

Table of contents

- A valuation analyst analyzes assets, using multiple methods to estimate approximate value, considering various types of investments.

- The tasks that valuation analysts work on include financial analysis of businesses, discounted cash flow analysis, financial modeling of companies, reviewing debt and equity securities, valuing intellectual property, valuing businesses, valuing intangible assets, and valuing options across various industries.

- The valuation analyst career combines science and art, involving financial modeling and techniques. It requires constant learning, market understanding, market updates, and application. Ideal for those passionate about financial modeling.

Required Skills of A Valuation Analyst

Let us look at the required qualification of a valuation analyst.

- The basic qualification of becoming a valuation analyst is to pursue your graduation in finance or accounting. Even if this is the basic qualification required to pursue a career in valuation analysis, you need to be pretty advanced in financial modeling and valuation. MBA is also an added advantage.

- A good idea is to go for CFA while joining a company as a Junior Associate since you can pursue CFA while doing a job (actually, to pass CFA, you need to have four years of full-time employment in the financial field).

- Having a CFA degree and an experience of 4-5 years would turn out to be a great advantage for you.

- Excellent skills with applications like Microsoft Word and MS Excel.

Video Explanation of Valuation Analyst

Valuation Analyst Career Graph

If you want to be at the top level in your valuation analyst career, here is a snapshot –

- After completing your bachelor’s degree in accounting or finance, you will join a company as a junior associate of valuation. Before joining a company, it’s a great idea to do an internship with a reputable company. It will increase your chances of full-time employment with the same or similar company.

- Then after a few years of learning and gaining the expertise, you will become a senior associate.

- At this stage, you should start pursuing your CFA. While you finish your CFA Level 1, CFA Level 2, and CFA Level 3, you would be promoted to the position of Manager in Valuation or Consulting.

- At this stage, you would have two options – the first option is to continue in the same profile or join a public accounting firm as a partner or a similar position. If you choose the latter, this is how you would exit your career.

- If you decide to continue in the same valuation analyst career profile, you will become the vice president of the consulting firm after a few years as a manager. From here, most of the candidates change their profiles. You would have three options at this juncture. You can join the corporate sector as a CEO or CFO. You would have the option to join a company in the financial sector and get a managing director position or sort. The last option is you can choose to start your venture and become an entrepreneur.

Valuation Analyst Salary

Many candidates choose this profile because of their great career growth and decent compensation.

- As a junior or senior associate, you can expect to earn around $60,000 to $90,000 per annum (the amount is inclusive of the bonus).

- As a manager, you would earn around $90,000 to $150,000 per annum (the amount is inclusive of the bonus).

- As a vice president, your earning (including bonus) would be around $150,000 to $300,000 per annum.

- If you choose to continue on your path, you will become a company partner, and you will pay around $300,000 to $1 million per annum (including bonus).

Conclusion

The valuation analyst career profile is 80% science and 20% art. You would be involved with many financial modeling, valuation techniques, etc. At the same time, you need to make certain assumptions to conclude.

That’s why you need to constantly learn, understand the market, update yourself about what's going on, and apply what you learn. Overall, the valuation analyst career is a great profile and will be suitable for those who love financial modeling.

Frequently Asked Questions (FAQs)

Market, cost, and income are the three primary types of valuation methodologies frequently used to determine the economic worth of firms.

The primary challenge for valuation analysts is to improve their analytical abilities and market knowledge to make correct value assessments.

Valuation analysts must be skilled and self-assured communicators to support audit teams, provide comprehensive reports, and distill complicated financial analyses into information that senior managers, non-finance team members, and investors can understand.

While valuation analysts and investment bankers work in finance, their roles are distinct. Valuation analysts specialize in determining the value of assets and businesses, providing crucial information for various purposes, including M&A deals. Investment bankers, on the other hand, focus on facilitating corporate finance transactions, such as mergers, acquisitions, IPOs, and capital raising, by connecting buyers and sellers and providing advisory services.

Recommended Articles

This article is a guide to who is a Valuation Analyst. Here we discuss the roles of a valuation analyst, career profile skills required, and salary expectations. You may learn more about Corporate Finance from the below articles –